July 2, 2019

By James Mintert and Michael Langemeier

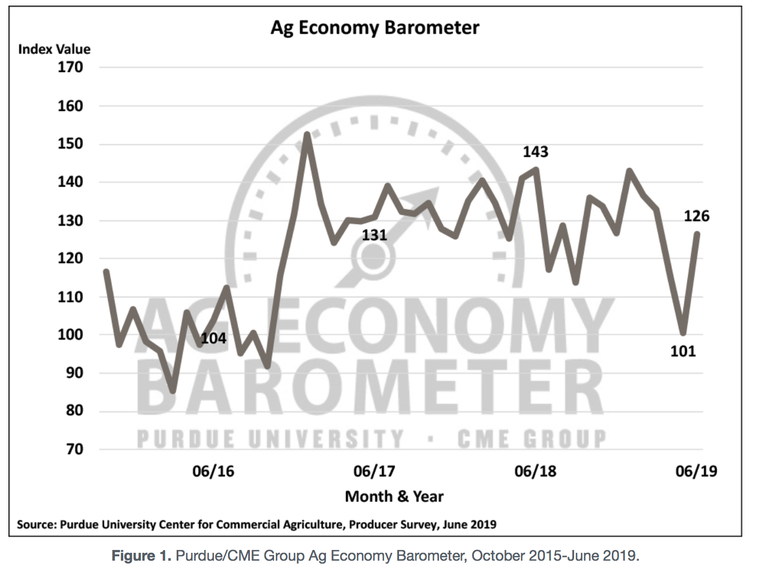

The Ag Economy Barometer rose 25 points from May to June, to a reading of 126. The barometer is based upon a nationwide monthly survey of 400 U.S. agricultural producers.

Both of the barometer’s sub-indices, the Index of Current Conditions and the Index of Future Expectations, improved compared to a month earlier. The largest increase was in the Future Expectations Index, which rose 33 points compared to a 13-point improvement in the Current Conditions Index. The rise in the Index of Future Expectations effectively wiped out the two-month decline in future expectations that took place during April and May, pushing the index back up to the level observed in March. This was in contrast to agricultural producers’ sentiment regarding current economic conditions which, although improved from a month earlier, remained well below that of earlier this spring. The June reading of the Index of Current Conditions stood at 97, which was still 23 points lower than in March.

The improvement in farmers’ sentiment occurred in the midst of this spring’s corn and soybean planting delays in the nation’s mid-section, which is expected to lead to unprecedented levels of prevented planting claims for both corn and soybeans. The prospect of large prevented plantings, combined with expectations for yield reductions attributable to delayed planting, pushed both corn and soybean prices up sharply since the May survey was completed, which contributed to the sentiment improvement. From mid-May to mid-June nearby CBOT corn futures prices increased by about $1 per bushel (+28%) and nearby CBOT soybean futures prices also increased by nearly $1 per bushel (+12%). This month’s Ag Economy Barometer survey was also conducted after USDA announced on May 23 that a new round of Market Facilitation Payments would take place in 2019 and after President Trump signed the Disaster Aid Bill in early June.

USDA’s announcement of a 2019 MFP program indicated that payments would be based on planted acres of a large number of covered crops, including corn and soybeans. In particular, USDA indicated that prevented planting acres would not qualify for MFP payments. In light of that announcement and the historic corn and soybean planting delays this spring, we asked producers who planted corn or soybeans in 2018 whether or not the MFP announcement affected their decision on whether or not to take a prevented planting payment this year. Ten percent of corn and soybean producers said it did impact their prevented planting decision making and one out of five farmers within that group said they intended to plant more corn, while one out of ten farmers within that group said they intended to plant more soybeans, because of the MFP program announcement.

The June barometer survey was conducted after USDA-RMA’s final planting dates for corn throughout the Corn Belt. Corn planted after RMA’s final planting date is still eligible for insurance coverage, but at a reduced coverage level. Alternatively, after the final planting date producers who purchased Federal Crop Insurance can choose to certify their unplanted corn acres for prevented planting payments, the size of which is based on their insurance coverage. As a result, one of the big question marks in the 2019 outlook is how many acres will be enrolled in Federal Crop Insurance’s prevented planting program. On the June survey we asked growers who planted corn or soybeans in 2018 if they intended to take a Federal Crop Insurance prevented planting payment on any of their 2019 intended corn acres. Nearly one-third (32%) of farmers in our survey said they intended to take prevented planting payments on some of their corn acres. Following up with those producers who intend to take a prevented planting payment, just over half (51%) of the farmers in our survey said they intend to take prevented planting on more than 15% of their intended corn acreage.

Large investments

Farmers’ perspective on making large investments in their farming operations remained very cautious. The percentage of farmers who said now was a good time to make large investments rose slightly from 18% in May to 20% in June and the percentage who said it was a bad time to make large investments declined slightly to 78% in June from 81% in May. The result was a modest improvement in the Large Farm Investment Index to a reading of 42 from 37 a month earlier, which was still the second weakest reading of the investment index since data collection began in 2015.

Farmland values

Farmer sentiment regarding farmland values improved modestly during June compared to a month earlier. Looking ahead 12 months, the biggest shift was a reduction in the percentage of producers expecting farmland values to fall, which declined from 30% to 22%, coupled with a 9-point rise in the percentage expecting farmland values to remain about the same. When asked to look 5 years ahead, producers were a bit more optimistic. The percentage of producers expecting higher farmland values increased to 45% from 39% a month earlier with the increase coming from those expecting values to remain unchanged (4-point decline) and those expecting values to decline (2-point decline).

Trade

We’ve been asking producers if they expect the dispute to be settled by July 1 (on the March-May surveys) or by Sept. 1 (on the June survey). There was a bit more optimism expressed about settling the dispute soon on the most recent survey as 32% of producers in our mid-June survey said they expect it to be settled by early September, whereas just 20% expected the dispute to be settled by July 1 when we posed the question back in mid-May. We’ve also been asking producers if the they think the trade dispute will ultimately be resolved in a way that benefits U.S. agriculture. We first posed this question back in March and have included it in every survey since then. From March through May, the percentage of producers expecting a beneficial outcome to the trade dispute declined from 77% to 65%. On the June survey, the percentage of farmers who expect the trade dispute to ultimately benefit U.S. agriculture rose slightly to 69%, suggesting that the decline in support observed from March through May leveled off.

Source: Purdue University/CME Group, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like