Harvest is over and this morning I read a short blurb in a farm newsletter. It was titled “Grain prices need to increase enough to ration demand.” The sentiment expressed in that title was unthinkable just 3 months ago. This market is an early Christmas gift for grain producers.

So what do I hear from producers? The old laments of a person who sold too early. “I wish I hadn’t sold my soybeans at harvest,” or “Why did I sell my corn in September?”

Snap out of it! Never forget that you are a producer with more grain to selI, and higher prices are always good. Did you sell out of soybeans at harvest? Quit looking in your rear-view mirror! Between special payments and a market bounce, 2020 will be a good year for most producers. Look ahead and see the opportunities. Last year at this time, the Nov’21 contract was trading at $9.20/bu. At the depths of COVID despair in late April, the Nov’21 contract was trading under $8.50/bu. As I write this, the Nov’21 contract is establishing life-of-contract highs, trading at $10.45/bu.

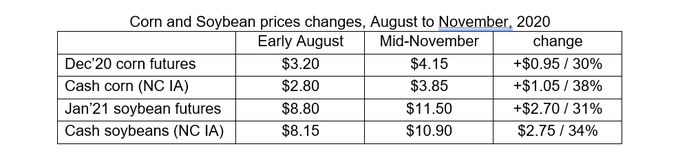

In early August, I suggested that we might be in for early lows in the corn and soybean markets. At the time, I saw an outside chance at a 5-10% price rise into harvest (25 to 75 cents/bu. for corn and soybeans, respectively). Not in my wildest dreams did I see the 30% increase in futures prices and 35% increase in cash prices that we have seen in the past 15 weeks. (See accompanying table)

I combed through 40 years of corn market history, looking for another year with a similar August to November price rise, such as 2020. I found one year better; 2010 (from the 2nd Golden Age of Agriculture, of course). I found just two more years of note, 2006 and 1995, neither as good as this year.

(By the way, does anyone recall one of the main driving factors pushing prices higher in 1995? It was an unprecedented and unexpected rise in corn imports by China, from none in the previous 4 years to 170 mb in 1994/95. Two years later, they were back to near zero. Chinese buying made it happen - how’s that for eerie?)

The market is celebrating a strong export market, driven by Chinese buying. This demand-driven party was going strong when a November WASDE report spiked the punch, trimming the supply side of the balance sheet. The party got better.

Now look ahead. Eventually this market will get around to thinking about planting intentions in 2021. Could we see an additional 5-8 million soybean acres? How about another 1-3 million corn acres. How could we not?

Look ahead. The best Christmas present you could ask for is right in front of your eyes.

About the Author(s)

You May Also Like