June 21, 2019

How time flies! Only a month ago commodity markets looked overwhelmingly bearish. But now futures may be the hottest trade around.

Here’s what funds were up to through Tuesday, June 18, when the CFTC collected data for its latest Commitment of Traders.

![]()

Even money

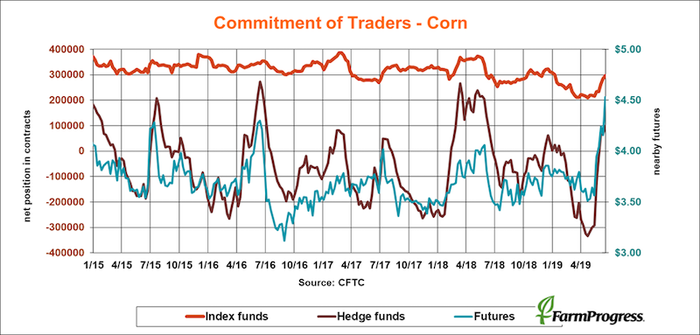

Big speculators held a record bearish bet against agriculture just five weeks ago. But the latest CFTC tally showed they’ve covered most of those short positions to move closer to neutral, buying a net 103,994 contracts. These hedge funds added most crops but sold the protein space.

Bulls run

Big speculators added 32,573 contracts to their bullish bets in corn over the past week, though some took profits later in the week.

Nervous bears

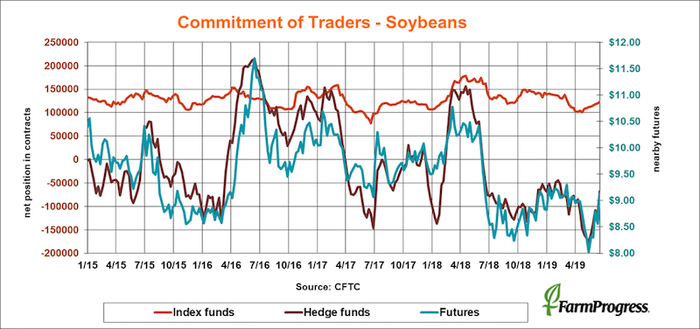

Big speculators are still net short soybeans but appeared anxious this week, buying back 47,050 contracts of their bearish bets.

Product placement

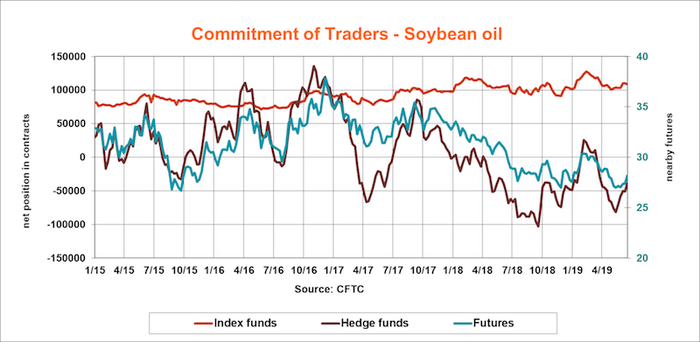

Fund bought soybean oil this week, trimming 12,236 contracts off their modest bearish bets in that end of the product market.

Crushed hopes

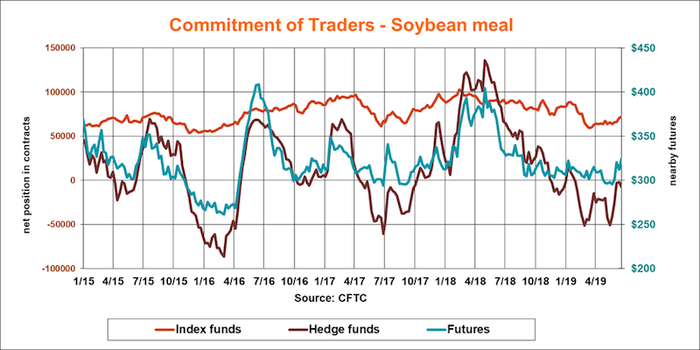

Funds bought beans and oil but sold 5,229 meal as crush margins deteriorated over the past week. Argentina is capturing more exports after a bad crop last year.

