March soybean futures prices were up 3 to 4 cents immediately following the release of today’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA after traders absorbed some bullish data before turning lower later in the session. Exports rose 50 million bushels from January’s estimates on favorable trade prospects with China, although it’s also worth noting that Brazilian soybean production increased substantially from January’s estimate.

Corn prices were down about 2 cents after markets may have overestimated demand. Seed and ethanol production each rose 50 million bushels while exports surprisingly dropped 50 million bushels after a recent uptick in export demand at the U.S. Gulf. Wheat exports rose 25 million bushels, but futures prices followed corn prices lower.

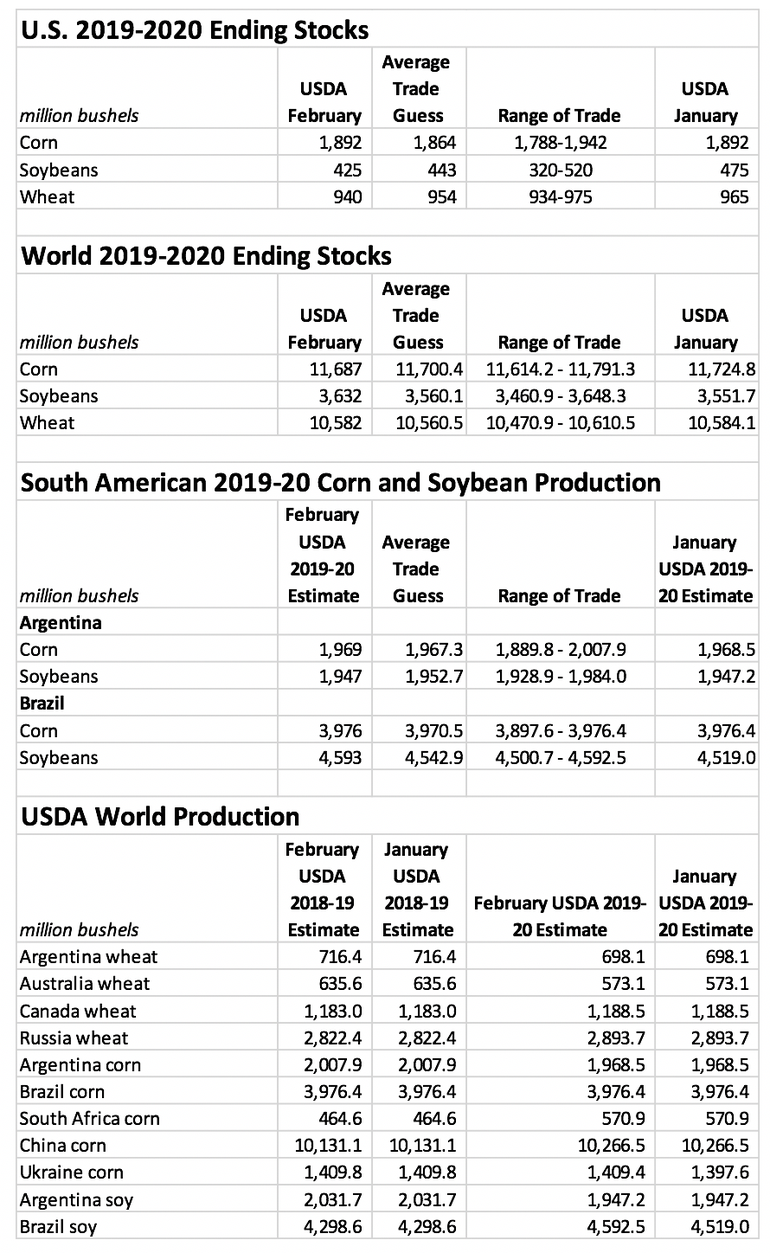

USDA offered a balanced look at domestic corn supplies after offsetting lower exports with higher ethanol usage. The agency lowered its corn export outlook by 50 million bushels, based on a sluggish pace through January, while bumping up corn usage for ethanol by the same amount. That left ending stocks at 1.892 billion bushels, versus trade estimates of 1.864 billion bushels.

USDA also left the season-average price unchanged, at $3.85 per bushel.

