There are two types of rallies in the grain markets: supply-driven or demand-led.

Supply driven rallies tend to be explosive and short-lived, while demand tends to be more of a grind toward higher trade action.

The grain market has had a supply-driven rally, which soon after the June WASDE report was released. This was as hot, dry conditions had traders pricing in lower production prospects. Within eight trading sessions, December corn rallied $0.99 ¼ while November soybeans rallied $1.95 ¾.

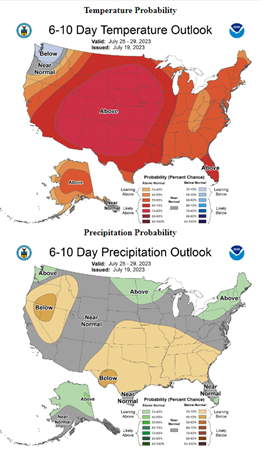

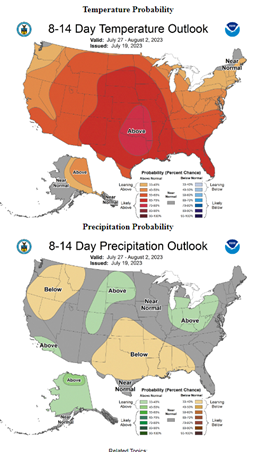

When the weather pattern changed, bringing rain into the corn belt, November soybeans gave back $1.21 ¼ of the rally in five days, while the December corn market broke $1.44 ¼ in nine days. With the weather forecast projecting a return of 100°F temperatures across the Southern Plains and Western Corn Belt (with below-normal precipitation), the market is amid the second supply scare of the season.

We view this rally as an opportunity to make catch-up sales as this rally is likely to be fast but short-lived. The June rally was as well as higher prices are rationing demand we don’t have, especially in the corn market.

If demand is left unchanged year-on-year and the crop declines another 4.3 b/a, USDA would not need to make any ending stock adjustments. If the national yield were cut 7.4 b/a off the current estimate to 170.1 b/a ( 11.4 b/a off trend ) and the rest of the balance sheet was left unchanged, ending stocks would still be a comfortable 2 billion bushels.

USDA's feed and residual category is projected to increase by 225 mb yearly, which looks optimistic. If it is overstated, the reduction will add back to the already burdensome ending stocks number. Export competition from Brazil has limited U.S. corn exports, and we believe this trend will continue. Brazil has produced two record corn crops in a row and is now the world's largest exporter of corn. In July, Brazil will likely ship 17MT of total grains/meals. The U.S. has never been close to this type of volume. Currently, offers out of Brazil are cheaper than the U.S. through April 2024.

Soybean situation ‘precarious’

The soybeans situation is a bit more precarious than the corn. With the adjustments made to the balance sheets on the July WASDE report, current ending stocks are projected at 300 million bushels using a trendline yield of 52 BPA. There are projections of record heat and little rain in the forecast for the western portion of the Corn Belt. If this occurs, as we end the month of July and move into June, the odds of hitting that 52-bushel bean yield seem very low. If you dropped the national yield by two bushels, that would equate to 165 million bushels of lost production. Without any demand adjustments, carry-out would fall to 134 million bushels. If you took three bushels off the national yield, the carry-out would fall to 50 million bushels without any demand reductions. It is not all bullish news as South America's competition will be fierce.

Brazil beat its previous record crop this past season by 17MT (625 Mbu), which will help offset the void of lost U.S. production. Brazil's soybean acreage is expected to expand again with plantings this October. Odds are Argentina will rebound from its smaller crop due to drought this past season. USDA uses a trend yield for forecasting new crop Brazil production at 163Mt (a new record and 1.69 Bil Bu more than is forecasted for the U.S.)

If the current weather concerns play out, the role of the market will be to rally high enough to shift exports to Brazil.

AgMarket.Net encourages producers to take a “sell-and-defend" approach. We recommend purchasing calls against futures and cash sales for upside protection (if the crop is smaller than the trade currently pricing in. Or consider using a put strategy to put a floor under the market and leave the topside open. Consider purchasing the weekly or short-dated calls to limit the cost of the options.

If you have questions or would like specific recommendations for your operations, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

About the Author(s)

You May Also Like