Last March in Orlando, I stood in front of 800 people at Commodity Classic and stated that I knew of 16 publicly announced plans to expand soybean crush capacity in the United States (a mix of new plants and expansions of existing capacity). This total investment of roughly $4 billion was slated to come online over the next 4 years. When (and if) completed, U.S. crush capacity would increase by 25%, or 600 million bushels annually. Big numbers.

Later that day as I was walking the tradeshow floor, a gentleman pulled me aside. He said, “I was at your talk this morning. You presented some interesting data but you’re wrong. There are not 16 expansions that will increase crush capacity by 25% – there are 23 planned expansions that will increase crush capacity by 33%.” How did he know this? This person served on the board of a state soybean association with an inside track on planned industry expansions. The numbers get bigger.

Three of these announced expansions are now operating in Iowa, North Dakota, and Ohio. Another facility – actually the conversion of an existing plant from processing sunflowers to soybeans and canola – has been announced for Kansas. In Canada, five planned projects will add 6.7 million metric tonnes of canola processing capacity by 2025 – a 60% increase. Bigger and bigger numbers.

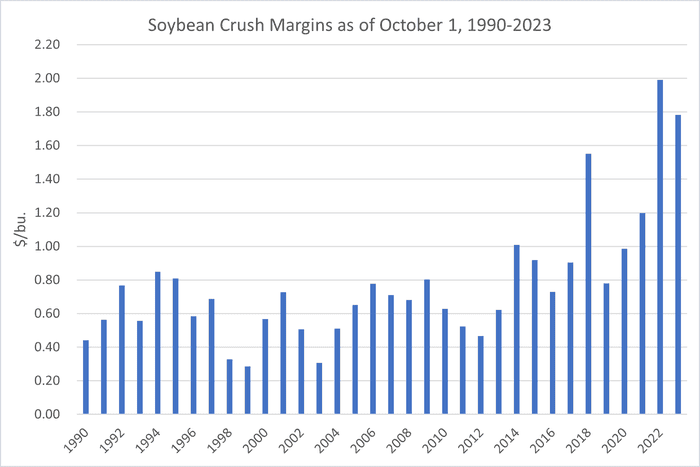

This rapid expansion is driven by the anticipated growth in renewable diesel and it is reflected in the current high level of soybean crush margins. The accompanying chart shows crushing margins over the past three decades. This is a “Board” crushing margin which is calculated based on the CME futures prices for November soybeans, December soybean meal and December soybean oil. To be clear, a crush margin is not a profit margin. It is a gross margin used to cover all fixed and variable operating costs, with the remainder being profit. This is also a simple snapshot of one day. Crush margins generally follow a seasonal pattern and they are often higher in the fall when soybean supplies are abundant and prices low.

Let’s review the history. From 1990 to 2013, board crush margins averaged 60 cents per bushel. From 2014 to 2017, board crush margins averaged 89 cents per bushel, a level higher than the highest crush margin recorded in the previous 24 years. But it just keeps getting better. Since 2018, board margins have averaged $1.38/bu. This is a highly profitable time to be a soybean crusher.

Soybean meal and oil are coproducts, and the rise in crushing margins since 2020 is primarily driven by higher oil prices. From 2011 to 2020, the share of total product value averaged a 65% meal/35% oil split. As soybean oil prices soared starting in 2021, the share of product value has been 55% meal/45% oil.

Will oil continue to be the main driver? Renewable diesel is the story but look at the market from early October to mid-November. Over a six week period, December meal prices are up $85/ton and near life-of-contract highs while December soy oil prices are down 5 cents per pound. Crush margins remain high, but for now the share of product value has returned to a 65%/35% split.

There should be no question why crushing capacity is expanding rapidly. Just look at the margins.

About the Author(s)

You May Also Like