It has been a rough beginning of 2024 as the grain markets have seen aggressive selling almost weekly since the beginning of January. Managed money has led to the selling accumulating massive short positions in the corn and soybean markets.

Managed money trades have been net sellers in the corn for seven consecutive weeks, selling another 16,597 contracts last week alone. This puts their short position at just over 314,000 contracts, the largest since May 2019 and the second-largest short position ever reported.

Managed Money has been short corn for the past 33 weeks; this is the second longest stretch of them carrying a net short. The only longer time was between August 2019 and August 2020, which was 54 weeks.

The soybean market has not been immune to fund-selling as managed Money has been net soybean sellers for the past 13 consecutive weeks. They were sellers of 4,200 contracts last week alone, which put their net short position at 134,500 contracts, the largest since May 2019.

History would suggest that the funds will reduce or even liquidate this short position at a time when it is what everyone in the industry is debating. Hopefully, the fact that they are near-record short indicates that we are near the time for them to exit.

Index funds go long

On the positive side, index funds continued to add to their ag length last week, adding 19,504 contracts and the ag space length at 1,052,588 contracts. This is their largest long position in six months. They have been buyers for three consecutive weeks and six out of the past seven.

Last week's USDA outlook form added to the negative tone of the market. As for the corn balance sheet, they projected the 2024-25 ending stocks at a whopping 2.532 bb, putting the stocks-to-use ratio at 17%, the highest since 1987.

The USDA Outlook Forum corn ending stock forecast has been above the final crop ending stock estimate in five of the past seven years. Do not get discouraged; as the saying goes, there is a lot of water to flow under the bridge before the final ending stocks are determined. The outlook form lowered the corn acreage estimate by 3.6 million acres from last year. This could still be too high due to the cost of putting in this year's crop vs. the current priding.

Soybean ending stocks were projected at 435 million bushels, up from the current ending stock projections of 315 million bushels. The ending stock projections from previous forums have been higher than the final ending stock numbers in 12 of the last 16 years.

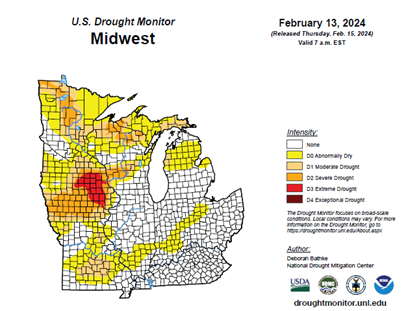

Weather will be a significant factor in whether we can hit the forums working national yield of 181 bushels per acre. for the corn yield and 52.0 bpa for the soybeans yield is achievable. The U.S. crop area under drought situations is less than last year. However, Iowa is still dealing with abnormally dry to severe drought, resulting in deficient subsoil moisture.

Watch South America

Over the next few weeks, the trade will continue to monitor the daily export wire for export sales and the South American weather. We are currently price-competitive with South America in corn but not in soybeans.

This is the time of year when we tend to lose out on export sales of soybeans to South America as their harvest ramps up. Brazil's soybeans harvest has reached 32%, up from 23% last week and ahead of last year's 25% pace. Michael Cordonnier lowered his Brazilian production forecast another 2 mmt to 145 mmt, below the Conab estimate of 149.2 mmt and the USDA estimate of 156 mmt.

Brazil's first corn crop is now 29% harvested as of last Friday. The safrinha crop plantings have reached 59%, up 21% for the week and well above the 40% pace of last year.

Moving averages will signal low

Keep an eye on the 10- and 20-day moving averages on the technical front. In this current down-trending market, traders have been selling against these moving averages. If the market closes above both these averages, it could be a sign that at least the temporary lows have been scored. The red line is the 10-day, and the blue line is the 20-day.

If you have questions or would like specific recommendations for your operations, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

About the Author(s)

You May Also Like