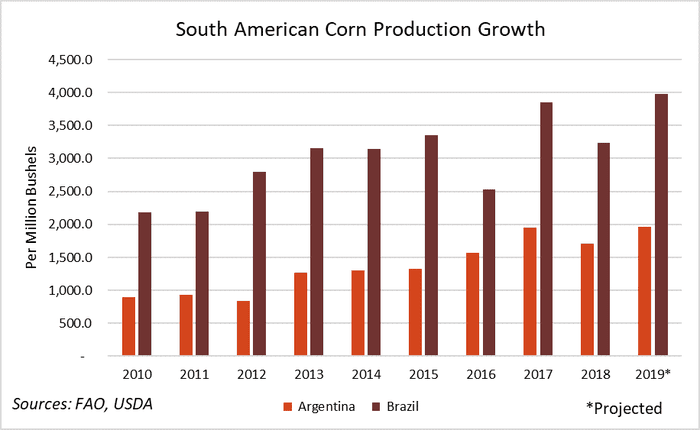

Worldwide, USDA slightly increased its estimates for grain production to reach 1.403 billion metric tons, based on increased from South Africa, Moldova and Ukraine. The agency also notes higher exports from South African and Ukraine, which largely offset reductions from the U.S. Ending stocks are now at 11.687 billion bushels, versus January’s tally of 11.724 billion bushels.

“South American corn production estimates were unchanged by USDA and global stocks tightened by 38 million bushels, which was more than expected by average trade estimates, so the futures price decrease was in large part a function of slashed export demand,” according to Farm Futures grain market analyst Jacqueline Holland.

Today’s report leads the question of acreage intentions for the spring, Holland adds.

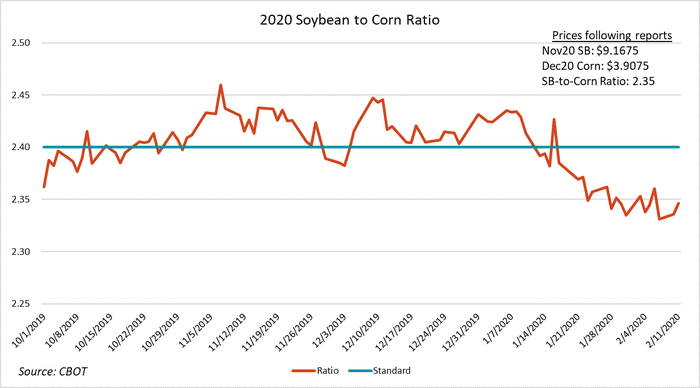

“The soybean-to-corn price ratio continues to show preference to corn acres following this morning’s report, trading comfortably below the 2.4 benchmark,” she says. “But the lack of movement from corn exports may leave many farmers concerned about profitable corn prices going into the early days of spring. Keep an eye on cash markets for more clues about export sentiments that may boost demand ahead of March’s prospective planting report.”

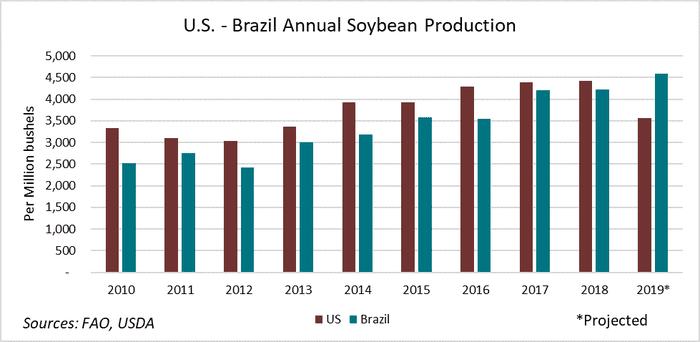

For soybeans, USDA’s outlook shows higher exports and lower ending stocks. Domestic soybean exports for 2019/20 are now projected at 1.825 billion bushels, a 50-million-bushel increase from January, based on an uptick in Chinese purchases. The agency left soybean crush estimates unchanged, with ending stocks down another 50 million to 425 million bushels. Analysts were expecting a more modest decline to 443 million bushels.

“The Brazilian soybean harvest received a 74-million-bushel bump from USDA’s estimates, which surpassed all market expectations,” Holland says. “Futures prices traded lower as a result, but losses were limited by the 50-million-bushel increase in U.S. exports.”

Still, a recent downward trend in prices had USDA revising the season-average price 25 cents lower, to $8.75 per bushel.

USDA’s latest outlook for wheat included stable supplies, an uptick in exports and lower ending stocks. Exports moved 25 million bushels higher than prior projections, leaving ending stocks at a five-year low of 940 million bushels. That was also lower than the average trade guess of 954 million bushels.

World ending stocks for wheat also moved lower, from 10.584 billion bushels in January down to 10.582 billion bushels. Analysts were expecting a bigger drop, with an average trade guess of 10.560 billion bushels.

USDA is still expecting bumper crops in South America, with soybean production estimates moving 74 million bushels above January’s tally to reach 4.593 billion bushels. The agency left Brazilian corn production mostly unchanged, at 3.976 billion bushels. The agency’s assessment of Argentina’s crop also held steady, with corn estimates at 1.969 billion bushels and soybean estimates at 1.947 billion bushels – both in line with analyst estimates.

Click here to read today’s full report.

About the Author(s)

You May Also Like