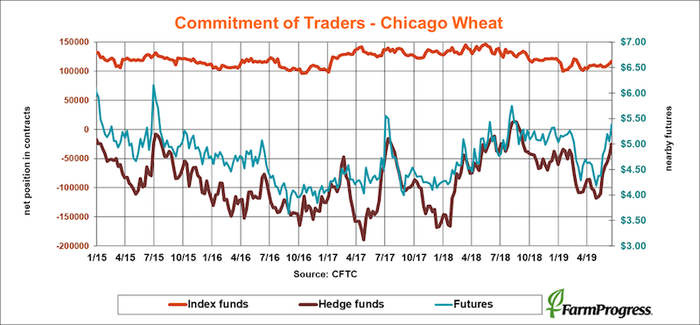

Lucky sevens

Big speculators covered bearish bets against soft red winter wheat for the seventh straight week as fears rise of damage from rain. The funds are still short, but not quite as much after buying a net 19,194 contracts.

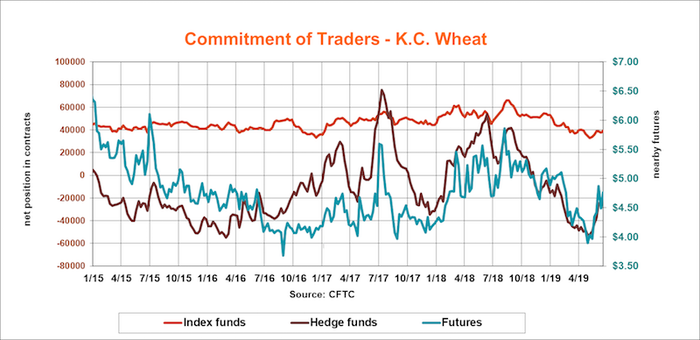

Weak link

Funds also bought hard red winter wheat over the past week, but that class continued to trade at wide discount to SRW. The amount of short covering reflected that: Big speculators covered only 1,504 contracts.

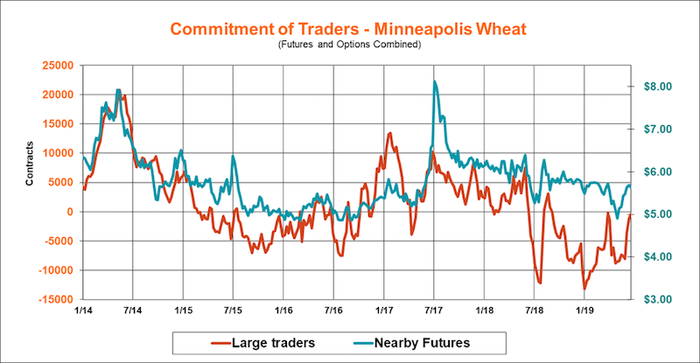

Clutch play

Large traders in Minneapolis moved closer to a neutral position in hard red spring wheat, covering 712 contracts to end the reporting period short only 449 lots.

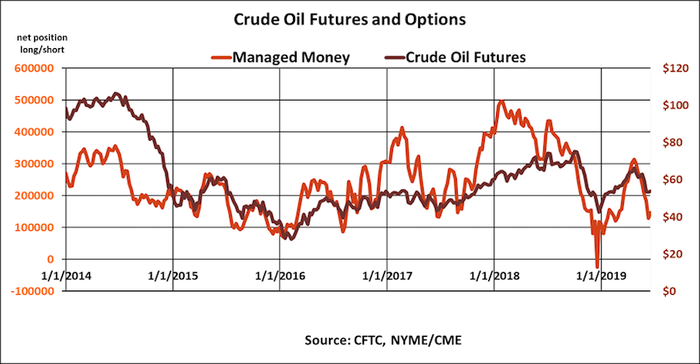

Back in business

After selling nearly $11 billion worth of crude oil futures and options this spring, money managers went the other way this week, just in time for a big rally. In all these fund traders added $934 million to their net long position.

You May Also Like