October 25, 2022

Predicting a harvest low can be challenging as price prediction is nearly impossible. In years that producers are able to swiftly harvest the crop, the market is more likely to experience a “harvest low” due to the influx of supply in a short time. The inbound flow of grain stresses the ability for the demand sector to handle the commodities.

Prices tend to ease while spreads in the markets try to slow the flow of grain. In years that harvest is drawn out, cash markets can move grain more efficiently as end-users consume more of the crop as it comes straight from the field. This reduces bottlenecks and requires less storage on the farm and in elevators.

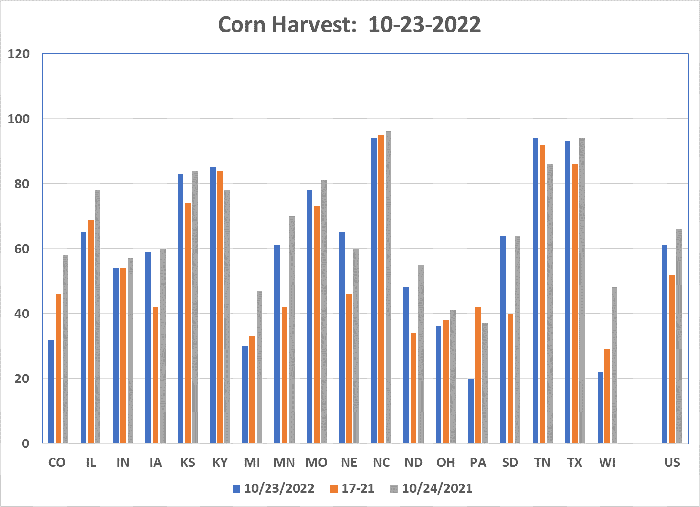

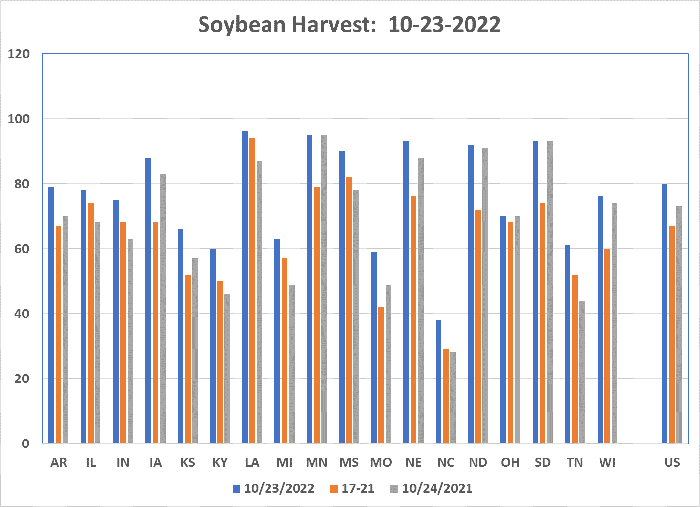

On Monday, USDA published the corn harvest at 61% complete versus the 5-year average of 52% and soybeans 80% harvested versus the 5-year average of 67%.

Quick harvest

Given the favorable weather since the beginning of September, the 2022 harvest looks to be on track for a quick one. Historically, many equate the completion of harvest with the bottom in the market because once the combines are back in the shed, grain stops flowing out of the countryside until producers are enticed to sell.

Once the bin doors are closed, the market must work to drive the flow of grain to end-users. To adjust the flow of grain the market really has three tools - basis, spreads, and futures movement.

The common question this year is “can corn rally over $7 and soybeans break $14 after harvest?” The answer is yes, but there are no guarantees.

In its October WASDE report USDA trimmed 805 million bushels off demand versus last year. This is due to a loss in U.S. production and expected competition from global producers. Even with the cut in demand, expected carryout is still 200 million bushels less than last year.

