Attention for the USDA monthly World Agricultural Supply and Demand Estimates report released today, April 11 at 11 a.m. CT, will be on trends in South American production. With a significant percentage of the Argentina soybean crop yet to be harvested, pollination weather for safrinha (double crop) corn in Brazil still ahead and the growing season for U.S. crops just beginning, uncertainty remains high.

Historic drought

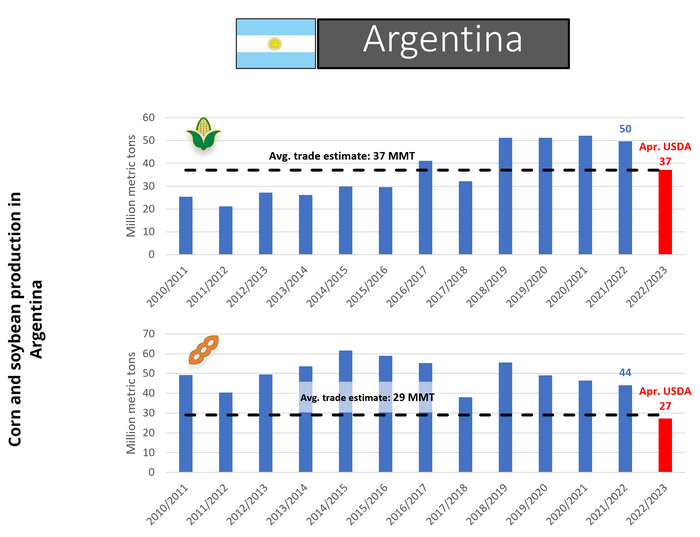

Looking at Argentina, all indications point to smaller estimates of corn and soybean production on the heels of one of worst droughts in decades. According to the Buenos Aires Grain Exchange (BAGE), 66% of the crop is rated poor/very poor compared to 17% a year ago.

USDA in March slashed soybean production in Argentina by 8.0 MMT to 33.0 MMT as a result of a major cut in yield (from 38.4 bushels per acre to 31.7) and modest reduction in harvested acreage (from 39.3 million acres to 38.3). Although rain has returned to Argentina the last week or two, it came too late for early planted beans. The average trade estimate for Argentina soybean output is 29.0 MMT, with a range of estimates of 25.0-31.5 MMT.

The following graphic have been updated to include data from the April 11, 2023 WASDE report:

Corn crop potential in Argentina also remains poor. Nationwide harvest is at 10.4% according to the BAGE, with 52% of the crop rated poor/very poor compared to 24% a year ago.

USDA in March lowered corn production by 7.0 MMT to 40.0 MMT due solely to a cut in yield from 111.7 bpa to 95.1. The average trade estimate for Argentina corn output is 37.0 MMT, with a range of estimates of 33.0-39.0 MMT.

Key weather period ahead

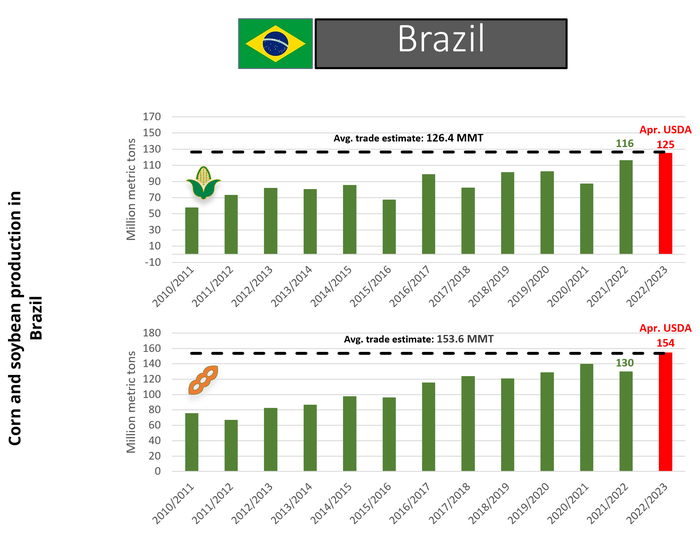

Soybean harvest in Brazil is near 80% complete, with high yields in many key areas. USDA in March pegged production at a record 151.0 MMT, up 17% from last year. The average trade estimate for the April WASDE report is 153.6 MMT (range: 151.0-157.7).

The following graphic have been updated to include data from the April 11, 2023 WASDE report:

Corn crop potential in Brazil also remains high. USDA in March projected a 4% increase in acreage and yield compared to last year, resulting in a record production estimate of 125.0 MMT.

Still, it’s important to remember that pollination of safrinha corn will not take place until later this month into early May. That’s also the time when the dry season for Brazil typically begins, making weather trends over the next month to six weeks very important.

Due to a late soybean harvest, planting of the safrinha crop occurred outside of the ideal planting window in parts of the south. These areas could be susceptible to yield loss if the dry season begins early or a frost is seen before July.

The average trade estimate for corn production next week’s report is 126.4 MMT, with a range of 123.0-131.3.

With many factors still in limbo, uncertainty remains high. Your Advance Trading advisor is well prepared to help you turn uncertainty into opportunity through implementation of customized risk management strategies.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like