Brazil’s soybean harvest has reached 60% complete overall this week with Mato Grosso on the home stretch, coming in at nearly 95% complete. Yields have been steadily improving in the later planted fields, but according to one farmer in North Central Mato Grosso, nothing “expressive” that would help offset lower yields from earlier planted fields.

This producer planted much later and still complained that yields were not what he had hoped. He thought the plants looked healthy, but pod weights were light due to a combination of heat, drought and white fly. This same producer was hearing a lot of large-scale farm averages of 36 to 40 bushels per acre – basically right at or slightly below the cost of production.

On the corn side, safrinha planting is virtually complete. This same producer cut corn acres on his farm by 50%! He planted later to improve his chances at a better soybean crop to the detriment of his corn area. This is a common theme that likely will see corn acres being cut further.

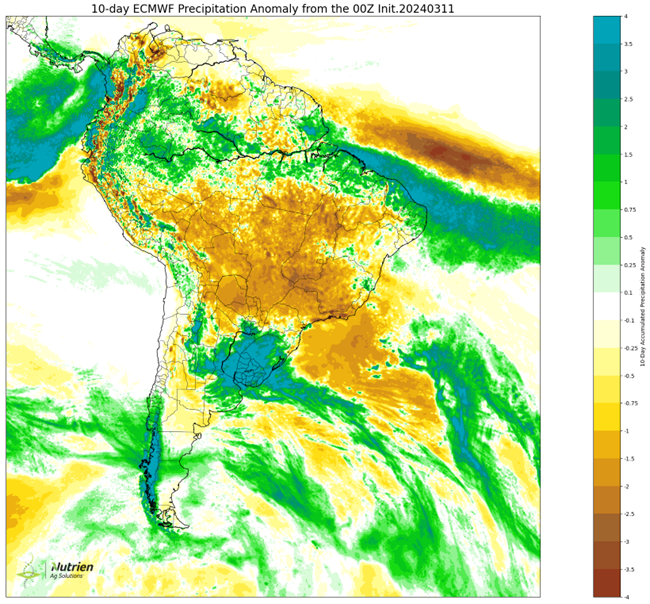

Weather going forward for the next two months will be critical for safrinha corn development. We see surface soil moisture deficits expanding dramatically in the past week. Scattered showers will help stave off the worst in Mato Grosso with many areas getting by with just 1” to 2” in the next ten days. But this will not be enough for the corn to flourish.

Furthermore, temperatures are in the low 90s this week and moisture demand is increasing along with evaporation rates. The 10-day precipitation anomaly continues to lean drier to the north. Other areas such as Parana, Mato Grosso do Sul and Goiás lean drier.

Parana is the second largest safrinha corn production state representing 15% of second crop corn output.

Combined with Mato Grosso do Sul and Goiás the three production areas represent 36% of second crop corn output.

There are better rainfall chances later in March, but many regions could use another shot of rain now. Dryness in the Center West region should help CBOT corn from making a new low.

Southern Brazil is an entirely different case, with heavy showers falling squarely over RGDS and primary production regions in Argentina. Many of these regions could collect up to 8 inches or more in the next 10 days. This might not do much for the first crop of corn which is around 75% harvested, but it should help fill soybean pods as harvest gets underway soon.

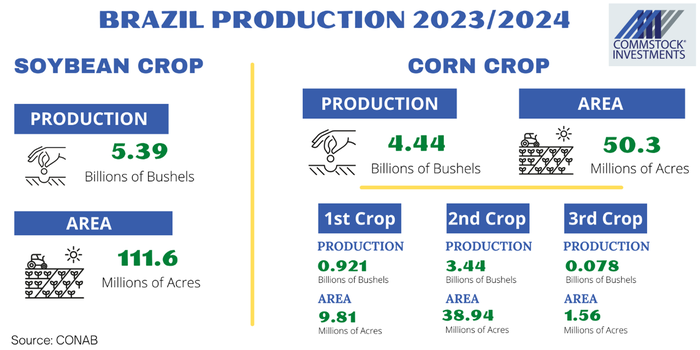

CONAB’s March report sees a slightly smaller soybean and corn crop, placing soybean production at 146.8 MMT down 2.6 MMT from last month. We still expect further cuts in their April report, inching their soybean production estimates closer with that of Commstock’s at 145 MMT.

