December is almost here, so for most of us that means an end to fieldwork for the season. But south of the equator, peak growing season is underway. While it is still early in the South American growing season, there are several market factors farmers will need to watch in the coming weeks that could potentially influence prices here in the U.S.

Why do we watch South America so closely?

Since they are located in the Southern Hemisphere, Brazil and Argentina’s growing seasons are on the opposite side of the calendar from U.S. farmers, which is why both countries have been generating so many market headlines lately. And their large production capabilities make their prices competitive with U.S. corn and soybean pricing.

To be more specific:

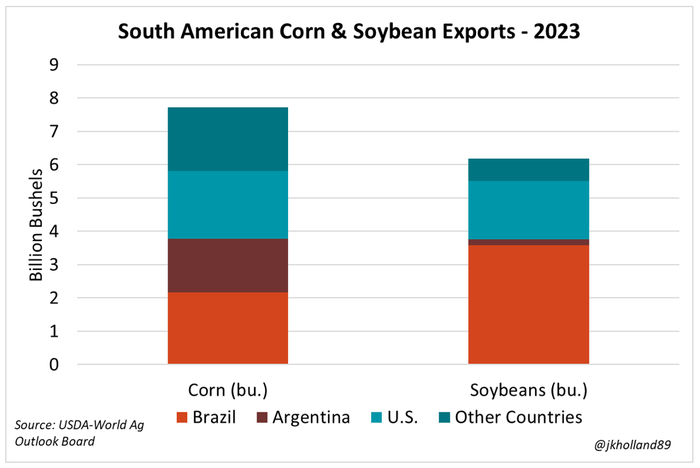

Brazil and Argentina combine to produce 49% of the world’s corn exports

Brazil ships 49% of the world’s soybeans

Argentina and Brazil combine to ship 65% of the world’s soymeal exports

In comparison, the U.S ships:

26% of the world’s corn exports

28% of the world’s soybean exports

20% of the world’s soymeal exports

Because Brazil lacks storage capacity for its corn and soybean crops, supplies flood the market at harvest and push international prices lower until they are shipped out. This dynamic creates a price disadvantage for U.S. farmers waiting to capture price opportunities with on-farm storage.

In recent years, the U.S. has become more of a secondary global corn and soybean provider, stepping in to satiate global demand when Brazil or Argentina has issues shipping out their crops. For example, U.S. soymeal exports soared to record highs this past fall after Argentina ran out of soybeans to crush due to its drought last season.

How it’s going so far

Brazilian soybean growers are currently running behind historical paces for planting progress – a situation that could force global soybean and corn production lower in the coming months. Brazilian agribusiness consultancy AgRural published its weekly planting progress figures this morning. Through last Thursday, 74% of anticipated 2023/24 Brazilian soybean acreage had been planted, up 6% from the previous week.

However, planting progress still remains well behind year ago paces amid uncooperative weather in Brazil over the past couple months. Through last Thursday, this year’s planting speeds are 13% slower than the same time the year prior. It is the slowest pace for Brazilian soybean sowing in the past eight years.

This week, rain is expected in Brazil, but markets were skeptical this morning that it would be enough to mitigate heat stress damage to the young crop.

While La Niña weather conditions the past several years have caused dryness for Argentina and Southern Brazil, the current El Niño system currently at play during the winter months is likely to bring dry weather to Brazil’s major soybean-growing regions in the Center West while Argentina and Southern Brazil are likely to see higher rainfall volumes.

Impacts to U.S. farmers

From an operations standpoint, winter months are typically slow times for corn and soybean farms in the U.S. But expect the markets to respond to weather data from Brazil and Argentina in the coming weeks.

Currently, Brazil is slated to be the world’s largest exporter of corn and soybeans during the 2023/24 marketing year. But the gap between Brazil and U.S. corn export volumes is only 140 million bushels – a fraction (3%) of both countries’ exportable supplies.

If Brazil’s soybean planting season continues to run too far behind in late 2023 or if La Niña takes a bite out of South American yields, U.S. corn and soybean producers could have a fighting chance to be competitive sellers in the export market in the early months of 2024.

Read more about:

South AmericaAbout the Author(s)

You May Also Like