John Shiers knows the pain of high health care costs.

He farms 1,500 acres in southcentral Nebraska, a state burdened with few options for farmers in life after the Affordable Care Act. With two children with Type 1 diabetes, his out-of-pocket medical costs climbed to $2,800 per month to cover insulin, needles, test strips and more, on top of the $2,800 he pays in premiums monthly and a $12,000 yearly out-of-pocket max.

Shiers found a bandage to stop the hemorrhaging -- or at least a 20% reduction in premiums. Last June, the Labor Department reopened the door for association health plans (AHPs). Shiers is now banding together with other farmers and getting insurance through the Nebraska Farm Bureau (NEFB).

A combination of escalating costs and fewer options on the ACA exchanges, new rules governing association health plans, and the increase in self-funded insurance options allowed companies such as the NEFB, Land O’Lakes, and Farmers Business Network (FBN) to create plans across state lines, where small businesses can be grouped as part of a common interest or take advantage of network pricing.

Risks ahead

Yet that could be at risk if the Democratic presidential candidates’ calls for “Medicare for all” gains traction, or Congress or the courts put the lid on AHPs.

A recent ruling in favor of 12 state attorneys general proclaimed the administration doesn’t have the constitutional right to override congressional intent of Obama-care by allowing reinstatement of association health plans.

AHPs give members more affordable options on the individual market, says Rob Robertson, NEFB chief administrator. He says the biggest threat is federal policy and politics taking away a solution that’s finally working for farmers. “I can’t think of any sector of the economy that is more affected by high health care costs. If you have policies to prohibit us to join together and save money, it is a huge discrimination against farm families.”

Robertson recalls up to 10,000 members in the previous health care offerings at Nebraska Farm Bureau. “After Obamacare, it became so expensive in the individual market that everyone pulled out, and everything went to shambles for our members.”

The first year of the reborn NEFB plan offers savings from $5,000 to $10,000 for members. The hope is to have 3,000 to 5,000 members, lowering costs across the board.

Also, Robertson wants to help farmers’ voices be heard on Capitol Hill, as he did in recent testimony before the House Ways and Means Committee. He says the Democrats’ proposals will raise costs for those in the individual market. “Farmers and ranchers will end up being the ones who pay for it. They’re not like most of us in society where employers pay 70% to 80% of premiums.”

There’s a faction on Capitol Hill who thinks AHPs undercut the ACA. “We don’t think it does,” he says. “We think it complements it.” AHPs provide similar coverage as ACA and cover pre-existing conditions, Robertson adds.

“If you’re in the individual market as a sole proprietor, as most farmers, you carry the entire burden of health care costs,” he says. “Sometimes this is one-third, half, or even most of your income. It sucks it away. It’s not right. Farmers and ranchers need to be able to form together to get more affordable premiums.”

Success in numbers

A report from associationhealthplans.com shows a trend toward comprehensive benefits and double-digit savings among the 28 AHPs launched over the last year in 13 states. Kev Coleman, president of the site, says he expects to see more farmer groups collaborate with one another to lower costs.

Coleman says employer collaboration creates competition. Large group health plans spend smaller amounts on overhead, administration and marketing, and can leverage lower prices through negotiation.

In its first year of launching, FBN Health is available in 22 states. Sign-ups are year-round, although the shopping season for health coverage is in late fall due to ACA and other insurer deadlines.

“We’ve already seen savings from 5% to 45%,” says Charles Baron, vice president and co-founder of FBN. “FBN Health is about strength in numbers. If you’re a traditional co-op or retailer, you’re typically not national. Now a rice farmer in Arkansas can be part of the system with the corn farmer in North Dakota.”

Pennies matter

Near Chester, S.D., Jeff Hass farms 3,000 acres of corn and soybeans with father Jon, 61, and mother Patty, 62. His parents were paying $44,000 a year for health insurance. By signing up through FBN, his parents cut those costs to just $10,000 a year in premiums.

“Let’s face it, farming at this point isn’t profitable. Anywhere you can save a dollar, you’ve got to,” Hass says. “We’ve got to save now, or no one’s going to be around to do it later.”

The FBN plan was a “huge game-changer” for his operation and took a major financial burden off his parents. It also saved one of his employees $1,300 per month for a family plan. “If I don’t keep my hired man happy, he’s not going to want to keep the job,” Hass says.

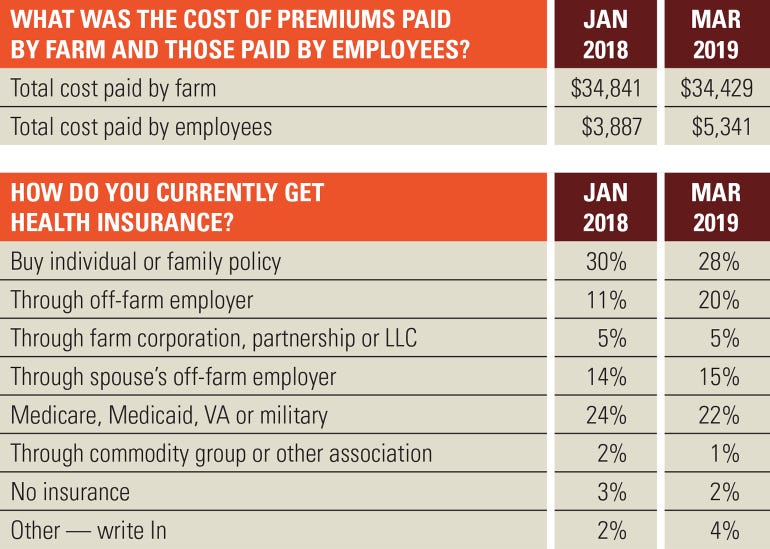

FBN showed a large number of farmers were either unhappy with their options or the cost of their coverage. Similar to Farm Futures’ surveys, FBN discovered that 11% of all farmers don’t have health care coverage, and a good number of farm spouses were working off-farm jobs just for health coverage.

“The comments we heard were gut-wrenching,” Baron says. “And these were from very advanced farm operations. Incomes are getting hammered on one side; then they have to deal with the rising cost of health care, too.

“You can’t allow yourself not to have coverage. One trip to the ER could put you out of business.”

About the Author(s)

You May Also Like