February 5, 2020

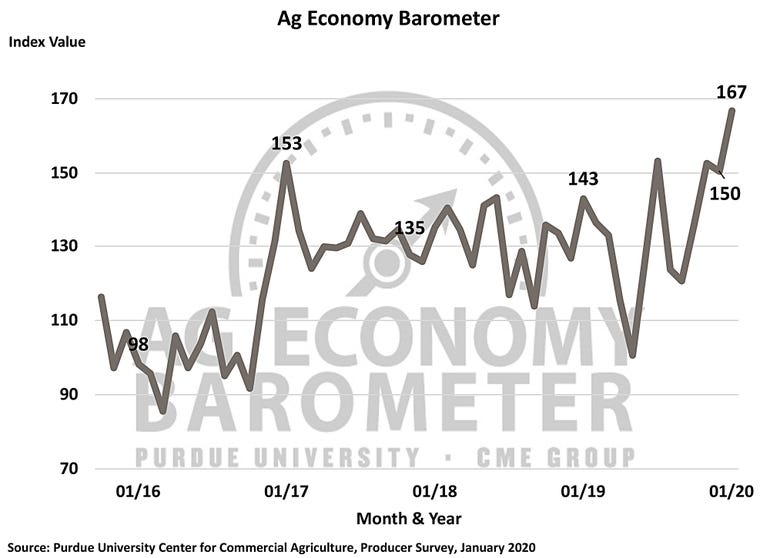

The Purdue University/CME Group Ag Economy Barometer rose 17 points from December to January to a reading of 167. Although the Index of Current Conditions was essentially unchanged, up one point to a reading of 142, the Index of Future Expectations jumped significantly, up 24 points since December to a reading of 179. The sentiment improvement took place as the Phase One Trade Agreement between the U.S. and China was being discussed and signed in mid- January. The Ag Economy Barometer is based on a mid-month survey of 400 U.S. agricultural producers and was conducted from Jan. 13-17, 2020.

“The Phase One Trade Agreement has largely been considered a win for U.S. exporters, although few details are available regarding how the additional $200 billion in purchases by China will be distributed over the next two years and how much impact it will have on the U.S. farm sector,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

One topic that was not directly addressed in the Phase One agreement was the soybean trade dispute. Despite that, producers remain optimistic about the dispute’s resolution. In January, 69% of those surveyed felt that the soybean trade dispute would be settled soon, up from 54% in December, and 80% felt that the outcome will be favorable to U.S. agriculture, up from 72% in December.

At the same time, producers’ expectations for an increase in U.S. agricultural exports over the next five years has steadily improved. As recent as October, only 55% of producers expected agricultural exports to increase; however, starting in November and continuing through January, about 70% of those surveyed expect to see an increase in U.S. agricultural exports in the next five years.

Rate of growth

Back at the farm level, each winter producers on the survey are asked about the rate of growth they expect for their farming operation over the next five years. Since the question was first posed in 2015, there has consistently been a small percentage of farmers who plan to grow rapidly and a relatively large group that either has no plans to grow or plans to exit or retire from farming. However, those who indicated they have no growth plans and/or expect to exit/retire has been rising steadily since 2018. For example, in January 2020, a combined 56% of farmers said that they have no plans to grow or plan to exit/retire, up from 50% in 2019, and up from 39% in 2018.

“The tremendous volatility the ag sector has experienced the last couple of years could be interpreted as a signal to producers to be more cautious regarding future expansion plans," Mintert said.

Time to invest?

Despite the big improvement in future expectations among farmers in our survey, the Farm Capital Investment Index in January actually fell 4 points below December’s to a reading of 68. The index is based upon a question that asks farmers whether now is a good or bad time to make large investments in things like farm machinery and buildings. The index has ranged from the high 60s to the low 70s since November and, despite the small decline in the January reading, remains much stronger than it was in late summer and early fall when it ranged from the high 40s to the high 50s.

PLC or ARC?

Farmers were asked if they planned to enroll in USDA's Agriculture Risk Coverage or Price Lss Coverage program under the 2018 Farm Bill. The majority (57%) of farms are still uncertain about which program they will choose. However, among the farmers who have decided, there appeared to be a shift away from the program choice made by many farmers for the 2014 Farm Bill. Under the 2014 Farm Bill, the most popular program choice among corn farmers was the ARC-County program. This month’s survey responses indicate that might not be the case for the 2018 Farm Bill sign-up. In the January survey, the PLC program was chosen by 23% of respondents, while 14% of respondents chose the ACR-County program. However, unlike in the 2014 Bill sign-up period, the ARC-Individual Coverage program appears to be a viable option for a significant number of producers as 6% of respondents indicated that was their preferred program choice.

Source: Jim Mintert, Purdue University Center for Commercial Agriculture, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like