USDA’s monthly World Agricultural Supply and Demand reports sometimes mean a lot. Other times, not so much. The March 8 edition of the WASDE accomplished both. Though little in the corn and soybean numbers changed significantly, the market’s reaction was a night-and-day difference.

Nearby corn did manage to close higher, by a whopping 1.75 cents. That was at least a recovery from the day’s lows.

Soybeans had an altogether different session, closing 17.75 cents higher, some 30 cents off the pre-report bottom.

To be sure, USDA did lower projections for world soybean ending stocks at the close of the marketing year in August due to stronger exports and slightly lower production in Brazil and stronger imports by China, while the U.S. numbers flatlined.

The world corn stocks estimate also went down, albeit by just half the drop in soybeans on a percentage basis. But the WASDE may have had little to do with the different reactions of the two markets.

What did? History may be one explanation, “animal spirits” another. Or maybe it was merely chance, a pattern not likely to repeat in coming days. But if you’re still holding old crop or looking for opportunities to price 2024 production, the next chapter in this saga should play out at the end of March, one of the bigger report days for government statisticians – and farmers.

Trace seasonal trend data

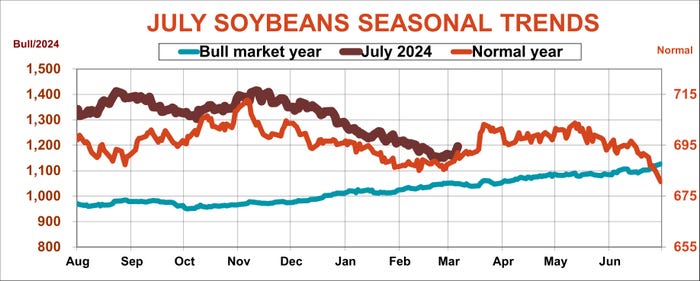

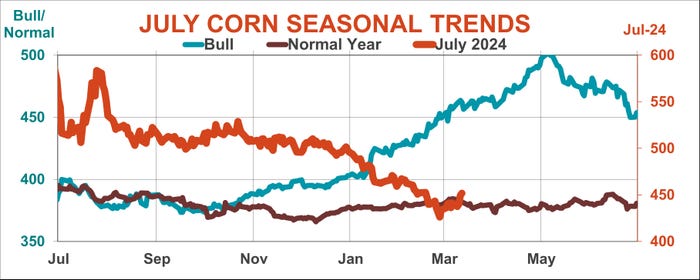

The cause of puzzling market moves can sometimes be found on price charts that guide some traders’ decisions. Both corn and beans are trying to pull out of downturns that began many months ago by rebounding off February bottoms. But the price chart that may be relevant now tracks seasonal trends – I use July futures as the old crop benchmark.

In “normal” years – ones that are not part of a bullish pattern – soybean prices on average bottom in February before a March rally. Though this bounce tops out around the end-of-March reports, at least prices stabilize.

The old crop corn market in normal years bottoms in December after the last of harvest weakness is finished and trends higher into early March – right around now – and never really goes anywhere on average after that.

The July 2024 contract made an early harvest low in September, then another new low in December, but its January attempt at a rebound failed, leading to more new lows in February before edging cautiously higher. Friday’s WASDE reaction could be a hint that traders don’t expect this version of the corn bounce to be any better than the previous attempts.

Hopes for lower interest rates?

Another potential cause for the market’s different response may have nothing to do with economics or technical patterns on price charts. When all else fails, blame those ubiquitous “outside markets.” Like when one of your children tried to avoid guilt by saying, “wasn’t me, it was those other kids!”

Sometimes the scapegoat for ailing markets is attributed to the value of the dollar, the end of the month or bearishness on Wall Street. The candidate this time could be the hopes for lower interest rates that sparked a move to record highs in the stock market last week.

The frenzy wasn’t limited to stocks. Some so-called risk assets, either old or new, joined the party. Gold, shunned for years, if not decades, made a new all-time high last week too. So did Bitcoin, which went from being the future of finance to a pariah. The crypto currency completed a remarkable recovery last week, making a new all-time high after losing 75% of its value.

Soybeans have long been a favorite for the fast money crowd. Money managers were aggressively selling both corn and soybeans since at least the fall. But they started buying corn recently, while adding to their bearish bets on soybeans. So maybe these players were looking for another horse to ride, and picked soybeans with hope the oilseed could be the next big thing.

Will supply tighten?

One day’s trade doesn’t make a trend, so the WASDE reaction could fade quickly. Cooler heads will wait until March 28, when USDA updates quarterly Grain Stocks data and puts out its first survey-based estimate of farmer planting intentions for 2024. Both, or neither, could provide enough of a shock to really sway the market.

The acreage report sets the stage for new crop and the growing season ahead. Grain stocks is all about old crop and influences new crop futures only if supplies could tighten enough to jack up new crop rallies.

The soybean stocks report could provide clues about the ultimate size of 2023 crop, but otherwise shouldn’t produce much in the way of fireworks.

Corn stocks are an indication of feed usage, which is larger than the amounts eaten up to make ethanol or send into the export pipeline. But it likely would take a real shocker to move the corn market much, unless weather forecasts are already threatening.

So, the WASDE waiting game is over. Let the next waiting game begin.

About the Author(s)

You May Also Like