Below we take a quick look at the USDA’s May Supply & Demand report which provided a snapshot of the current marketing picture for the 19/20-21 corn and soybean crops as well as a first glimpse of the 2021-22 outlook.

Corn ending stocks down

USDA took 20-21 ending stocks down 95 to 1.257 billion bushels (bbu) in the May WASDE which was just 18 less than the trade average. New crop carry-out was pegged at 1.507 bbu, 163 million above the trade. Old crop adjustments were limited to a 100 million bushel increase in exports to 2.775 billion, and a 5 million reduction to the FSI non-ethanol corn grind. The U.S. is expected to face strong export competition in the coming year with year-to-year production increases of 4, 16 and 7.2 MMT expected for Argentina, Brazil, and Ukraine (1.07 bbu!).

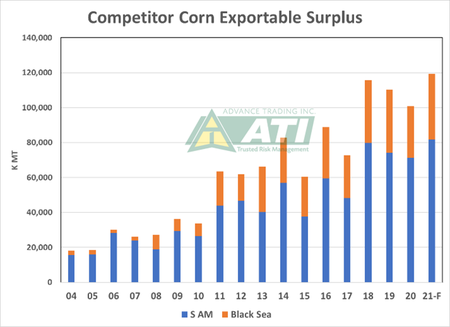

See also, the graph “Competitor Corn Exportable Surplus” below. These projections contributed to the initial forecast for exports to be 325 million less, at 2.450 billion. USDA did add 2 MMT to its old crop China import forecast, which is now at 26 MMT, but no growth is expected in 21-22.

USDA also trimmed Brazil’s 2020-21 corn crop estimate by 7 MMT, down to 102 million (and further cuts are likely according to trade sources).

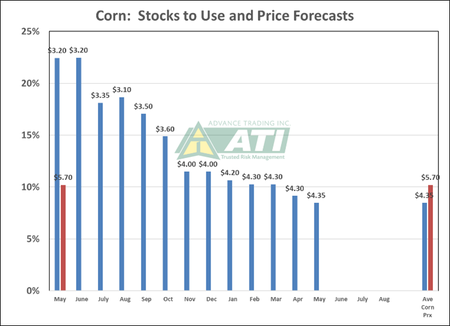

The 20-21 average producer price forecast was bumped $.05 higher to $4.35 as USDA’s ending stocks-to-use estimate tightened further from 9.2% in April, to 8.5%. 2021-22 is expected to see some build in the corn cushion with the ratio rising to 10.2% and justifying an average farm price which is $1.35 higher at $5.70. Note that in the graph “Corn: Stocks to Use and Price Forecasts,” the initial ratio printed back in May of 2020 at 22.4% is more than twice as large as the current estimate for 19/20-21 as well as for 20/21-22. And July 21 corn futures are well north of $6.00 per bushel.

Why was the report bearish for 2020/21-22 corn? Because of the anticipated large increase in competing corn production. Even so, the U.S. crop is not quite in the ground and it’s a long way to the South American harvest as well.

A key follow-up point is that USDA’s 19/20-21 carry-out figure is not exactly a certainty—further deterioration in Brazil’s safrinha crop will add marginally to U.S. exports for the remainder of the year (more so for new crop) and secondly, most in the trade will argue USDA’s 19/20-21 2.775 bbu export projection could be notably under-stated. Weekly inspections need to average 55-56 per week from Mid-May onward.

Yet, corn is flying off the shelf. It has been leaving U.S ports at the rate of a lofty 73-74/week for the 3rd quarter and, the unshipped total is record large at over 800 million bushels!

Soybean balance sheet

The old crop U.S. balance sheet was a non-event in the May report with ending stocks remaining at 120 mbu (2.6% stocks-to-use) and, the average producer price steady at $11.25. New crop carry-out is expected to be only 20 mbu larger at 140, nudging the stocks-to-use ratio up to 3.2% and supporting a $13.85 average producer price. Old crop South American production changes were limited to a ½ MMT decline in Argentine output to 47.0 but for new crop, stratospheric prices are expected to boost production in the former by 5 MMT (11%) and in Brazil, by 8 million (6%). Number one soybean importer China saw no changes in its 20/21 estimate (100 MT) with the 21/22 total 3 MMT greater.

IF South American production lives up to expectations and no major ASF problems recur in China, beans look a tad over-priced. But it is still a long way to harvest.

There are still a few factors that could impact old crop U.S. supplies:

There are reports of 3-4 cargoes of Brazil soybeans headed to the U.S. east coast;

Unshipped sales are at a 5-year low and inspections may struggle to reach the USDA forecast;

The National Oilseed Processor’s April crush was below trade estimates as the result of a particularly low export meal number as well as plant down time. Some are now suggesting the USDA could be 15-20 mbu TOO HIGH on its crush forecast;

The June 1 stocks report.

As with corn, soybean exports in the coming year are projected to decline, down 105 million to 2.075 billion. While global imports are expected to increase by 5 MMT (185 mbu +/-) with 3 MMT of that demand coming from China and the balance from the rest of the world, South American production is projected to rise by 14 MMT/515 mbu. That’s the equivalent of adding another Iowa’s production to world supply.

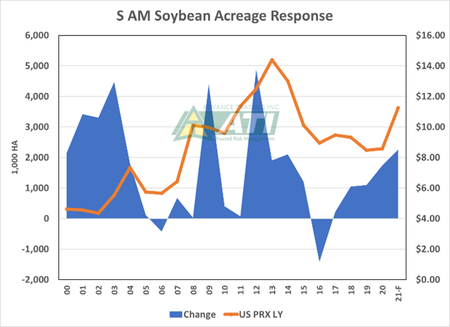

The graph below shows year to year changes in harvested acres (blue shaded area) in response to the preceding year’s average U.S. farm price (orange line). USDA is projecting that 20-21’s $11.25 per bushel price will encourage a 2.3 million hectare (about 5.7 million acres) increase in soybean area.

So, IF the production estimates come to pass, not only will South America produce enough soybeans to meet the expected growth in demand, but the world will be able to modestly add to stocks levels.

U.S. producers are coming off a strong year of rising prices. Agriculture is a global market on both the demand and supply sides; overseas producers will very likely respond in the same manner as their U.S. counterparts

U.S. producers are coming off a strong year of rising prices. Agriculture is a global market on both the demand and supply sides; overseas producers will very likely respond in the same manner as their U.S. counterparts

More acres equals more production (weather cooperating) equals, more than likely, lower prices in 2021-22.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like