Funds holding record bearish bets in grains this spring were caught leaning the wrong way when rains caused record slow corn planting. And surprise, farmers took advantage of their pain to start moving old crop inventory.

Here’s what funds were up to through Tuesday, May 21, when the CFTC collected data for its latest Commitment of Traders.

![]()

Ouch, that hurts!

Big speculators took a record net short position into the latest week and found out the hard way what it feels like to get stampeded. Though hedge funds continued to sell cotton, hogs and beef, they aggressively bought back bearish bets in crops, taking 224,234 contracts off their net short position in ag.

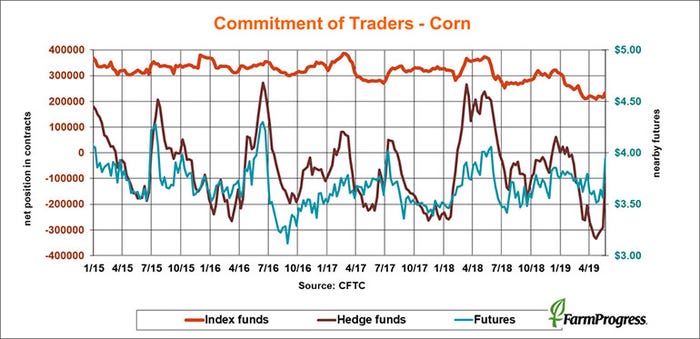

Move it or lose it

Big speculators held a record bearish bet against corn just a month ago. Their short covering was modest until the last week, when record slow corn planting forced them to abandon those positions. These hedge funds are still short, but they lopped 170,220 contracts off their net short position as of Tuesday, covering more the rest of the week. Commercial traders sold nearly as much, more than 800 million bushels worth, likely hedging corn purchased from farmers and smaller elevators

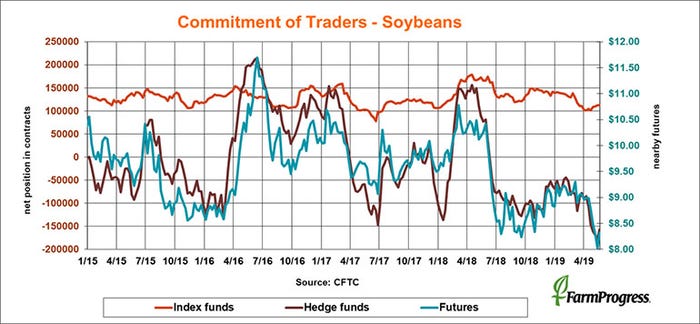

Second fiddle

Big speculators held a record short position in soybeans last week, and bought back 19,711 contracts of it as soybeans enjoyed a little bounce. But these hedge funds were still short 157,324 contracts as of Tuesday.

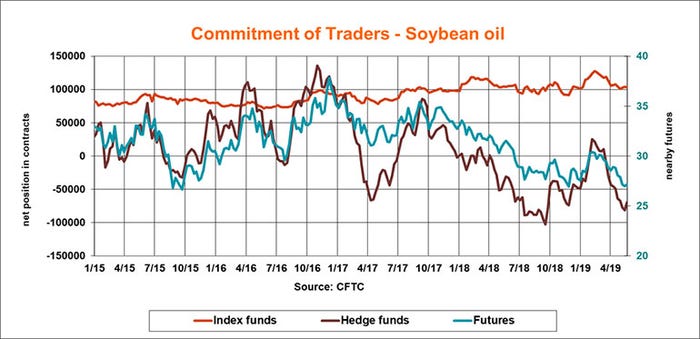

Bucking global trend

Vegetable prices moved lower again this week in Asia. But the U.S. market benefited by fund short covering as big speculators liquidated 11,964 contracts off their bearish bet in soybean oil.

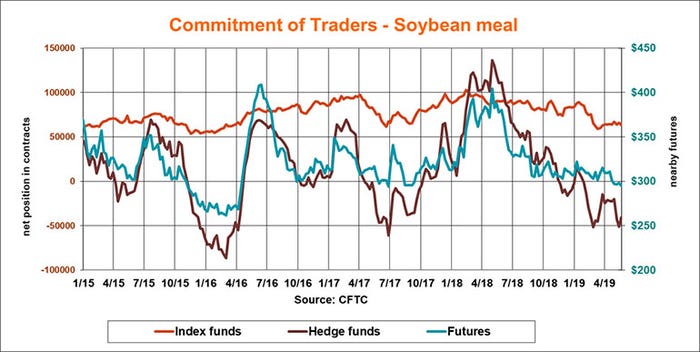

Off the bottom

Big speculators last week held their biggest bearish bet of the year against soybean meal. Not this week, as they covered 10,097 contracts of that net short position.