They increased soybean acres by over 200,000 acres, but they cut the yield by nearly 1 bpa to 48.2 bpa overall. Not surprisingly some of the biggest cuts came from Mato Grosso and Mato Grosso do Sul. Minas Gerais and Rio Grande do Sul were some of the few major production states left unchanged. RGDS is on track to have an excellent year following three years of drought that left crops decimated.

Who’s right: CONAB or USDA?

The main point to discern from all this is that there is an 8.2 MMT gap between the USDA and CONAB in their respective March reports – which we believe is the highest ever. Our bias is that the USDA will eventually have to make a more aggressive correction to their soybean estimates, but will choose to wait until after the planting intentions report is released on March 28. And so we wait.

CONAB cut their corn production estimates by nearly 1 MMT to 112.7 MMT. There was a minor cut to first crop corn, but most of the cut came from lower acres in Mato Grosso and Mato Grosso do Sul. Yield was reduced by 0.3 bpa to 88 bpa overall.

Yet again, CONAB’s corn estimate is 11.8 MMT below that of the USDA, which represents a 445 million bushel gap which nobody can (or wants) to explain. The USDA has more time to reduce this gap as the second crop of corn representing 77% of Brazil’s production, was just planted and has plenty of growing season left to go.

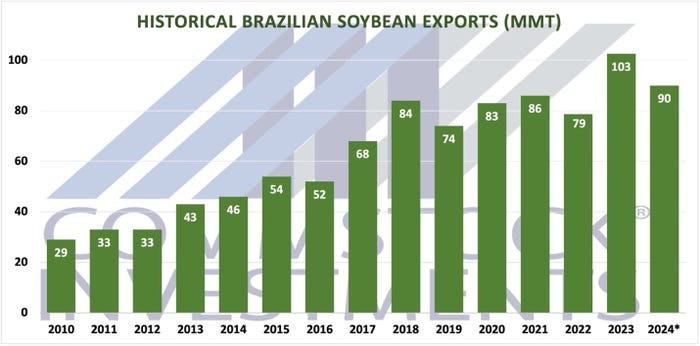

As Brazil’s soybean production estimates continue to fall, so too shall their export forecasts. The USDA March WASDE update has Brazil’s soybean exports pegged at 100 MMT, compared to 103 MMT last year. CONAB has their own soybean exports pegged at 92 MMT and we could see them drop closer to 90 MMT when all is said and done.

This leaves 10 MMT or roughly 368 million bushels that could get purchased from somewhere else. There is obviously not a lot of other places in the world to shop for soybeans and so the United States should fill some of this export gap.

Brazil’s soybean exports peaking

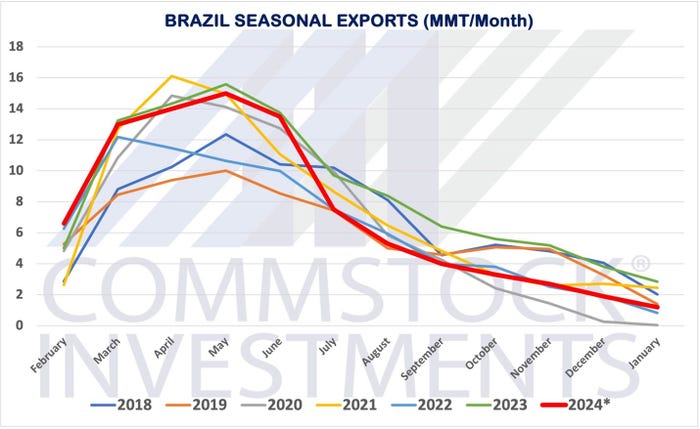

We are now entering Brazil’s peak soybean export period with a sharp rise expected for March soybean exports, estimated to be around 13 MMT. April/May exports will likely reach or exceed 15 MMT each month.

Exports will continue to rise and peak in the April/May timeframe before beginning their post season descent in June. In the meantime, grain buyers are busy filling old forward sales contracts and other commitments. We expect 2024 soybean exports from Brazil to perform toward the bottom of the 5-year range later in the year as production cuts lower supply.

Matthew Kruse is president of Commstock Investments. Subscribe to their report at www.commstock.com

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Read more about:

BrazilAbout the Author(s)

You May Also Like