When Martin Barbre, administrator of USDA’s Risk Management Agency, visited Georgia two weeks after Hurricane Michael, a fellow staffer looked at him and said, “This isn’t risk management. This is disaster management.”

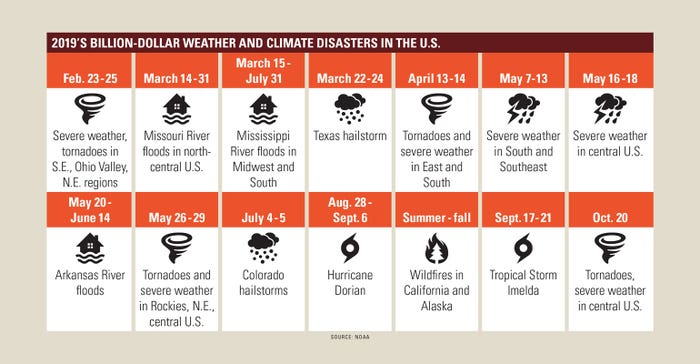

That comment neatly summarizes the coming debate over crop insurance as a risk management tool in the age of weather extremes. In 2019, the U.S. experienced 14 weather and climate disasters, with losses exceeding $1 billion. By January, RMA paid roughly $4.3 billion in claims related to prevented planting for the 2019 crop year, nearly all associated with flood and excess moisture. RMA paid out roughly $9.57 billion in overall claims for the 2019 crop year.

Keith Coble, ag economist at Mississippi State University, says even though 2019 was an extremely bad year, it did not lead to a dramatic spike in crop insurance losses because losses were mostly prevented planting payments rather than full-season crop losses. RMA incorporates the last 20 years of loss experience and then links it to weather for a longer period. But as technology rapidly advances, it does create challenges in accounting for those variables in any modeling.

“When we’re talking about extremes in weather, it’s very hard to sort changes in the climate from short-term random luck. Weather tends to be very variant,” Coble says. “Last year was a wet year, but it’s different to say, fundamentally, certain regions suffer flooding more frequently than in the past. It takes many years of data to be confident that is happening.”

So the question remains: What risk mitigation role will the government play to protect the food system as farmers continue to face more extreme weather events?

Barbre, an Illinois farmer, knows firsthand the importance of keeping crop insurance premiums manageable. It not only levels the risk across the pool of participants, but also ensures continued high participation. “If our policies were set up totally for disasters, then our rates would be so high our producers couldn’t afford them,” he says. “It’s a balance, and we try to rebalance that as often as we can.”

USDA Secretary Sonny Perdue says he’s charged Barbre and RMA to examine disaster losses and how the agency might adjust those losses for pricing and yield, especially as crop insurance policies often account for historical averages.

“We understand the challenges from producers’ perspectives, and we want to be as flexible as we can,” Perdue says.

Despite increased temperatures and rainfall, RMA trendline losses show the loss experience has improved rather than worsened over time. “It appears the program loss experience has improved. I suspect we have found ways to use technology and genetics to reduce risk,” Coble says.

For example, irrigating more effectively and using improved seed genetics have helped manage weather events. Over a decade ago, RMA offered a discount to producers who used triple-stack technologies, but eventually it was phased out as multiple-stacked seed varieties became the norm. In Iowa and Illinois, a state-level program approved by RMA offers a $5 discount on crop insurance premiums for planting cover crops.

Coble expects private add-ons to USDA-backed policies to continue to offer variations that help manage risk. He further expects “special data analytics to be a game changer,” as more policies can be compared to similar soil types rather than just county-based data. Improved data and understanding will drive the innovation.

At the end of the day, Coble says government will have to balance incentivizing mitigation rather than disincentivizing it.

About the Author(s)

You May Also Like