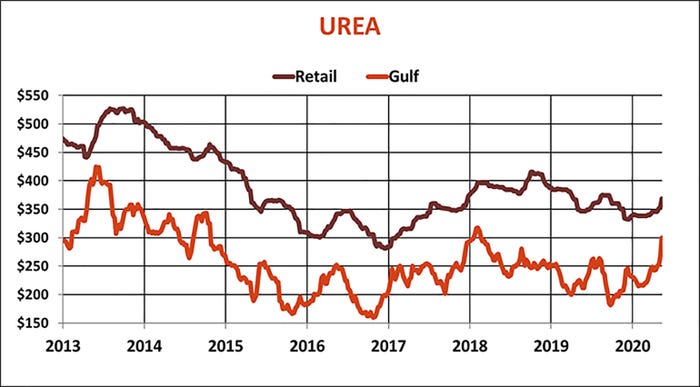

Crop prices aren’t the only thing going up to start 2021. Input costs for fuels and fertilizer are also on the rise, with some outpacing the rally in 2021 crop corn futures.

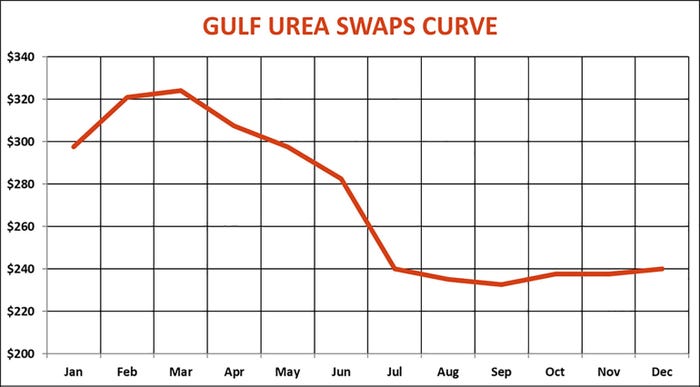

Urea led the charge last week. Swaps at the Gulf jumped $32 a ton to $300, a one-week increase of 12% as buyers scrambled to secure barges, with supplies limited by a slow pace of imports. International sellers had been focused on big tenders from India over the fall and early winter, along with demand from South America. Overall Gulf prices are up around 40% from early October lows and are 65% off the COVD-19 bottom last spring.

Pandemic concerns may also be a factor in last week’s rally. A new outbreak of the coronavirus in China could limit exporters’ ability there to ship urea to foreign customers before plants turn their focus to supplying that country’s farmers. The approaching Lunar New Year holidays Feb. 11-17 could also limit shipments

Ammonia looks cheap by comparison after Gulf contracts for January were settled at $245 a ton. That cost will increase soon for farmers hoping to apply anhydrous this spring. Some dealers posting new sheets last week raised offers $50 from fall levels. Corn Belt dealers are averaging $480 to $500 for ammonia with a range seen from $430 to $550. Costs on the southern Plains, which normally much cheaper, are also making a move, with quotes around $400, the same cost seen at some dealers there for urea.

Trading in Gulf urea swaps suggests price strength could last ahead of planting, with March quoted more than $25 higher than January last week.

UAN demand is still limited seasonally and remains an alternative for growers who can store it or work a deal with their supplier. Nearby swaps for 32% at the Gulf rose $2 last week but remain relatively subdued at $137. But April settled last week at $182.50, an indication of strong upside potential.

Gains in the nitrogen complex dominated the market as 2021 began, but costs for other nutrients are also higher. Phosphates surged last summer after the U.S. slapped anti-dumping tariffs on imports from Russia and Morocco. Prices levelled off during harvest then jumped again, with gains continuing into the new year. DAP at the Gulf settled $15 higher last week at $405 thanks to its nitrogen component and firm sulfur costs. Swaps into March are only $10 higher, while retail offer sheets updated last week are running $500 to $500.

Corn Belt terminal potash prices continue to chug higher as well, hitting $305, the most since June 2019. New dealer offers last week appeared to be running in the $370 to $400 range.

As dramatic as the moves in fertilizer were, the cost per typical acre of corn are still only 12% higher than a year ago. New crop corn futures, by contrast, are up 14%.

Fuels rollercoaster

Fuels farmers will need to plant, harvest and dry crops in 2021 are also on a roller coaster. The crude oil market reset earlier this month after Saudi Arabia said it would unilaterally cut exports and production in the face of demand weakened by the pandemic. Though output hikes by other countries could offset the move, it still added $4 to $5 a barrel to average price forecasts for 2021. Nonetheless, crude oil futures are trading 9% lower than a year ago.

The West Texas futures contract settled at $52.42 last week, a level very close to fair value according to current supply and demand fundamentals. Volatility remains elevated, however, suggesting a market that could trade anyway from $37.50 to $67.50 over the next 12 months. Investors plowed back into the market last week, adding nearly $1 billion to their bullish bets as Wall Street mulls commodities as a hedge against inflation caused by massive government stimulus. Big speculators have already built up a record bullish bet on corn futures in the meantime.

Diesel costs reflect this mentality. While Midwest stocks are 15% lower than last year, demand is down even more, despite refineries that continue to run a below average operating rates. So, even though prices are up about 35 to 40 cents a gallon from harvest levels, costs are still around 30 cents lower than one year ago.

January is normally a good time to refill diesel tanks. Whether that pattern holds true in 2021 could depend on the course of the pandemic. Diesel looks fairly priced currently based on fundamentals, and normal volatilities imply a farmgate range that could reach $2.35 if bullish factors converge just as ag demand kicks in this spring and fall. A worsening pandemic could take farm prices down to $1.70 if trucks stop rolling.

The rally in crude helped propane take a big leg higher, with added juice from a polar vortex putting Europe and Asia into a deep freeze. Prices at the Conway, Kansas hub jumped to 94 cents a gallon last week, some 70% higher than levels seen at harvest last fall. Prices typically weaken into late winter/spring or even summer. Swaps for July closed around 62 cents last week, which translates into a farmgate price around $1.20 to $1.25.

However, swaps into harvest of 2021 are mostly flat from summer levels, suggesting the market expects supplies to rebound once the economy begins returning to normal.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like