When marketing grain, the old adage is that market participants tend to do what they wish they would have done the previous year.

Last year selling right off the combine was the wrong thing to do as December corn bottomed on Aug. 12 and never looked back, rallying over $1 into expiration. That leads us to the question every producer is asking: Will the fall of 2021 follow the same pattern, and do I do what I didn't do last year? Do I hold off and not sell corn?

We believe that the odds favor seeing prices move higher than lower into the end of the year.

Shrinking ending stocks

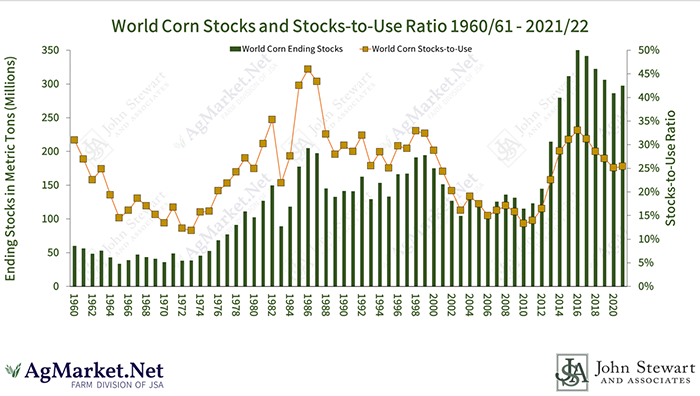

Last year we started off with the September WASDE report showing a 2.5-billion-bushel carryout and 17.1% stocks to use. By the January WASDE report, the USDA had reduced ending stocks to 1.552 BB and stocks-to-use to 10.6%. Our stocks-to-use today are starting at 9.5% with 15-billion-bushels of production and assuming a national yield just shy of the record 176.6 bushels per acre set in the 2017/18 marketing year.

We think the odds of this yield holding up is very low.

With disease pressure taking a toll on the eastern crops' yield, we believe the odds are very high that yields will drop in upcoming reports. Producers we have been talking to continue to point out how early yields are below expectations. It appears late-season disease pressure and early-season N-loss has taken the top yield off a portion of the crop by as much as 10%.

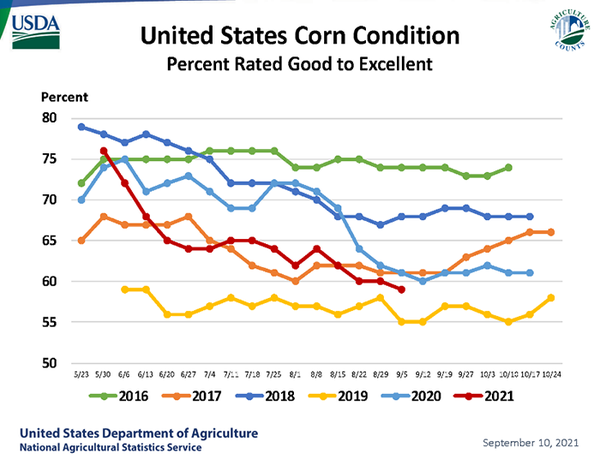

This year's current good to excellent ratings are lower than they were in the 17/18 crop year, when the national yield ended up at 176.6. The current good crop excellent ratings are lower than anytime last season when we ended up with a national yield of 172 bpa. If the nation drops four bushels per acre, it will lower national production by 338 million bushels without any other adjustments.

Bullish adjustment

In addition to potential yield drop, we believe that a bullish adjustment to last year's ending stocks is on the way. After last week's WASDE adjustments, the USDA projects Sept. 1 stocks (old crop corn carryout) at 1.117 billion bushels. With basis pushes across the country as much as $1.50 over the board to entice producers to harvest 30% moisture or higher corn (without drying charges), we have reason to believe the pipeline in some areas had run out of corn.

When the quarterly stocks report is released at the end of this month, we anticipate that it will show the carry out will be closer to a billion bushels, if not sub 1 billion, when all is said and done.

This could potentially be the fourth bullish stocks report in a row. The market was limit bid on the close of the past three quarterly stocks reports.

Global production expected to rise

With moderate La Niña conditions potentially building big South American production, this upcoming year is far from certain. Currently, USDA is projecting the Brazil crop to rebound to 118 million metric tons. If achieved, this would eclipse Brazil's best crop ever by 10 million metric tons.

It is not just Brazil that the USDA is optimistic about regarding a rebound in production this upcoming year. They are projecting that China's crop will increase by 12.3 million metric tons this upcoming year, which also seems very optimistic. The USDA's current forecast for the 21/22 world-ending stocks is 297.6 million metric tons, up 11.1 million metric tons from the previous year.

If Brazil only manages to match its best crop ever of 108 million metric tons, world stocks will not grow. The same situation will happen if China doesn't increase its production by 12.3 million metric tons as projected, ending stocks will hardly move.

Exports to China

Without a significant increase in China's domestic production for this upcoming year, we believe China will continue to be a major importer of corn. Final 2021 US corn exports to China were 21.390 million metric tons with 1.157 million metric tons rolled to the 21/22 marketing year as expected. This makes the 21/22 US commitments to China 11.901 million metric tons. Traders have believed up to 1.75 million metric tons also were sold in June, but these are not confirmed. If they are confirmed, the total commitments by China would be 13.650 MMT.

Ukraine published its final July exports that showed China took 71,000 metric tons of the 962,000 shipped to all destinations. Adjustments to earlier monthly data for China lowered Ukraine's total 11-month exports from 9.0 MMT to 8.510. Our best guesstimate is that China may have taken 50,000 metric tons in August, which would raise the Ukraine corn exports to China to a total of 20/21, marketing your exports to 8.568 million metric tons.

When we combine the total 2021 US Ukraine, Argentina, and Bulgaria corn exports to China, the totals equal 29.950 million metric tons. We anticipate China imports to be approximately the same amount for this upcoming year.

Gulf shipping problems ease

The export situation in the Gulf seems to be improving by the day. It looks like 4 of the 9 facilities at the Gulf can load, and the rest may be loading by the end of the month except Cargill Reserve, which may be months, not weeks, until they can load. But until the Gulf is back to full capacity, it looks like the U.S. will lose some export business.

It was reported that China purchased six cargos of Brazilian beans for October shipment at substantial premiums to the U.S. this week.

Oversupply ahead?

We would encourage producers to start taking a serious look at marketing a portion of the 2022 soybean crop. Fertilizer prices have exploded around the world due to supply issues. With the right weather this upcoming year in South America and the U.S., we could easily oversupply the market. We have producers already talking about planting more soybeans next spring. November 22 beans are near $12.50 a bushel, not a bad price to start marketing next year's crop.

As always, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

Reach Jim at 815-665-0461 or [email protected].

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like