The funds. The big investment money that trades in commodities. Fund managers watch and monitor grain market fundamentals and technical chart aspects, as they look for opportunities to invest and make money.

When they are long (buyers) in the grain market, prices tend to trade higher, and there are usually underlying friendly fundamental components supporting grain prices, too. When funds are short (sellers) in the market, it is often due to grain supply and demand fundamentals that are shifting to bearish.

This year, the global perception is that grain supplies around the world may be building and demand slowing, therefore the funds have been sellers of grain commodities in recent weeks. However, there may be a potential third influence in fund trading, and that is the trend of interest rates.

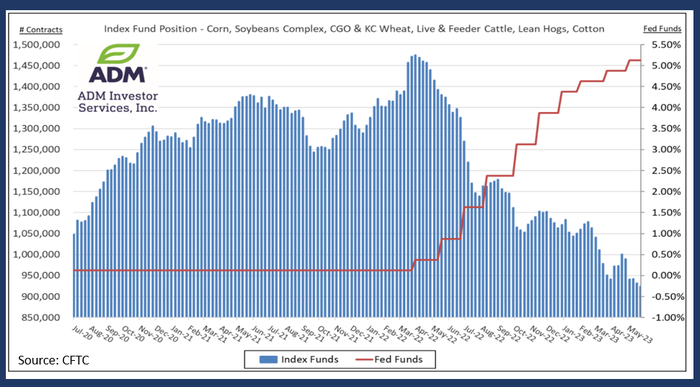

Looking at the chart below, you can see how as interest rates started to rise in spring of 2022, the funds began to exit long positions in the agricultural sector. The more interest rates continued to rise, the more the funds sold off those long positions, and even started to become net sellers in some commodities, like wheat, hogs, and now even corn and soybeans.

The assumption was that higher interest rates would reduce demand for commodities, therefore less demand would likely equal more supply. In addition, because of higher interest rates, now the funds could invest in other potentially less risky investment areas and see a decent rate of return on those investments due to the higher interest rates themselves.

Every week, the government requires the funds to disclose the number of positions they bought or sold during the week. From there, we can track if they are amassing a long position in the market or a short position.

Will the funds keep selling?

Looking at the chart below, you can compare the activity of the funds this year in the agricultural commodity sector, compared to the prior three years.

As of right now, it seems that it may take a dramatic weather event or sudden burst of friendly demand news to get the funds to buy back the hefty number of short positions they currently possess in the agriculture space.

Or, potentially, they might want to show profits for the end of the second quarter, therefore they may buy back short positions during the month of June in order to show profits on their books.

However, if interest rates continue to rise, they may stay content to hunker down and continue to hold their ground.

Upcoming Fed meeting matters

As the Feds continue to battle still-high inflation rates, the U.S. central bank has raised interest rates to the highest level in 16 years. In early May, the Federal Reserve increased its key interest rate by 0.25 percentage points, raising the Fed funds rate to a range of 5% to 5.25%. This was the 10th increase in 14 months.

Regarding the upcoming Fed meeting on June 13-14, Chairman Jerome Powell hinted that a pause in raising interest rates might occur. However, minutes from the last meeting showed some members still see the need for additional interest rate hikes.

A weather market? A change in interest rates? Showing profits on the books at the end of the second quarter? Hard to say for sure what might inspire the funds to trade in the future. But one thing is for sure, monitoring the weekly positions and trends of the funds is an important aspect of agricultural commodity prices.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like