August 31, 2018

USDA released its August 2018 Farm Income Forecast on Aug. 30. According to the report, the farm business average net cash farm income is forecast to decline $16,600 (19.9%) to $66,700 in 2018. This would be the 4th consecutive decline since 2014 and the lowest average income recorded since the series began in 2010. All categories of farm businesses are expected to see declines with dairy farm businesses expected to see the largest decline. Every resource region of the country is forecast to see farm business average net cash farm income decline as well.

Among the findings:

Net farm income

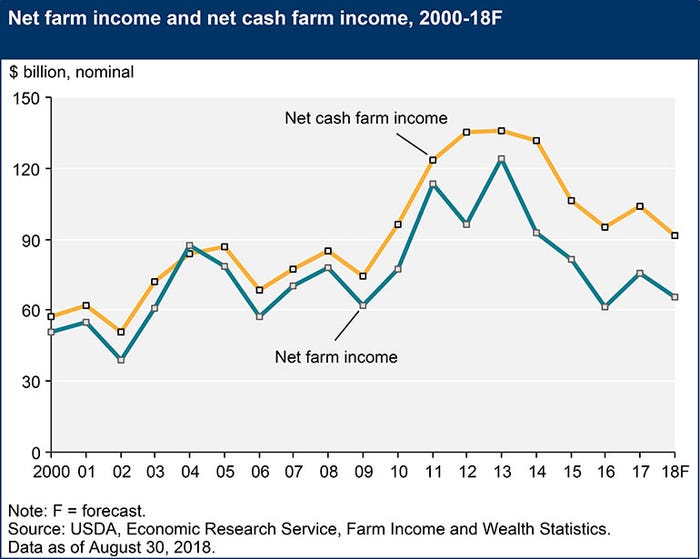

Net farm income is forecast to decrease 13% from 2017 to 2018. It is forecast to decrease $9.8 billion from 2017 to $65.7 billion in 2018, after increasing $13.9 billion, or 22.5% in 2017. Net farm income is a broad measure of profits.

Net cash farm income

Net cash farm income is forecast to decrease $12.4 billion (12%) to $91.5 billion.

In inflation-adjusted 2018 dollars, net farm income is forecast to decline $11.4 billion (14.8%) from 2017 after increasing $13.0 billion (20.3%) in 2017. If realized, inflation-adjusted net farm income would be just slightly above its level in 2016, which was its lowest level since 2002.

Defintions

Inflation-adjusted net cash farm income is forecast to decline $14.6 billion (13.8%) from 2017 to $91.5 billion, which would be the lowest real-dollar level since 2009. Net cash farm income encompasses cash receipts from farming as well as farm-related income, including government payments, minus cash expenses.

Net farm income incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income of operator dwellings.

Stable receipts

Cash receipts for all commodities are forecast to remain nearly stable in 2018 at $374 billion. Both total animal/animal product and total crop receipts are forecast to be relatively unchanged from 2017 as increases in receipts for some commodities are offset by declines in other commodities.

Milk and eggs

Receipts for milk are expected to decline $2.8 billion (7.4%) in 2018 while receipts for poultry/eggs are expected to increase $5.2 billion (12.1%).

Corn

A forecast $0.8-billion (1.8%) decrease in corn receipts will be partially offset by a forecast $0.5-billion (6.3%) increase in receipts for wheat.

Government payments

Direct government farm payments are forecast to decline $2 billion (17.4%) to $9.5 billion in 2018, with most of these declines due to lower anticipated Agriculture Risk Coverage and Price Loss Coverage program payments.

Production expenses

Total production expenses (including operator dwelling expenses) are forecast up $11.8 billion (3.3%) in nominal terms to $365.9 billion in 2018, led by increases for fuels/oil, interest, feed, and hired labor.

Farm financials

Farm sector equity is forecast up by $21.8 billion (0.8%) to $2.62 trillion in 2018. Farm assets are forecast to increase by $35.6 billion (1.2%) to $3.0 trillion in 2018, reflecting an anticipated 1.8% rise in farm sector real estate value. Farm debt is forecast to increase by $13.8 billion (3.5% ) to $406.9 billion, led by an expected 4.4% rise in real estate debt. The farm sector debt-to-asset ratio is expected to rise while the total rate of return to farm assets is expected to decline in 2018.

Reaction

National Farmers Union President Roger Johnson said financial stress is widespread among farmers, with a majority of family farmers experiencing negative farm income.

“What family farmers and rural America need right now is action,” Johnson said. “They need a farm bill passed on time this year. They need strong, fair trade agreements, and they need long-term solutions to current trade market disruptions that are depressing farm prices even further. They also need the administration to deliver on its promises to support the RFS and expand our use of biofuels, which opens new markets for American family farmers and rural communities.”

Source: USDA ERS, NFU

You May Also Like