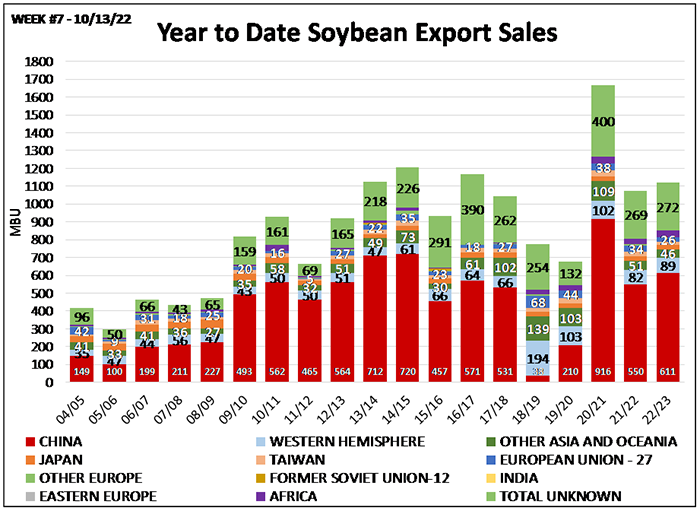

For soybeans the 2022/23 demand picture has been reduced 63 million bushels due to the expectation of increased production in the southern hemisphere. The projected soybean carryout is still 74 million bushels tighter than last year. What does all this mean? Both corn and soybean inventories are tighter than last year and any disruption in production or shipments from other countries around the globe can quickly move the markets higher.

Focus on exports

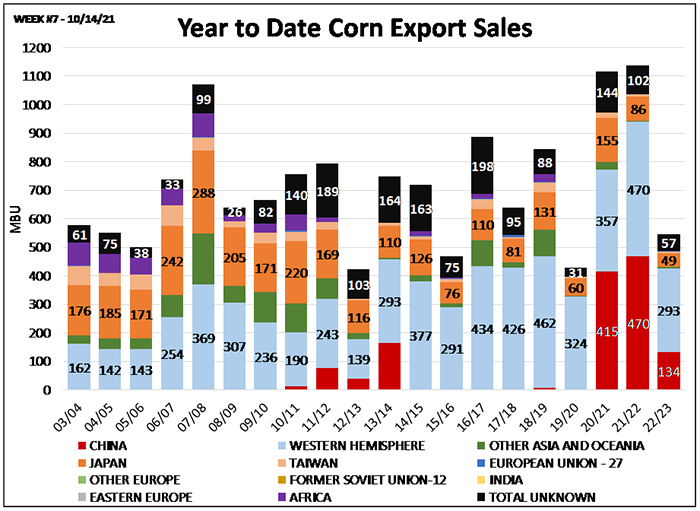

The “not a guarantee” element of my answer places exports front and center. Corn export sales are down nearly 593 million bushels compared to this time last year. USDA has accounted for a drop of 321 million bushels, but if exports don’t pick up there could be additional cuts in the months to come.

Brazil corn is roughly $1.60 per bushel discount to U.S. corn for October into the Asian markets. Soybeans appear a bit more optimistic at meeting their expected shipments as sales are 54 million bushels ahead of this time last year, yet USDA is expecting a drop of 113 million bushels for the overall marketing year.

Logistic disruptions along the Mississippi have put September- November shipments behind most years leaving the markets to question if global buyers will continue to buy from the U.S. after February, once the Brazilian crop is ready to harvest. Weather in South America will be monitored closely in the months to come for any change in expected production.

What’s next

How does a producer position themselves in a market with tight supplies yet the looming risk of demand destruction? For harvest logistics and cash flow needs one can simply sell their grain and purchase a Call option to participate in a stronger market. With the call option, a producer’s only risk is the premium when you enter the position, unlike storage. If on-farm storage is available, consider purchasing a Put option to guarantee a floor price and sell the grain on a market rally or when basis appreciation entices producers to sell their grain.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like