Fireworks are an Independence Day tradition. But grain markets after the holiday all too often light duds, not skyrocketing rallies.

On average over the past 50 years, both December corn and November soybean futures lost ground when traders returned to work. And most of the time, when prices fall the first day after the Fourth, they keep falling through the week.

To be sure, that record doesn’t rule out rallies. In 2011 corn was 61.25 cents higher a week later, and almost matched those gains the following year during the big drought.

But all too often prices head the other way, when selling opens the floodgates for more losses, sometimes sounding the death knell for bull markets.

The 2008 rally to $8 corn fell apart after the holiday, and didn’t stop until the contract traded below $3 into delivery after harvest.

Weather usually turns the trend one way or the other, so futures can surprise with gains if forecasts turn hot and dry. Here’s a look how the last five decades played out, for better or worse.

July crucial for corn

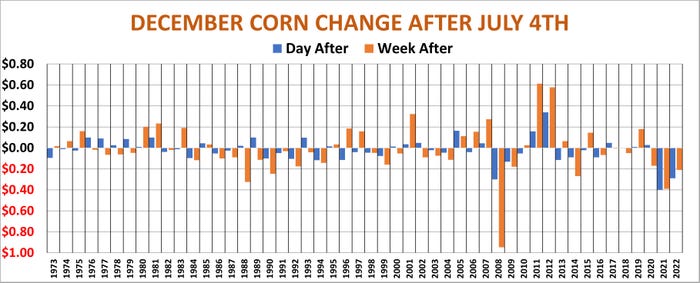

Corn typically faces the most risk from July conditions during the crucial pollination window. But most years scares don’t turn into the real deal, and the close on the first day back can set the trend for the rest of the season. December ended higher the day after 22 times from 1973-2022, losing ground in 28 of those years. One week later the market was higher just 20 times, going lower 30 years.

Of the 22 years that started higher the day after the July 4th observance, the rally kept going only 10 times. Markets that began lower, tended to stay that way too.

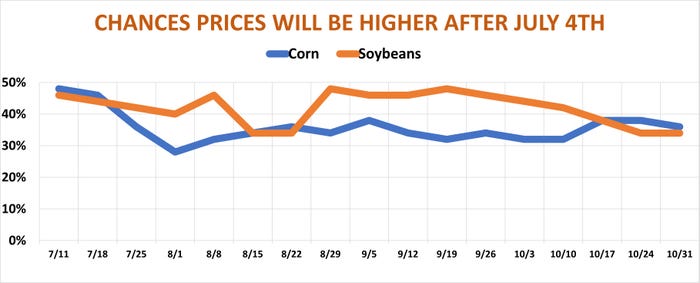

Summer rallies must confront powerful seasonal tendencies to maintain their momentum. On average over the past 50 years December futures peaked in mid-June, and downturns accelerated quickly. By the beginning of August, new crop prices were higher than the day after the Fourth just 28% of the time. Average prices bottom the next week, ahead of USDA’s crucial August crop production report. Futures can firm before Labor Day, then resume trending lower into the first week of October as harvest gears up.

Soybeans’ second wind

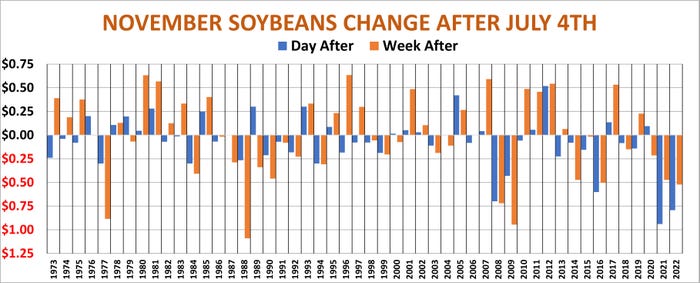

Soybeans face an even bigger immediate hangover than corn from the patriotic parades and cookouts. November futures rose 18 times the day after the holiday, going down 31 years and ended unchanged once. A week later, however, the story was brighter than corn: Prices were higher 24 years and fell 26 years. And only five of the years that had first-day-back gains reversed lower a week later.

On average, soybeans get a brief second wind after a June rally, making one final push in mid-July before slumping into August and its USDA report. August weather can be critical for yields, keeping rally hopes alive. Near one of every two years November futures are above post-July 4 highs by the beginning of September and the official start of the new crop marketing year, though prices typically weaken into harvest, just like corn.

Acreage fallout

In addition to weather, USDA reports on acreage and stocks put out at the end of June can prime the pump for both bulls and bears. That big selloff in 2008? In addition to fallout from the financial crisis, corn also was hit by the 1.3 million additional acres that turned up in the government’s updated plantings data.

And even seemingly friendly June data can’t fight the tide of markets in retreat. November futures dropped 20 cents after the June 30 report last year, despite a cut in plantings of 2.6 million acres compared to March intentions. Selling continued the next day, posting another 62.75 in losses. When markets reopened July 5 after the holiday, November fell another 79.25 cents – total losses of $1.6225 in just three sessions.

Friday’s reports provided plenty of surprises that traders will mull over the holiday. While the corn stocks number was right in line with my forecast, it was well below trade estimates. Soybean inventories were below my guess, but in line with trade thinking.The acreage numbers were a bombshell, with soybean plantings off 4.6% from March intentions, with corn going the other direction, rising 2.3%. That could reset the table for July, and beyond, if the weather outlooks change or rains don’t materialize. The summer of 2023 hasn’t exactly played by the rules so far, featuring one of the driest starts to June on record, not to mention thick smoke from the Canadian wildfires that choked the eastern half of the U.S. Toss in these surprising June 30 reports and the results should make for an interesting summer.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Knorr writes from Chicago, Ill. Email him at [email protected].

About the Author(s)

You May Also Like