As we approached the end of the three-day holiday weekend, this question lingered: would market prices follow the 2012 chart pattern and explode higher, or mimic what happened last year and start working lower into the fall?

As it turns out, there was no definitive directional move to begin the week.

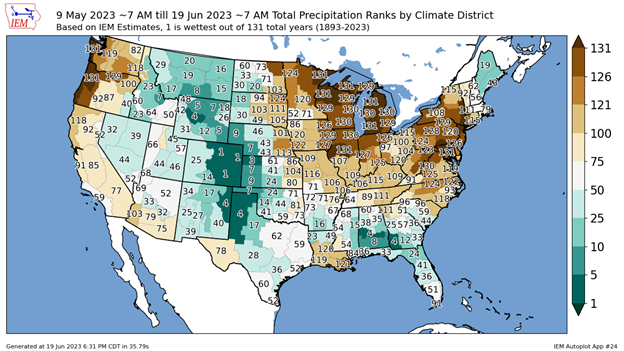

Two main topics currently dominate the trade's viewpoint. On the bullish side, the lack of rain has supply bulls anticipating a lowering of the national yields for both corn and beans. It looks like we'll be dealing with dryness issues, at least until this upcoming weekend, across most of the Midwest.

It does look like we could be seeing a pattern change as the long-range models have been putting in better opportunities for moisture as we move into the latter half of June into the beginning of July. The trade is skeptical of the rain, as longer-range maps have hinted at rain in the 10 to 15-day portions of the map for the last couple of weeks. Unfortunately, if that rain doesn’t occur, dryness across the Midwest will continue to intensify, dinging yields.

We warn market participants from getting too bulled up on this supply-driven rally, as supply-driven rallies tend not to last. In fact, it is demand for corn that could be the Achilles heel of this year's rally. This week's old crop inspections came in at 35 million bushels at the low end of expectations and below the 42 million bushels needed per week to reach the USDA export forecast for inspections. This week's Inspections were at a 10-week low and brought year-to-date inspections at 1.25 billion bushels, down 31% from a year ago.

The weak old crop demand for corn should be considered a “canary in the coal mine” for new crop demand. USDA is currently estimating new crop exports to increase by 375 million bushels compared to the old crop. With the current poor demand for old-crop corn, it seems incredibly optimistic to see a massive rebound in the upcoming year. The feed and residual may be overstated, as they are looking for an increase in this category by up to 375 million bushels year-on-year.

The current USDA new crop ending stock estimate is 2.257 billion bushels. That’s using harvested acres of 84.1 million acres, a trend yield of 181.5, and total demand at 14,485 bb (Adding to the supply are the current carry-in estimate of 1,452 bb and imports of 25 mb).

Consider this scenario

If the national corn yield dropped 4.5 bushels to 177 bpa, export demand is unchanged year-on-year and there’s no adjustments to ending stocks; we are looking at a burdensome 2.257 billion bushels. If the crop's national yield falls 9 bushels, the feed and residual category and exports are unchanged; the same result in your carryout would be left unchanged.

If the weather stays bullish and we take 18 bushels off this crop, the national yield would fall to 163.5 bushels per acre, equating to a production loss of a shade over 1.5 billion bushels. If we lost this amount of production and left demand unchanged at the current estimate (14,485 bb); the ending stock estimate would be a very bullish 750 million bushels, but this will not happen. Why? When we lose production, we lose demand. On average, you lose roughly 1/2 a bushel of demand for every bushel you lose in production.

Of couse some of this demand loss is due to higher prices. In this scenario, if we lowered production by 1.5 billion bushels and then turned around and cut demand by 805mb (which would mean there would be zero change in the demand side of the balance sheet year-to-year), the carryout would be projected at 1.562 billion bushels or roughly 100 mb higher than the current old crop ending stock estimate.

Many variables will determine the final carryout size of both old and new crop corn. However, unless the rain completely shuts off, the odds are high that ending stocks will increase year-on-year, and this rally is one to take advantage of because of it. With this in mind, we encourage producers to take a sell-and-defend approach. We recommend purchasing calls against futures and cash sales for upside protection in case the pattern change does not materialize. Or consider using a put strategy to put a floor under the market and leave the topside open. Consider purchasing the weekly or short-dated calls to limit the cost of the options.

If you have questions or would like specific recommendations for your operations, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like