Agricultural markets have not been a fun topic over the last several months.

A year ago, we saw December 2023 futures just below $6 and November 2023 futures right around $13.60. Compare that to this year’s new crop prices of $4.75 and $11.90. Many farmers are sick and tired of seeing consecutive down days in the markets and have all but stopped paying attention to them.

We find several people stating there “has to be a bounce,” and they are willing to bet half of their old crop and all their new crop on it. What happens if there is no bounce? What happens if we are all just dead wrong?

Instead of waiting and hoping for the best, let’s take some action. I believe we should focus on what we can do today, specifically on the soybean side of things.

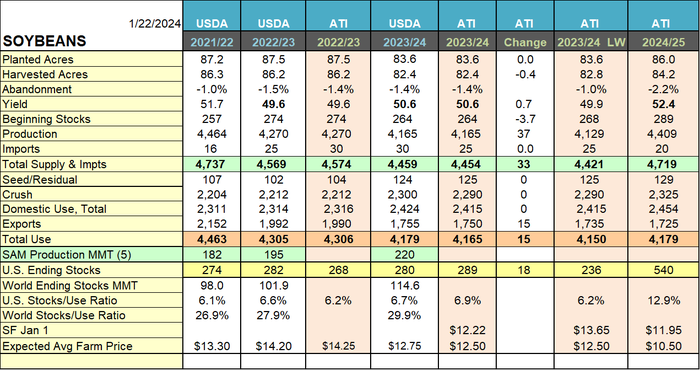

It is common for operations to market corn and soybeans hand in hand, meaning that when we get sick of the corn market, we forget to look at what can be done with soybeans. Yes, they have both dropped well over a dollar year over year, but percentage wise corn is down 20.8% compared to soybeans being down 12.5%. Beans are still hovering right around that $12 mark, which pencils out a lot better than the $10-$10.50 area many private companies are projecting for the 24/25 crop.

The last time we saw carryout over 500 million bushels was the 19/20 marketing year, when the U.S. farm price was $8.57. Obviously, the trade with China was a big factor there, but it goes to show that we could drop a lot further from this $12 mark. Enough with all the doom and gloom. What can be done today?

A soybean marketing sample

Let’s look through a marketing plan for a farmer who is projected to produce a nice round number of 100,000 bushels of soybeans in 2024. He wants to be 100% marketed/covered before planting a seed and implements four different strategies to achieve this:

Sells 25,000 bushel at $11.90 futures without re-ownership. This can be done as an HTA, forward cash sale, or a futures sale on the board.

Sells 25,000 bushel at $11.90 and buys a November $12.20/$14.20 call spread for 42 cents. Again, this starts with an HTA, forward cash sale, or a futures sale. However, this time he buys a $12.20 November call and sells a $14.20 November call giving him some upside potential in order to capture some premium if we see a strong rally. This position would give him a net floor of $11.48. ($11.90 sale – 42 cent cost of call spread)

Buys 25,000 bushels worth of $11.40 November puts for 44 cents. This position gives him a net floor of $10.96 but also leaves these bushels with unlimited upside. If the market crashes to $9 by harvest, he will sell his beans for $9 and at the same time collect $2.40 from his put. ($9 sale + $2.40 put premium – 44 cent put cost = $10.96). If the market rallies to $13, he will sell his beans there and be out the upfront 44-cent cost to have a net price of $12.56.

Buys 25,000 bushel of a $11.80/$13.80 put-call spread costing 44 cents. This position is made by buying an $11.80 put for 64 cents and selling a $13.80 call for 20 cents. The put-call spread provides a price floor of $11.36 and a ceiling of $13.36. This position does leave you open to margin risk and should only be executed by operators who fully understand it.

These positions together provide a complete marketing plan and have you 100% covered to the downside, leaves you with some upside potential on 50%, and another 25% of unlimited upside potential. Say if the market does crash to that $10.50 area we discussed, this farmer would receive an average price of $11.43. If the market rallies higher and we see futures at $14, this farmer would receive an average price of $13.03.

Market to your style

The positive about marketing your crop with options is that you can tailor them to your specific wants.

If you want upside completely left open, just buy puts, or don’t sell any calls on top.

If you are too worried to sell 50% before you ever plant, don’t make any sales and just protect through puts.

After just a few conversations with the right risk management advisor you will easily understand how to utilize options and what strategies are meant for your operation.

Don’t wait for the markets to improve because they “have to bounce.” Set up a marketing plan that provides some comfort for you in case we never see that bounce – or if the bounce comes after we already dropped another dollar or two.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like