Corn prices pared earlier morning gains following USDA’s release of the April 2022 World Agricultural Supply and Demand Estimates report this morning. Despite higher ethanol usage forecasted for the 2021/22 marketing year, feed reductions left corn stocks unchanged in today’s report, taking some of the wind out of recent corn rallies’ sails.

Meantime, revisions to Brazilian corn and soybean estimates put both crops relatively even with one another at 4.58 billion bushels and 4.60 billion bushels, respectively. If corn production surpasses soybean production in Brazil, that would mark the first time in a decade that this has happened.

“USDA’s April 2022 WASDE report didn’t really tell markets anything more than they already knew and didn’t generate much additional price movement following the report’s release,” according to Farm Futures grain market analyst Jacqueline Holland. “In fact, markets are increasingly less concerned with old crop price movement in favor of anticipated changes to 2022/23 pricing.”

Corn

USDA noted offsetting changes on feed and residual use versus corn used for ethanol production, which kept ending stocks unchanged at 1.440 billion bushels. Analysts were expecting to see a modest reduction, with an average trade guess of 1.415 billion bushels.

“Corn pared some gains in the immediate aftermath of the report’s release for lack of increased domestic export forecasts, higher Brazilian production, and easing import demand from top global grains buyer, China,” Holland says. “But the market bought much of the losses back after as the overall outlook for global corn availability going forward remains constrained amid the ongoing crisis in the Black Sea. “

Feed use dropped 25 million bushels to 5.625 billion based on disappearance between December and February. Ethanol production increased 25 million bushels based largely on weekly ethanol production reported in March by the U.S. Energy Information Administration.

It was a bit of a surprise that USDA was only bullish on ethanol consumption rates and not export paces, Holland says: “To be sure, corn consumption rates for ethanol are strengthening as fuel prices remain high, but after China booked the largest daily flash sales of corn exports since May 2021 this week, I was expecting more of a boost for export paces.”

Meantime, peak corn export season is a about to ramp up, so Holland says her hopes may be too premature for April.

“I was not at all shocked at USDA’s downward revision for feed and residual usage for corn – it’s not easy feeding cattle at $7/bushel at a time when interactions with meat processors continue to be contentious and unpredictable,” she says.

USDA raised the season-average farm price another 15 cents to $5.80 per bushel “based on observed prices to date.”

World ending stocks trended modestly higher, moving from 11.849 billion bushels in March up to 12.026 billion bushels. Analysts were expecting that number to be virtually unchanged, with an average trade guess of 11.847 billion bushels.

USDA left most overseas corn production estimates unchanged, including for China, South Africa, Ukraine and Argentina. However, the agency did increase its estimate for production in Brazil to 4.567 billion bushels.

“As December 2022 corn futures continue to rise to new contract highs ($7.125/bushel at last glance), the market is desperate for additional 2022 acreage after last week’s Prospective Plantings report signaled a mere 89.5 million acres of corn likely to be planted this spring,” Holland says.

“Cool and wet weather continues to plague the regions of the Midwest that are prime for adding corn acreage this spring and the longer it lasts, the further the probability of adding corn acres falls.”

Soybeans

USDA made some alterations to the soybean balance sheet this month, including an increase in exports and seed use that led to lower stocks. Exports improved 25 million bushels to 2.12 billion bushels. And seed usage moved higher to reflect the expectations for an increase in planted acres this year. Ending stocks are now estimated at 260 million bushels, which was very close to the average trade guess of 262 million bushels.

Soyoil saw a similar trend, with higher exports and lower ending stocks. Export sales have been “stronger than expected through March,” according to USDA.

Holland says rapid soybean export loading volumes to China over the past eight weeks prompted USDA to increase its soybean export forecasts for two consecutive months. Prior to that, USDA had left soybean export estimates largely ignored through much of the peak soybean export season last fall.

“But the boost is more than warranted now,” she says. “During the last eight weeks, soybean export loading paces to top buyer China have risen 121% over volumes from the same time last year. This is significant because the time period typically represents peak Brazilian exporting periods – and downtime for U.S. soybean exports.”

Meantime, domestic usage appears to largely be limited by high prices at the moment, Holland says.

“September through February 2022 soy crush rates are trending fractionally below (0.4%) year-ago rates, so I’m inclined to believe that growers are going to need to rely on export markets for any hopes of further spring and summer rallies for the soybean market.”

The agency kept the season-average soybean price unchanged, at $13.25 per bushel. Soymeal prices are also unchanged, at $420 per short ton, while soyoil prices firmed 2 cents to 70.0 cents per pound.

Global ending stocks tightened slightly, moving from 3.305 billion bushels in March down to 3.291 billion bushels. Analysts were expecting that number to drop even further, with an average trade guess of 3.262 billion bushels.

