February 2, 2017

Old crop cotton contracts on the Intercontinental Exchange (ICE) rallied in January, accelerating a gradual uptrend from the late August six month lows back toward the early August contract highs.

One source of price strength has been strong demand for U.S. exports, which is driven by the quality of the U.S. crop, and perhaps some temporary glitches in Indian supplies.

More recently, there have been two catalysts for higher old crop prices, and the combination of these influences may lead to some fireworks. Just like fireworks, the price impact from these two catalysts will rise and fall — but it may rise pretty high.

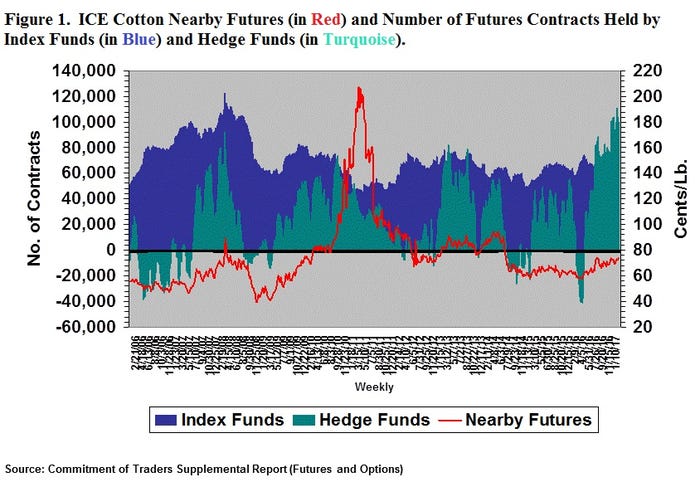

The first catalyst is the now familiar influence of speculative funds that either buy and hold cotton futures (index funds, the blue area in Figure 1) or buy/sell cotton futures in anticipation of a trend (hedge funds, the turquoise area in Figure 1).

The position of the hedge funds has been particularly variable over the past five years, and it appears to explain a lot of variability in cotton futures price movements. A good example is the price rally in late July/early August when Dec’16 cotton rose to 78 cents for several weeks. The brevity of that upside volatility is typical of the hedge fund influence.

The second catalyst is the occasional influence of an imbalance between unhedged mill purchases from merchants compared to unhedged merchant purchases from suppliers. The former are ordinarily fixed by purchasing cotton futures, while the latter are hedged with cotton futures sales.

A LARGE IMBALANCE

Data from the U.S. government (http://bit.ly/2kVEpMa) reflect a large imbalance between the implied purchases and sales of cotton futures on the old crop contracts. The resolution of these kinds of imbalances is linked to the maturity of the specific old crop contracts. Hence, the effect of mill fixations also implies a temporary source of upside price volatility.

There also may be some strategic behavior going on that combines these two short-run catalysts. The hedge fund managers are doubtless aware that the textile mills have to buy futures to fix their on-call purchases by a certain deadline. Hedge funds may be intentionally buying up the market to create something like a squeeze situation.

What does this mean? The old crop contracts have the potential to go over 80 cents. The effect may be a roller coaster kind of ride.

While the new crop Dec’17 will be pulled up by this, it will not be as high (maybe mid-70s), and I doubt it will endure. So, be nimble, and contract or hedge those prices if you get the chance. There is not enough real demand to sustain new crop futures prices in the mid-70s. And if we have halfway decent growing conditions, with a large increase in planted acres, that will likely pressure new crop prices before the end of summer.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

Figure 1

About the Author(s)

You May Also Like