Grain futures are posting modest losses this morning, led by selling in corn after USDA’s first estimate of 2019 ending stocks was much larger than expected. Corn futures were down more than 1% following the report’s release, with soybeans falling less than 0.5%.

“Selling was relatively modest in the wake of today’s reports, even though the numbers look bearish, especially for corn,” according to Farm Futures senior grain market analyst Bryce Knorr. “But the initial burst of selling came from computer-driven, high frequency traders and quickly subsided because humans recognized what the machines could not: USDA’s numbers for both corn and beans are based on assumptions that are largely a fiction.”

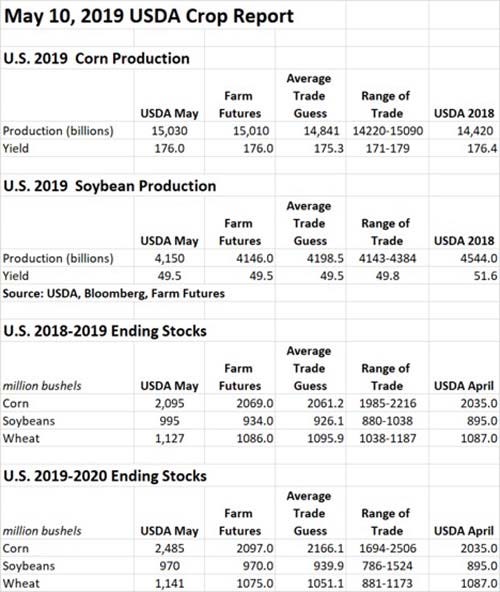

USDA’s latest corn numbers put domestic production this year at 15.030 billion bushels, which comes in moderately ahead of 2018’s tally of 14.420 billion bushels and an average trade guess of 14.841 billion bushels. USDA estimates average yield potential to reach 176.0 bushels per acre, also above analyst expectations of 175.3 bpa.

Farm Futures, which regularly participates in analyst surveys, came quite close to the agency’s May numbers, offering estimates of 15.010 billion bushels on average yields of 176.0 billion bushels.

The agency’s data has corn ending stocks moving from 2.035 billion bushels in April up to 2.095 billion bushels. Domestic soybean stocks are also on the rise, moving from 895 million bushels a month ago to 995 million bushels. That’s also the case for domestic wheat stocks – moving from 1.087 billion bushels in April up to 1.127 billion bushels this month. Analysts expected smaller increases for corn and soybean stocks, and a fractional decline in wheat stocks.

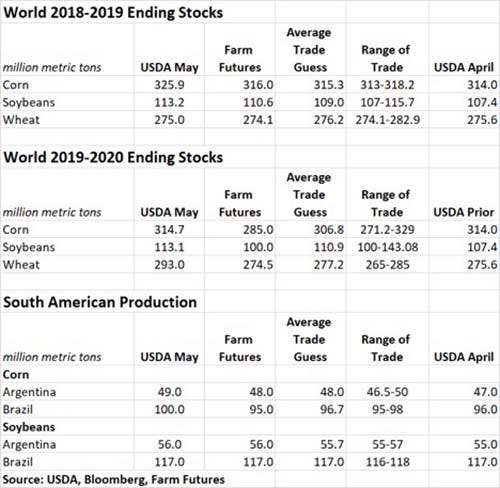

World ending stocks for 2018/19 corn took a large leap forward, moving 3.8% higher to 12.830 billion bushels, according to USDA. Soybean world ending stocks also moved higher, to 4.159 billion bushels, with wheat world stocks declining slightly to 10.105 billion bushels.

USDA’s estimates for 2019/20 world ending stocks includes 12.389 billion bushels for corn, 4.156 billion bushels for soybeans and 10.766 billion bushels for wheat.

USDA predictably did what Knorr expected by incorporating March planting intentions with yield guesses that assume normal planting rates and summer weather.

“So, USDA’s production estimate of 15 billion bushels of corn is what would happen if the spring of 2019 never happened,” he says. “But it did, and yield potential will likely be less, depending on how much corn farmers plant in the next 10 days.”

A more reasonable starting point for corn production is 14.575 billion bushels, Knorr suggests. Once that is plugged into forecasting models, ending stocks fall below 2 billion bushels rather than the much larger number USDA currently projects.

USDA is predicting lower production for soybeans this year, in contrast, moving from 4.544 billion bushels in 2018 down to 4.150 billion bushels on average yields of 49.5 bpa. Trade estimates were on the nose on per-acre yield estimates (also at 49.5 bpa) but predicted a slightly higher final production of 4.198 billion bushels. Farm Futures contributed estimates of 4.146 billion bushels and 49.5 bpa.

But just as Knorr thinks corn production numbers are too high right now, he also thinks soybean production estimates are too low.

“It’s hard to justify anything but a bearish outlook for oilseeds, even if a trade deal with China gets inked,” he says. “USDA finally bit the bullet an acknowledged that China’s appetite for soybeans is lower than previously estimate due to the impact of African swine fever, not to mention the trade war with the U.S. Demand is likely to improve only slowly in the coming year, whether the beans come from the U.S. or Brazil.”

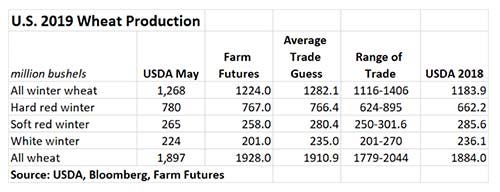

For wheat, USDA estimates all-wheat production this year at 1.897 billion bushels, up from 1.884 billion bushels in April. Increases in hard red winter wheat production are expected to more than offset small declines in soft red winter and white winter wheat production.

“The key to wheat may be damage from ongoing rains that could prove too much of a good thing,” Knorr says. “That wouldn’t help U.S. farmers with less to sell, though it would raise prices. Otherwise, wheat’s troubles look set to continue for another year.”

In South America, USDA raised its production estimates for Brazil and Argentina corn production to 3.937 billion bushels and 1.929 billion bushels, respectively. If realized, that would make Brazil’s corn crop this year the largest on record. USDA also raised its estimates for Argentina soybean production to 2.058 billion bushels, holding Brazil’s soybean production estimates steady at 4.299 billion bushels.

About the Author(s)

You May Also Like