U.S. farmers might plant less corn than last year, but it will likely still be larger than what previous USDA forecasts have indicated, according to new survey data from the March 2024 Farm Futures grower survey.

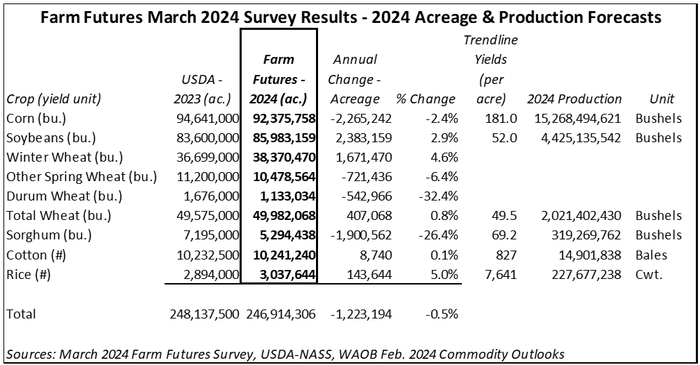

In fact, total corn and soybean acreage will likely vary minimally from last year based on the survey findings. Growers expect to plant 92.4 million acres of corn in the upcoming weeks, down 2.3 million acres (2.4%) from year ago seedings. Soybean acreage is forecast to be 2.4 million acres (2.9%) higher than last year at 86.0 million acres. This represents a nearly one-for-one trade off between corn and soybean acres from last year.

Farm Futures surveyed producers between March 12 -17, 2024 on their 2024 acreage intentions. The survey was conducted via an email questionnaire and garnered 493 responses.

If realized, that would bring the total corn and soybean acreage planted in 2024 to 178.6 million acres or the third largest combined corn-soybean acreage on record. Last year, farmers planted 178.2 million acres of corn and soybeans, which currently stands as the third largest combined acreage.

Growers are still anticipating USDA to find more winter wheat acreage planted relative to last year, with survey respondents estimating 38.4 million acres of winter wheat will be reported in next Thursday’s Prospective Plantings report from USDA. However, farmers are less convinced that other spring wheat acres will see an uptick in the report.

Despite drought conditions still plaguing parts of the Plains, farmers opted for fewer 2024 sorghum acres in the Farm Futures survey. With farmers still bullish on winter wheat acreage expansion in 2024, this could mean those acres in the High Plains that were planted to sorghum amid dry conditions last spring could have been returned to winter wheat thanks to replenished soil moisture over the past ten months.

Farm Futures survey respondents also hinted at a 15% uptick in alfalfa plantings for hay this spring. Hay stocks through December 1, 2023 stood at 76.7 million tons, which is substantial progress from the prior year’s 68-year low for domestic hay supplies.

But lingering drought on the Plains continues to keep U.S. hay supplies at levels not experienced since the 1950s and could warrant an uptick in acreage allocated to hay production during the 2024 growing season, especially if profit opportunities for corn are scarce this year.

Growers in the Farm Futures March 2024 survey also expect a 9% increase in acreage for other crops this spring. The “other” category could include oilseeds, edible beans, and small grains – among others – and could potentially drive corn and soybean acreages towards more lucrative returns this spring.

Comparison to current USDA estimates

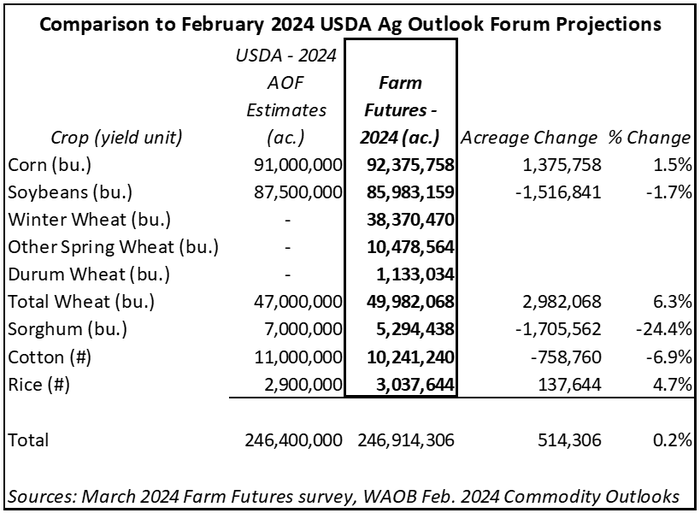

The Farm Futures March 2024 corn acreage estimates are trending 1.4 million acres higher than USDA’s figure published at its Agricultural Outlook Forum in mid-February 2024. Our soybean estimate is running 1.5 million acres lower than USDA’s forecast published at that time.

