Worries about supply and demand pushed corn and soybean futures to new multiple-year lows last week in the aftermath of bearish USDA reports. But cash markets showed signs of life in some areas as trading for 2024 advanced, once again demonstrating the complex nature of basis.

Of course, it’s not unusual for the difference between cash and futures to tighten when down futures markets discourage farmer selling, thereby forcing buyers to raise bids to secure supplies. But even these usual mechanics got whacked upside the head this winter, thanks to the unpredictable mixture of both man and nature.

Two blasts of bitter cold temperatures – and real explosions in the Red Sea – disrupted shipping, whether the grain was on rail cars, barges or ocean-going vessels. The fallout strengthened basis compared to year-ago levels in some markets, while others weakened from December.

Futures traders tend to look at the big picture, keeping many focused on USDA’s Jan. 12 reports, which showed large Dec. 1 inventories and forecast more corn and soybeans will be leftover at the end of the marketing year Aug. 31. But the reality in the cash market was entirely different as end users improvised.

Rail helps corn bids

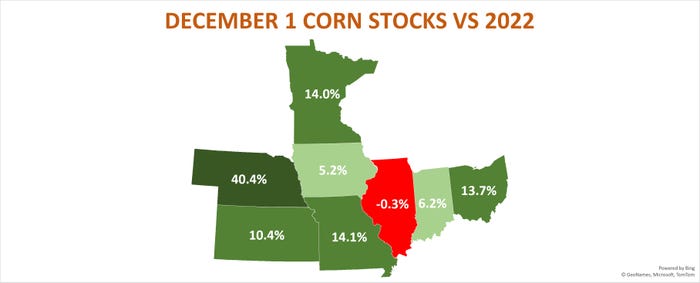

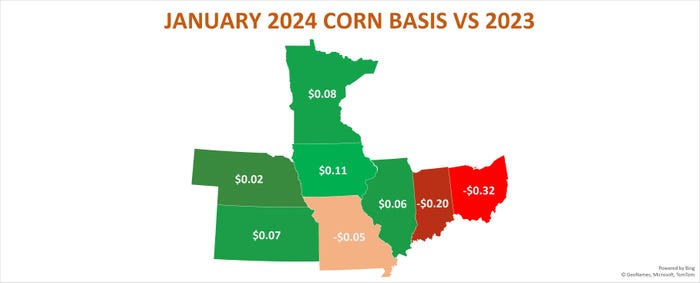

Corn stocks in eight Midwest states were up 12.5% compared to the previous year as winter began. Predictably, corn basis in those areas was three cents weaker on average. That doesn’t sound like anything to write home about. But compared to December, bids improved eight cents, seven cents more than average, and some of the winners and losers ran against form.

Dec. 1 corn stocks in Nebraska jumped 40% year-over-year, rebounding from poor 2022 crop yields. But basis so far in January is two cents stronger, with bids up four cents from December. Similar patterns played out in Minnesota, Kansas and Iowa. All those states ship grain west, where demand is booming. While that demand and cold weather increased the cost of rail freight, overseas buyers don’t have much choice at the moment.

Shipments out of the Gulf, which normally dominates export business, suffer from triple-whammy woes.

The fastest route to Asia out of the Gulf is through the Panama Canal, a waterway beset by drought that slowed movement and increased costs.

Rerouting that traffic through the Suez Canal was the bypass of choice – until rockets from Yemen’s rebels caused many shippers to divert vessels around Africa and the Cape of Good Hope, a more expensive option.

Frigid temperatures aren’t helping traffic on parts of the river system normally open for business during the winter. Ice blocked much of the harbor in St. Louis, with problems further south in Missouri too. The lower Mississippi also is trying to recover from low water levels.

Indeed, states with weaker corn basis this January compared to a year ago share the same story. Ohio and Indiana are suffering from a poor cash market because much of their surplus typically heads east on railcars to feed livestock in the Southeast. Ongoing issues from smaller herds and environmental problems caused two plants to close recently, the latest in a series of shutdowns triggered by problems during the pandemic. Corn bids in Indiana also may be suffering from problems at a big terminal there.

Crush offsets export woes

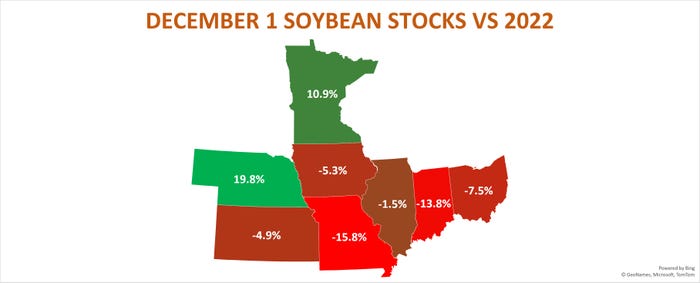

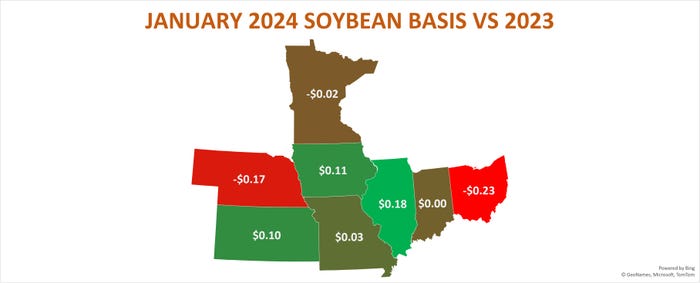

Local supplies also are affecting soybean basis, though not to the extent of corn. Disappointing yields trimmed Dec. 1 stocks nationally, with inventories down in six of the eight Midwest states. Supplies rose in Minnesota and Nebraska, where basis already was weaker than a year ago, and also slipped sharply from December.

But bids were flat in Indiana and lower in Ohio despite smaller inventories as plants coped with demand issues back East and difficulties on the Ohio River, though the Marine Safety Information Bulletin for low water on the Lower Mississippi was lifted earlier in January.

While export inspections are up for 2023 crop corn, soybeans suffer from falling Chinese demand. Unshipped sales to China are off 26% from last year, with more bad news this week on that country’s prospects. A falling population that’s also aging will eat less meat, reducing demand for imports as the Communist Party tries to figure out how to right its ailing economic ship.

Still, domestic consumption remains strong in the U.S., helping big processing states like Illinois and Iowa. The National Oilseed Processors Association Tuesday reported its members crushed a record amount of soybeans in January for any month, despite a slump in margins.

Both corn and soybean basis on average tend to strengthen into spring and summer, and both should make gains this year, too. Corn basis in January so far is running on track with what forecasts expect. Soybean bids are on average about 13 cents stronger. Futures carries from March to May reflect the difference: 10.5 cents in corn but only 9.75 cents for soybeans.

About the Author(s)

You May Also Like