With barely a month left in the year, 2023 crop chores are winding down – just in time for 2024 operations to start taking shape. Planting rotations, fall fertilization and juggling pre-paid expenses with year-end tax planning mean there’s plenty to do, even after equipment is put away.

The good news comes on the expense side of ledger, where costs should be down. The income side of income statements is another matter altogether.

Margins are thin, if available at all, because November soybeans and December corn futures with 2024 handles are down 7% and 15% respectively from year-ago then-new crop 2023 levels.

And, while the clock is ticking towards the end of 2023, important crop insurance protection is months away from clarity when spring prices are set by trading in February.

At least officials in Washington resolved budget gridlock, avoiding a government shutdown with a deal that extended the current Farm Bill for another year. That means farm program signup, open through March 15, can be made with more certainty for this other key component of agriculture’s safety net.

So, here’s what we know, and don’t know about profit potential for 2024.

Better news on costs

While all farms are different, USDA Nov. 15 updated forecasts for 2024 expenses, after its first look in July. These put the average national cost for corn at $869.52 per acre, with soybeans at $614.81. Based on “normal” U.S. yields of 177.7 bushels per acre corn and 52.4 bpa soybeans, costs per bushel translate to $4.89 for corn and $11.73 for soybeans. USDA’s initial forecast of acreage, supply and demand, released in its budget baseline Nov. 7, assumed 181 bpa corn and and 52 bpa soybeans, based on what the agency says is normal weather.

Basis is another unpredictable variable, but using 35 under December and 45 under November futures that last week that traded around $5.10 corn and $13 soybeans provides at least some level for comparison.

While corn looks in the red, losing more than $50 an acre, soybeans would be at least profitable, though netting $10 or less.

That math confirms the ratio of soybeans to corn futures, the favorite of traders, which at 2.55 to 1 comes down on the side of planting more soybeans.

Whether those prices last affects not only spring planting decisions, but risk management choices as well. Higher February averages also spell higher spring crop insurance prices, another variable in the profit equation.

Fertilizer cheaper

Costs, of course, are always a moving target, especially nearly a year before anything is harvested. USDA’s accounting may also be different from your farm’s, even if you use management accounting and enterprise analysis.

Input markets change, too, and USDA’s cost forecasts were prepared in October. Fertilizer is the biggest variable expense for most operations, and what you pay depends not just on the products used, but international markets and where you are in the supply chain.

With shipments on northern segments of the river system already winding down for the season, low water levels to the south continue to restrain movement of product into position for rail shipping, clouding deliveries this winter.

Costs for nitrogen remain in a tailspin due to weak demand, though lack of Chinese urea shipments could be an issue this winter. The government there has also curtailed phosphate exports, supporting products getting a break from lower tariffs on Morocco and a smaller than expected increase on Russia.

Energy takes up a smaller piece of the expense pie, but is no less volatile. Crude oil traded at its lowest level since summer ahead of the holiday, restrained by demand worries but supported by worries about production cuts from OPEC and its allies at a meeting this week.

And financial markets remain a minefield. USDA’s forecasts assume lower costs and a slight reduction in interest rates will reduce operating borrowing charges for growers, and the pace of those cuts by the Federal Reserve may be faster. Hopes for a falling greenback in turn broke the dollar to its lowest of the fall, another factor that could affect bills for imported goods as well as commodities generally.

Flat markets, for now

Prices for corn and soybeans plugged into any projections have just as much uncertainty. Yet in years of normal production, market moves on average into May and June are limited. So, without big disruptions this winter or spring, history at the least favors relatively flat prices for the new crop.

With so many moving parts to consider, how do you portray your plans to family, partners, landlords and lenders? One place to start is with a sensitivity analysis that lays out a grid of profit outcomes resulting from varying harvest prices and yields that can be adapted depending on how you use words, graphs, tables in your discussion.

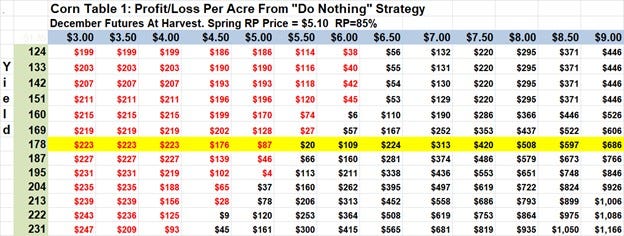

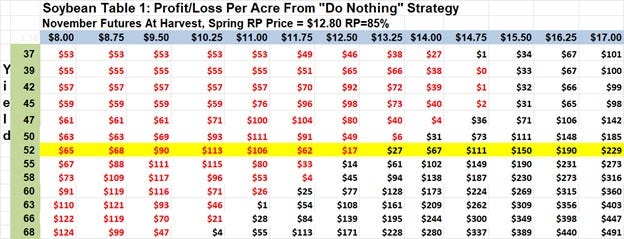

I put together a sample of profit/loss projections using USDA’s costs and my own yield assumptions, along with farm program and crop insurance expectations. Selling prices in these use the middle of recent price ranges for 2024 crop futures, showing what happens if sales are made now compared to just selling off the combine at harvest.

The outlook, shown on Table 1 for both crops, doesn’t look good if nothing is done until fall unless prices rally significantly or yields far exceed expectations. Soybeans’ favorable price at the moment gives that crop the edge if sales are made now, but the cushions shown on Table 3 fade quickly under some scenarios, especially if prices later take off and yields fall.

Crop insurance choices likewise can affect profits and costs, and these tables can also be used to illustrate what happens if the market plays out as you anticipate.

Sure, any analysis is only hypothetical. Reality has a habit of turning out different than we expect, or at times want. But spending money now locks down some of the equation, and this approach can show the results, for better, or worse.

About the Author(s)

You May Also Like