In a recent Southern Ag Today article, we highlighted the overwhelming need to increase commodity reference prices in the next farm bill based on hearing testimony from the commodity groups.

While we continue to believe that this is the first and most important step in making meaningful changes to our country’s farm safety net, a very close second would be to increase the payment limit to account for the impact of inflation. Actually, we would argue that payment limits should be eliminated completely because they are implemented for social engineering not economic reasons… but that is a discussion for another day.

Payment limits

Why do we think payment limits should be increased? Using data from the Agricultural and Food Policy Center’s (AFPC) database of representative farms—and illustrated for crop year 2025—the 3,400-acre Iowa corn/soybean farm is projected to be facing much lower commodity prices. In 2025, market receipts are projected to be $2.5 million, with corn and soybean prices at $4.30 and $10.46/bu.

Costs in 2025 are projected to be lower at $2.7 million, resulting in a $200,000 loss without government assistance (of course, the loss could also be much larger if prices fall more than expected). Assuming ARC and/or PLC are improved to the point that they would trigger assistance in 2025, the support would be limited to $125,000, leaving the farm with a loss of $75,000.

Even though Congress will have spent hundreds of hours conducting hearings and debating how to help farmers stay in business… payment limits will reduce the effectiveness of the improved safety net. Said another way, the producer puts $2.7 million at risk through borrowing or self-financing, and if there is a price or production problem, the federal government will help with up to $125,000, or 4.6% of what the producer has at risk in this example.

How much payment limits should be raised tends to be almost as contentious as whether we should have them.

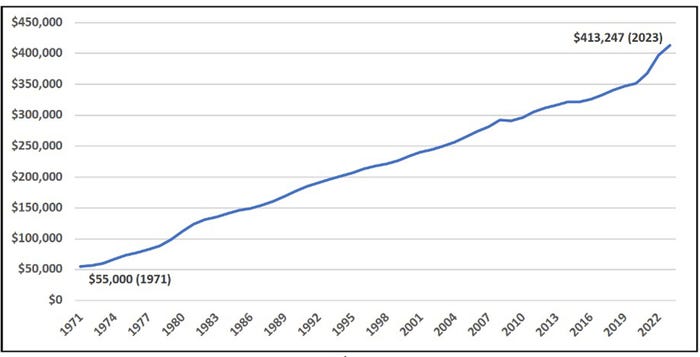

As a frame of reference, modern-day payment limits trace their roots to the 1970 Farm Bill, with a $55,000 payment limit for each of the annual programs for wheat, feed grains, and cotton in crop years 1971, 1972, and 1973.

The figure below illustrates the magnitude of that payment limit ($55,000 for a single program/crop) were it in place today and indexed for inflation. That $55,000 payment limit would have been $413,247 in 2023, more than three times larger than the current combined payment limit of $125,000, applying to all covered commodities eligible for ARC and PLC. If the limits from the 1970 Farm Bill were combined for a producer growing all three crops (i.e., $165,000), the payment limit today would be just over $1.2 million.

Figure 1. Initial 1970 Farm Bill Limit ($55,000) Indexed for Inflation.

Again, this doesn’t mean a producer is entitled to a payment of $1.2 million; it simply means that any losses up to $1.2 million could be covered. Instead, under current law, any losses beyond $125,000 are borne entirely by the producer.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

About the Author(s)

You May Also Like