Timing of input purchases and crop sales will play an important role in 2024 acreage decisions and is likely leading to stubbornly high corn acres, based on the Farm Futures March 2024 survey findings. Even though crop budgets currently favor soybean returns, plentiful on-farm cash reserves, high harvest prices for corn, and affordable input pricing last fall could have locked in 2024 corn acreage before 2023 crops were finished being harvested.

USDA expected lower sorghum acreage in its February findings, but despite an uptick in exports and tightening domestic stocks threatened to buy more acreage this spring. But Farm Futures growers bucked that theory, instead calling for nearly a quarter fewer acres of sorghum to be planted in 2024 relative to the prior year.

Cotton growers are not expecting significant acreage growth in 2024, contrasting USDA’s estimates earlier this winter of an increase in 2024 cotton acreage. Tight global rice stocks are helping to contribute to an uptick in planted rice acreage this year, which aligns with USDA’s expectations for rice production in 2024.

Prior survey findings

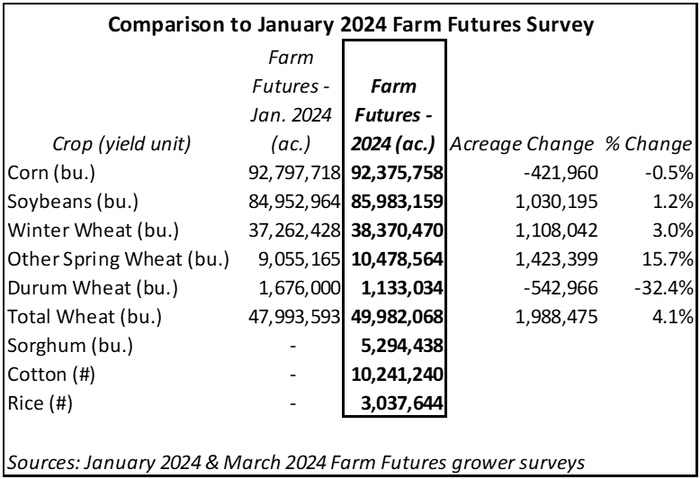

Since Farm Futures’ previous survey published in January 2024, farmers have opted for slightly fewer corn acres and more soybean acreage based on recent price trends. Late last month, Mar24 corn futures dipped below the $4/bushel psychological benchmark. Soybean futures have held slightly more value against their corn counterparts in that time, favoring 2024 soybean profit prospects.

During that period, farmer respondents also grew more interested in planting other spring wheat acreage in the Northern Plains. Decreasing nitrogen prices since last fall and a dry winter in Canada may be making spring wheat sowings a profitable prospect for growers along the Canadian border this spring, though farmers are less convinced that durum wheat will warrant an acreage expansion this year.

However, spring wheat and durum acres are still expected to be lower than year ago totals, even though farmers reported slightly higher spring wheat acres in the March survey relative to our January counterpart. After trending neutral on durum wheat expansion in January, farmers are opting for fewer durum wheat acres in the March 2024 survey.

Price implications

The larger corn and winter wheat acreage will help keep domestic supplies of both crops plentiful for another marketing year. But without additional demand prospects – or another catastrophic round of weather events – that will likely keep price gains for both commodities severely limited in the coming months.

Under Farm Futures’ estimates, soybeans have a much better chance of enjoying bullish price prospects. Consumption rates continue to outpace production growth for the soybean market, which is a favorable long-term omen for soybean prices, particularly as crush expansion continues across the Upper Midwest to continue feeding consumer demand for renewable diesel fuel options.

Several consecutive years of market upheaval, tight supplies, and supply chain headaches are finally starting to smooth out. Commodity prices have eased significantly during that time, tightening crop budgets for farmers throughout the Heartland. The changing price dynamics could generate some additional market volatility when USDA releases its farmer plantings estimates later next week.

USDA releases its Prospective Plantings report on Thursday, March 28, 2024. Stay tuned to FarmFutures.com as well as to our social platforms (@FarmFutures) for all the latest insights and analysis!

About the Author(s)

You May Also Like