June 23, 2021

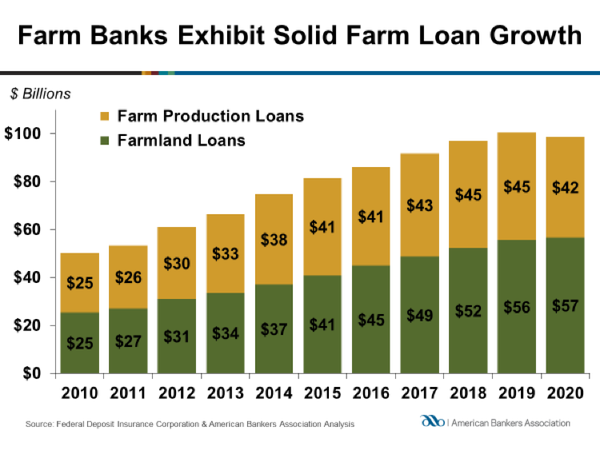

Despite the global economic slowdown in 2020 due to COVID-19, total agricultural lending by U.S. farm banks remained strong at $98.6 billion, decreasing by only 1.8% from the year before according to the American Bankers Association’s annual Farm Bank Performance Report. The report attributed the change to a 6.7% decline in agricultural production loans. By contrast, outstanding loans secured by farmland increased 2.1% to $56.7 billion. According to the report, rising costs, supply and production bottlenecks, price volatility, and a significant increase in federal cash payments depressed demand for agricultural production loans in 2020. Government payments also enabled producers to pay down existing loan balances.

“American farm banks have remained healthy this past year and continued to play a critical role in supporting farmers and the broader US economy through the turbulence of 2020,” said ABA’s Chief Economist Sayee Srinivasan. “While the agricultural sector will continue to face challenges as the economy reopens and recovers from the coronavirus pandemic, the strong asset quality and capital levels of America’s farm banks will help ensure that they continue to provide support to rural communities.”

The report—an analysis by ABA’s economic research team based on FDIC data—examines the performance of the nation’s 1,642 banks that specialize in agricultural lending. ABA defines farm banks as banks whose ratio of domestic farm loans to total domestic loans is greater than or equal to the industry average.

According to the report, farm banks also supported rural communities via the Paycheck Protection Program. At the end of 2020, farm banks held 172,818 PPP loans worth $12.7 billion on their balance sheets. Farm banks distributed these loans via more than 7,700 branches across rural America, preserving jobs at local small businesses and providing an important lifeline to the communities they serve.

The report also shows that farm banks are also a major source of credit to small farmers—holding more than $45.2 billion in small farm loans with $10.5 billion in micro farm loans at the end of 2020. A small farm loan is a loan with an original value of $500,000 or less and a micro farm loan is a loan with an original value of $100,000 or less.

In 2020, farm banks’ asset quality improved slightly despite a struggling ag economy as consolidation and cash payments aided the paydown of loans by farmers. More than 97% of farm banks were profitable in 2020, with more than 51% reporting an increase in earnings. Farm banks also served as job creators, adding more than 2,000 jobs in 2020, a 2.4% increase, and employing more than 81,000 rural Americans.

Farm banks also continued to build strong, high-quality capital reserves throughout 2020 and are well-insulated from risks associated with the agricultural sector. Equity capital at farm banks increased 9% to $52.6 billion, while Tier 1 capital increased by $3.6 billion to $48.3 billion.

The entire banking industry – not just farm banks – provides farmers and ranchers with the credit they need. At the end of 2020, banks held $174 billion in farm and ranch loans. The U.S. banking industry is also a major source of funding to small farmers holding more than 1.1 million small farm loans worth $71 billion at the end of 2020. This included more than 744,000 microloans worth nearly $17 billion.

The Farm Bank Performance Report also provides regional summaries:

The northeast region’s 10 farm banks increased farm loans by 4.01% to $1.1 billion in 2020. Ag production loans fell 11.6% from the year before while farmland loans increased 6.09%.

The south region’s 164 farm banks increased farm loans by 0.40% to $8.2 billion in 2020. Ag production loans fell 3.11% from the year before while farmland loans rose by 1.70%.

The Corn Belt region’s 792 farm banks decreased farm loans by 1.93% to $46.0 billion in 2020. Ag production loans loans fell sharply by 6.89% from the year before while farmland loans rose by 1.93%.

The plains region’s 626 farm banks decreased their farm loans by 2.29% to $38.0 billion in 2020. Ag production loans fell 6.75% from the year before while farmland loans increased 2.27%.

The west region’s 50 farm banks decreased farm loans by 2.40% to $5.3 billion in 2020. Ag production loans fell sharply by 7.56% from the year before while farmland loans rose 1.48%.

Read the 2020 Farm Bank Performance Report.

Source: American Bankers Association

The source is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like