Join the party

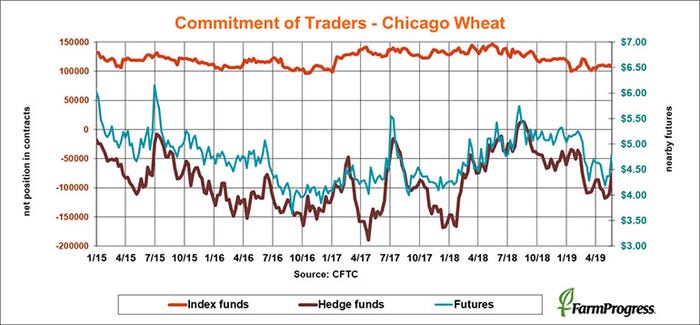

The soft red winter wheat market got a lift from corn and from the same reason – short covering by funds, who bought back 33,237 contracts of their bearish bet this week.

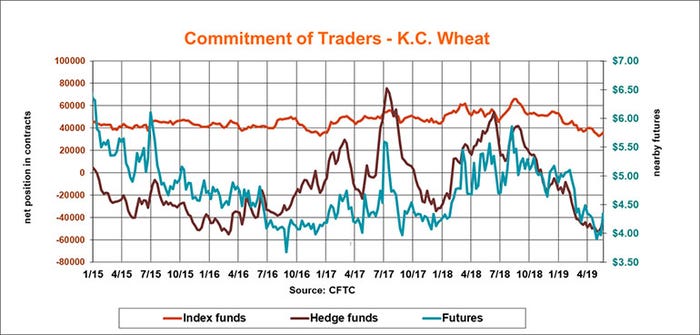

Stubborn bears

Big speculators also were forced out of hard red winter wheat positions, but short covering wasn’t as aggressive. The hedge funds bought back 6,883 contracts in the latest week.

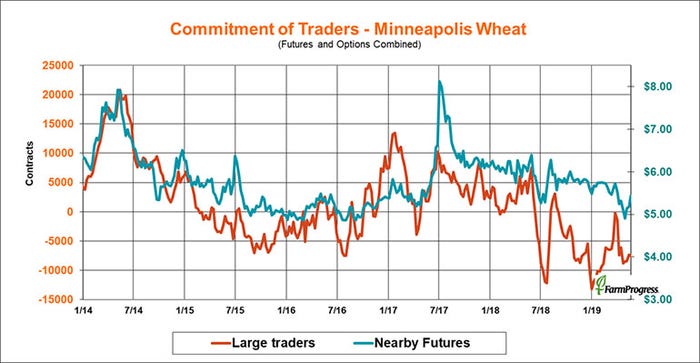

Lost in translations

Large traders in Minneapolis didn’t get the message from the rest of the grain market this week. Non-commercials, likely a few funds, cut both long and short positions, while commercials increased both longs and shorts.

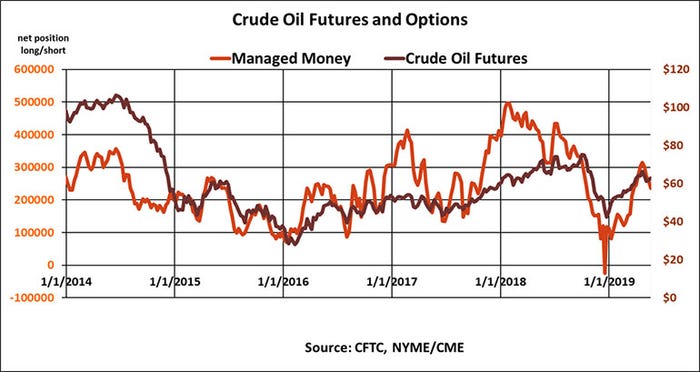

The right bet

Money managers have been selling crude oil futures and options aggressively the last month. They continued that trend through Tuesday, before prices broke the most this year. In all funds sold $1.4 billion worth of crude paper.

About the Author(s)

You May Also Like