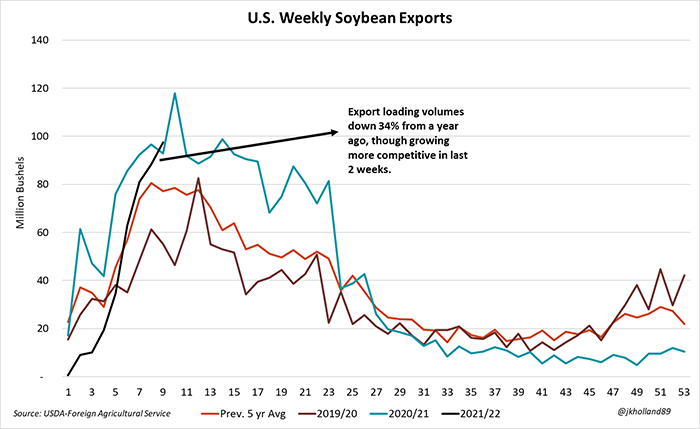

Soybean export shipments were the star of this week’s Export Sales report from USDA, rising 10% above last week’s marketing year high to 97.4 million bushels for the week ending November 4. It marked the highest weekly shipping volume on record for the 2021/22 marketing year and was the largest weekly soybean export shipment volume since the week ending Dec. 3, 2020.

Chicago soybean futures had been trading at a $0.01-$0.03/bushel loss in the moments leading up to the report’s release. In the aftermath, soybean futures rose $0.02-$0.03/bushel on the prospect of improving shipping volumes.

China was the top destination for U.S. soybeans last week, with nearly 85.9 million bushels, or 63% of the weekly total, shipped to the world’s second largest economy. Germany (11.4M bu.) and Egypt (5.2M bu.) rounded out the top three for the week.

Chinese buyers booked 34.5 million bushels of new 2021/22 soybean export sales during the reporting week, contributing to the weekly sales tally of 47.4 million bushels. While the total for old crop export orders was on the lower end of analyst estimates (35M – 66M bu.), new crop export sales of 1.1 million bushels surpassed the nearest analyst guess of 734,867 bushels thanks to a 1.1-million-bushel sale to unknown buyers over the reporting week.

Corn export sales remain strong

Even though peak corn export season is still a few months away, 2021/22 corn export sales reported in this morning’s weekly Export Sales report saw some glimmers of optimism on the horizon for the corn complex.

International buyers booked just shy of 51 million bushels of 2021/22 corn export sales during the Oct. 29 – Nov. 4 reporting period, coming in on the higher end of analyst expectations leading up to the report’s release (28M – 55M bu.).

Canada led the charge on old crop export purchases, booking 14 million bushels over the reporting week. Colombia (12M bu.) and Mexico (11M bu.) rounded out the top three orders for the week ending Nov. 4.

Despite recent flooding and crop damage in its northern corn belt, China was noticeably absent from interest in U.S. corn this week. Barely 7,000 bushels of 2021/22 corn were shipped to China over the past week and no new sales were booked, even though nearly 44% of current outstanding 2021/22 corn export sales are slated to be delivered to China at some point in this marketing year.

But in fact, weekly corn export shipments fell slightly from last week, due in large part to slow Chinese buying rates. Of the 28 million bushels of U.S. corn shipped to international buyers over the past week, 12 million bushels went to Mexico, 7 million bushels were shipped to Japan, and Colombia will receive nearly 4 million bushels in the coming weeks after the past week’s shipments.

The weekly report had little effect on futures prices at the Chicago Board of Trade, remaining largely unchanged from the morning’s $0.02-$0.03/bushel loss.

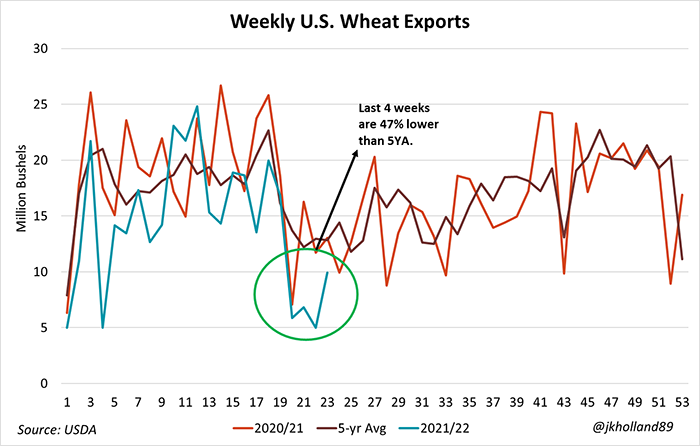

Wheat shipments struggle

Weekly wheat shipments backed off from last week’s lows, rising by nearly double on the week to 10 million bushels. Over the last four weeks, U.S. wheat shipments are down a staggering 43% from the same levels recorded a year ago and are 47% lower than the five-year average for the same period.

Top three destinations included Mexico (3.9M bu.), Thailand (1.9M bu.), and Columbia (1.6M bu.).

Export sales data offered more optimism for the U.S. wheat futures complex, which did ease back about a penny’s worth of losses following the report’s release. Weekly orders for 2021/22 wheat export sales held steady at 10.5 million bushels, down about 4.2 million bushels from the previous week.

Notable 2021/22 export sales included a 5.6-million-bushel order from the Philippines, 2.1 million bushels booked by Japan, and Mexico booking 1.4 million bushels during the week ending Nov. 4.

But despite the lackluster 2021/22 wheat movement in this week’s report, there was some optimism for 2022/23 wheat export sales, which totaled a notable 826,725 bushels for the reporting week thanks to an order booked buy an unknown buyer. Market analysts had only been expecting no more than 367,433 bushels of new crop wheat export sales, which helped support optimism in the wheat futures markets this morning.

Even though the morning’s report had little short-term optimism for the wheat sector, market watchers are expecting better prospects in the months to come. Tight European Union and Black Sea exportable supplies currently are predicted to help boost U.S. wheat export shipments later in the 2021/22 marketing year.

And with increasing geopolitical turmoil amidst Russia’s military presence at the Ukrainian border, U.S. wheat prices could see a windfall in the wheat export market sooner rather than later.

About the Author(s)

You May Also Like