USDA’s surprise cut in corn acreage announced June 30 sparked a quick rally that pushed December corn futures up nearly 40 cents in just three days.

But those gains came mainly from short-covering as speculators caught leaning the wrong way rushed to get out of bearish bets. Monday’s Commitment of Traders showed these hedge funds cut their net short position by 77,665 contracts as of the end of the month, and they bought back more since according to daily player sheets.

Now, with much of the Midwest confronting warm and mostly dry forecasts for pollination over the next two weeks, the market faces a key test.

Legs from the cut in acreage didn’t last long on their own, in part due to the other report released at the end of last month. USDA’s June 1 stocks estimate of 5.22 billion bushels was 275 million more than anticipated. Statistical noise from sampling errors may have caused some of the shortfall. But it also likely suggests feed usage plummeted from a livestock sector disrupted by COVID-19 in the March-May quarter.

This means more bushels could be leftover at the end of the 2019 marketing year Aug. 31, offsetting some of the lost acres.

Record crop on the way?

With crop ratings strong last week the rally ended just about right where fundamentals predicted, according to my pricing model. The 73% of U.S. corn fields rated good or excellent translates into a yield of 184 bushels per acre, compared to the 178.5 bpa the government is using as “normal.” The bigger yield represents a crop of 15.5 billion bushels, a record if it holds. Ending stocks 14 months from now could still reach 3.2 billion bushels – in other words, plenty – keeping the average cash price around $3.20.

Still, as the acreage report rally shows, futures markets have a way of overshooting expectations, providing pricing opportunities when they do. Now the question is where the rally goes from here.

The answer lies with the market’s guess about what’s happening to the crop in this critical month when yield potential is established.

Eye on July weather

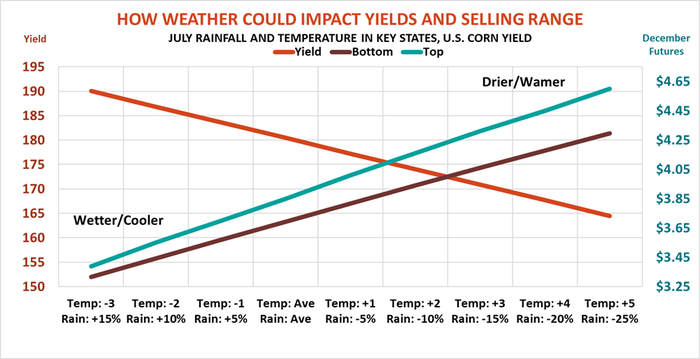

After fast planting this spring and lack of weather extremes in June, July rainfall and temperature in major corn-growing states are used in a model popular with traders for assessing yields. The chart below shows how varying July temperature and rainfall affect this hypothetical yield, and with them, my forecast futures selling target ranges.

Average precipitation and heat during the month would produce a yield right where crop ratings predicted last week, and with it selling price targets in a range of $3.57 to $3.70. December futures traded up to $3.63 before the Independence Day holiday.

Increasing average temperatures by 1 degree and cutting rainfall 5% cuts the projected yield to180 bpa, boosting the selling range to $3.69 to $3.85. Adding 2 degrees and taking 10% off average rainfall ups the range to $3.82 to $4.01.

Cooler and wetter July weather would have just the opposite impact. So if the outlook changes, summer highs likely are in.

Monday’s Crop Progress report trimmed about a bushel an acre off yield potential after a warm week that saw little or no rainfall in parts of the Corn Belt.

How long that pattern continues should determine whether the market can take a stab at $4, or maybe more.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like