Welcome to 2024 (almost)! For row crop producers across the country, last year was characterized by easing input cost pressure and revenue prospects as well as by widespread weather uncertainty. It wasn’t an easy year by any means, but it wasn’t as dire as it may have felt.

At $151.1 billion, 2023 U.S. net farm income (inflation adjusted) was the twelfth largest in history, keeping company with other lucrative years including 2011, 1951, and 2021. And it’s worth remembering that 2022 net farm income in the U.S. set a record high of $188.9 billion. So, we knew coming into 2023 that it might not be as good as the prior year, but that it would still be profitable for row crop production.

But what does 2024 have in store for farmers’ profit margins this year? It’s still early to tell with any kind of certainty, but there are a few pieces of evidence in both the global and domestic markets that are giving us a bit of a preview early in the year.

A look abroad

Late in the 2023 calendar year, South American crop production prospects were the dominant price drivers for corn and soybeans. And that is not likely to change through at least the first few months of 2023.

Even with a hot and dry start to its 2023/24 soybean season, Brazil is on track to set a new record for its 2023/24 soybean production, which will likely propel another record-breaking export season for the South American country beginning in February.

Top buyer China remains hungry for large soybean volumes, but unprofitable hog production and lackluster consumer demand for pork during peak Lunar New Year celebrations are casting some doubts on China’s ability to repeat last year’s record-breaking soybean import volumes in 2023/24. That means that harvest delays to Brazil’s crop in the coming weeks could create opportunities for U.S. exporters.

Corn has a bit murkier of a forecast for 2024. China is expected to overtake Mexico as the world’s second-largest corn buyer in 2023/24. But a lot of China’s corn purchases were made late last year from Brazil after it harvested a large corn crop this year following the largest corn sowings on Chinese soil since 2015.

Peak U.S. corn export season begins to ramp up in February and lasts through the beginning of summer. The only guarantee U.S. corn exporters have of sudden and sizeable corn export orders from China is if Brazil’s soybean delays push back Brazilian safrinha corn production and yields as the U.S. is beginning its planting season.

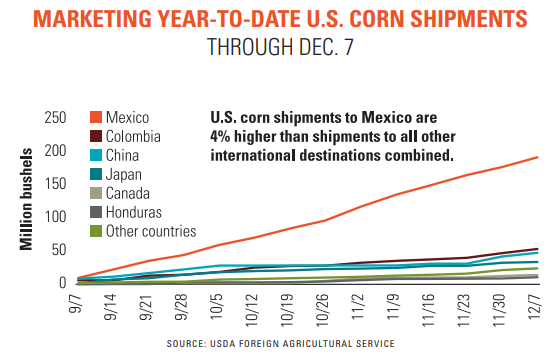

Until that point, Mexico has been a prominent destination for U.S. corn, with corn shipments to Mexico accounting for 51% of marketing-year-to-date U.S. corn exports in the first third of the 2023/24 marketing year. Volumes to Colombia – though smaller than Mexican purchases of U.S. corn – are 25 times bigger than the same time last year through early December 2023.

If the export market is going to provide any support to corn prices in the coming months, it will likely come from our southern neighbors.

Higher interest rates

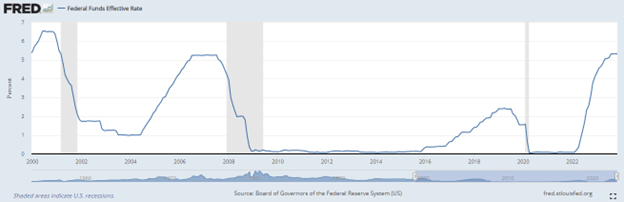

The Federal Reserve surprised the financial markets in late 2023 when it announced no further interest rate increases were planned for 2024 and that there was a possibility of rate reductions in 2024. The Fed indicated three cuts totaling 0.75% could take place in 2024, with four to follow in 2025 and three in 2026.

Interest rate cuts could help the farmland market to heat up again towards the end of 2024. While higher operating expenses could squeeze profit margins this year, there is an overwhelming consensus among economists that profits from the past few years are likely to offset some of the pain of higher interest costs.

Plus, fertilizer prices have been declining over the past year at a faster rate than interest rates have been rising. Vendors are eager to offload inventories and offered farmers favorable financing terms through the end of 2023. Strong net farm income has fortified on-farm liquidity and will likely continue to be farmers’ best tool to combat high interest through the next year.

Profit margins

The U.S. harvested its largest corn crop on record last year, ending a three-year run of tight domestic corn supplies. To be sure, through mid-December 2023, December 2024 futures contract prices for corn remained at or slightly above average break-even prices based on my redneck math.

There is a lot less wiggle room for corn profitability in 2024. Profit margins could quickly fall into the red if Brazil can successfully harvest another record-breaking safrinha crop in the next five to six months or if domestic consumption for ethanol faces any downturns.

But soybean acres could offer more price stability for farmers in the coming months. Domestic ending inventories are ending the 2023/24 marketing year at the twelfth tightest level on record amid growing soy crush volumes being largely driven by expanding renewable diesel production.

My earnings projections for soybeans offer more wiggle room for 2024 profits, but those prospects can also vary depending upon local markets. Soybeans typically require less upfront investment and in an era of high interest rates, that may be a more affordable option for growers looking to avoid paying higher operating costs.

Through mid-December 2023, the market was calling for more soybean acres to be planted in 2024. Our Farm Futures January 2024 grower survey that provides the first look at acreage intentions for 2024 acreage intentions was not complete at that time, but the futures market offered a good case for how this year may shake out.

The November 2024 soybean – December 2024 corn new crop futures price ratio traded at or above 2.50 through mid-December 2023, suggesting that the futures market is displaying a strong preference for soybean acres this spring.

While I can’t speak to the size of a potential acreage shift (yet), I have a pretty good idea of where these shifts could occur. Large acreages in Northern and Central Illinois tend to have a significant impact on annual acreage swings. But while these crop rotations tend to remain fixed between corn and soybeans, the Northern Plains and Mississippi River Delta tend to provide more prominent crop swings that can shape the final acreage outlay, even though these regions don’t have as comparably large acreage.

The last few years have been among the most profitable in U.S. agriculture since the post-World War II. Farmers may need to exercise more marketing and cost management discipline in 2024 relative to the past few years to ensure profits can continue to be earned for another year.

Read more about:

Farm FinancesAbout the Author(s)

You May Also Like