After planting more soybeans than corn in 2018 for the first time in 35 years, farmers want to return to more normal rotations this spring, according to Farm Futures latest survey of growers. But weather and economics likely mean final crop decisions are still in flux, with many operators looking for alternatives to traditional choices.

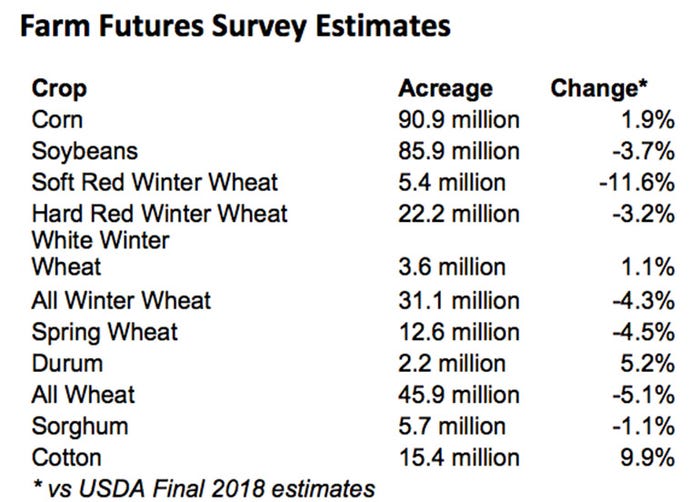

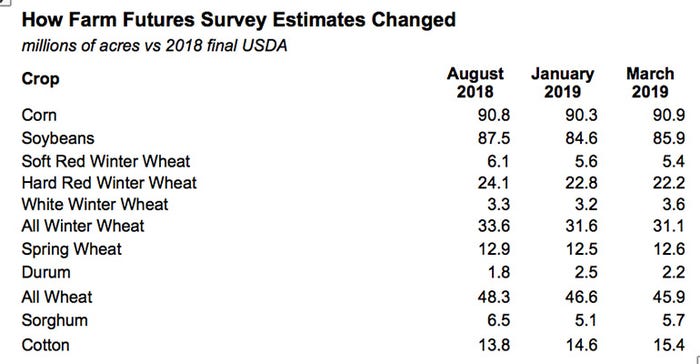

Our survey of nearly 1,000 producers nationwide put corn acreage at 90.9 million, up 1.725 million from last year. The 1.9% increase was more than we found in two previous surveys of planting intentions, but less than the 92 million USDA forecast over the winter. Those estimates from the government came from statistical models, not actual surveys. The agency releases its first survey-based forecast March 29.

Low prices and uncertainty over a trade deal with China convinced farmers to slash soybean seedings this spring to 85.9 million. That would be down 3.3 million, or 3.7% from 2018 totals, but would be higher than the 85 million USDA forecast recently. Our latest estimate is higher than we found at the end of 2018 but lower than we put out in August, when China’s 25% tariffs on U.S. imports were still new.

Soybean acreage could rise further if farmers are forced to abandon corn due to wet conditions. Weather could also be a factor for spring wheat producers on the northern Plains. The survey put seedings of spring wheat at 12.6 million, down 588,000, or 4.5% from 2018, though durum could see a modest increase.

USDA published its first survey of winter wheat in February, pegging acreage at 31.3 million. Our latest survey reduced that slightly, which would drop all-wheat seedings to 45.9 million, down 2.4 million or 5.1% from 2018. That would be the lowest total since at least 1919.

Sorghum, a feed grain popular on the central and southern Plains, could also see reduced acreage, down 1.1% to 5.7 million. But the crop could bounce back if a trade deal with China gets inked quickly. Buyers there started purchasing cargoes recently after a near-ban on imports.

Otherwise, cotton could be one of the few traditional row crops to attract more acres this spring. Our survey put plantings up 9.9% to 15.4 million due to relatively higher prices for the fiber. But wet conditions in the Southeast could change that dynamic as well.

The swing factor this year for acreage estimates may be a shift to other crops. Plantings not covered by the choices in our survey jumped more than 25% from 2018, accounting for one in ten total acres. That is indicative of the hard decisions farmers face, when many traditional crops show red ink on cash flow projections.

Farm Futures surveyed 994 growers from March 4 to March 21. Growers were invited by email to fill out an online survey questionnaire. Since 2010 the absolute difference between Farm Futures March survey and USDA Prospective Plantings was 2% for soybeans and 1.3% for corn.

About the Author(s)

You May Also Like