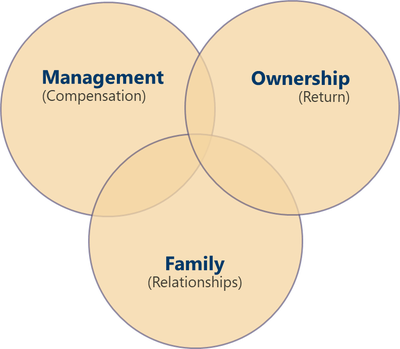

In my most recent blog I introduced the three circles of family business and discussed how overlap among them can be confusing. The words underneath the roles indicate how you get “paid” for wearing each cap.

You are compensated with wages or salary for doing your job as a Manager. Owners hopefully realize Return on Investment for the capital they have in the business. Relationships, good or bad, are the renumeration for Family activities.

Related: Three circles of family business, part 1

You often have overlap between financial compensation for doing a job and return to being an owner. Due to tax strategies, you may keep cash wages low and focus on building ownership equity or providing housing/vehicles as business deductions. Due to reinvestment strategies, we may accumulate land instead of making distributions or dividends.

These are sound strategies in many cases, but it’s worth review and discussion to make sure they are not changing motivations or causing discord. Many young families on the farm are cash poor but building equity. Is that agreed upon? Do they understand the value of non-cash compensation they are receiving via housing, vehicles, or tax savings?

Owners who are not actively working in the business may evaluate leaving “patient capital” in the business versus exiting and using it elsewhere; does your distribution policy impact that?

And finally, most people have the goal of harmonious family relationships. Thinking of those as payment for a job well done in managing these circles well may help you realize that.

Davon Cook is a family business consultant at K Coe Isom. Reach Davon at [email protected]. The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like