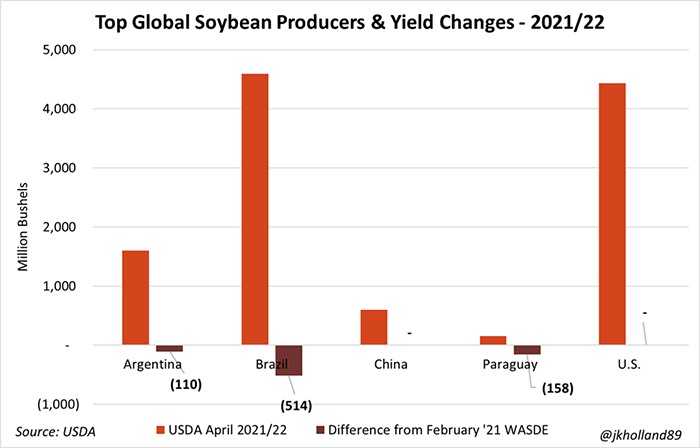

In South America, Argentina’s production estimates held steady from last month, with 1.598 billion bushels. USDA trimmed its estimates for Brazilian soybean production, however, with 4.593 billion bushels.

Revisions to South American crops were among the most widely watched items in today’s report, according to Holland. Corn production (4.57B bu.) in Brazil is now only 26 million bushels smaller than the soybean harvest (4.59B bu.), thanks to favorable winter weather for Brazil’s corn crops.

“It is the most even both crops have been since 2013,” she says. “In fact, 2012 was the last time that Brazil harvested more corn than soybean bushels so the narrow gap this year is certainly something to watch.”

While USDA left Argentine corn and soy crops alone in today’s reports, it took another 114 million bushels of combined soybean production away from Brazil in Paraguay, Holland adds. Since the December 2021 WASDE report, USDA has erased over 1.1 billion bushels of soybean production from Brazil, Argentina, and Paraguay’s combined soybean harvests for the year, she says.

USDA also made aggressive cuts to its Brazilian soybean export forecast, eliminating 101 million bushels from its 2021/22 totals. That means the new total is just a hair above 2020/21 volumes, at 3.04 billion bushels.

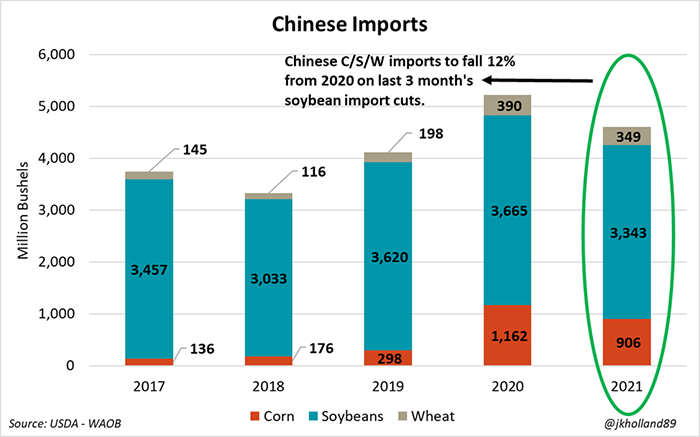

“To that end, USDA also slashed Chinese corn and soybean imports for the 2021/22 season,” Holland says. “While a USDA attaché report released last week suggests that China’s feed grain demand for livestock will increase in 2022/23, it seems that the country is attempting to ward off high prices as long as possible for the time being.”

About 118 million bushels of corn imports and 110 million bushels of soybean imports were cut from China’s forecasts for the remainder of the year, Holland adds. It was the third cut USDA made to Chinese soybean imports in the same number of months. The markets clearly do not expect this trend to last long though, as new crop corn and soybean futures continued to rally higher after today’s reports, she says.

Wheat

For wheat, USDA reports “stable supplies, lower domestic use, reduced exports and higher ending stocks.” Exports fell another 14 million bushels to 785 million bushels, with the agency noting that U.S. wheat is priced out of many overseas markets at the moment. Exports will fall to the lowest level since 2015/16 if this trend plays out.

Ending stocks moved 25 million bushels higher to 678 million bushels. Analysts were expecting to see a much more modest increase, with an average trade guess of 656 million bushels. Still, ending stocks are 20% below year-ago levels.

USDA increased the season-average farm price by another dime to $7.60 per bushel – the highest SAFP since 2012/13.

World ending stocks retreated lower, in contrast, bucking analyst expectations. Ending stocks dropped from 10.343 billion bushels in March down to 10.229 billion bushels. Trade guesses came in 100 million bushels higher than that number.

Click here to access the April 2022 WASDE report in its entirety.

About the Author(s)

You May Also Like