USDA chose to punt this week, making no revisions to domestic supply nor demand categories when it released its March 9 WASDE report. The trade wasn't surprised by this move as USDA tends not to make significant adjustments in the March report.

Still, in the big picture, we believe that USDA delayed the inevitable and upward demand adjustments will happen; it’s just a matter of when.

The power of exports

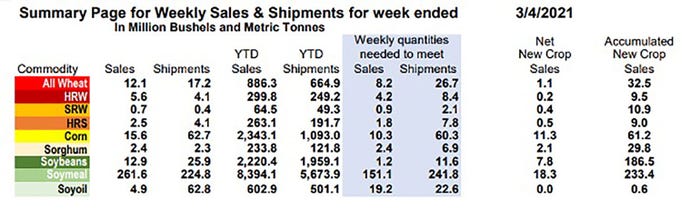

Even though USDA chose to ignore it, we are not rationing demand for corn or soybeans. This past week alone we sold 15.6 million bushels (mb) of corn. To hit USDA's current export target of 2.6 billion bushes (bb), we will only need to sell 10.3 mb a week through the end of the marketing year ( August 31st).

This week's soybean sales were even more impressive when we look at what we sold this week compared to what we will need to sell to hit the USDA 2,250 bb export target. We sold 12.9 mb this week while a paltry 1.2 mb a week is needed to hit the current target.

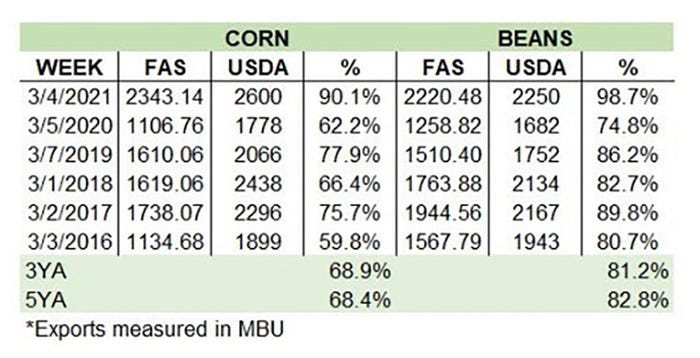

According to USDA’s Foreign Ag Service, corn export sales have reached 90% of the WASDE export projection for the 20/21 marketing year, while soybean sales have reached 98.7%. The five-year average for corn at this point in the marketing year is 68%, while the average pace for soybeans is 83%.

There is some trepidation that we will see massive cancellations of these purchases; certain importing countries have a history of buying and then canceling purchases. We believe there could be some cancelations, but that a vast majority of the commitments will be delivered.

Total year-to-date soybean sales total 2,220.4 mb, while year-to-date shipments are 1,959.1 mb. This week alone, the U.S. shipped out 25.9 mb. We will only need to ship 11.6 mb a week for the rest of the marketing year to hit the current export number.

Year-to-date, corn shipments have reached 1,093.0 mb. As a percent of sales, corn shipment looks like they are lacking. This is to be expected as exporters have aggressively shipped beans prior to the South American harvest. As the bean shipments wane, corn shipments will increase dramatically. This week alone, we shipped 62.7 mb, which is higher than the 60.3 mb per week we will need to ship to hit the USDA goal.

And then there’s ethanol

Ethanol demand is another category that we anticipate will see increased demand. Last week's production for the week ending March 5th averaged 938 thousand barrels per day, up 10.485 vs. the previous week. Ethanol stocks were down 1.58% vs. last week and 9.3% last year. Corn used in last week's production is estimated at 94.77 mb.

As the economy opens up further throughout the year, we anticipate miles driven by the consumer will increase, which will dramatically increase the demand for ethanol. In turn, we will see an increase in corn use.

Trying to trade these anticipated demand changes could be challenging as the USDA seems to take a long time to recognize what appears obvious to many. So be prepared for some frustrating volatile trade.

Eventually, USDA will have to run the ball into the end zone and factor the demand we are seeing into the balance sheet.

Reach Jim at 815-665-0461 or [email protected] @jpmccormick3

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like