Winter isn’t over just yet in the grain market, with corn and soybean futures grinding out more new lows last week. But spring is in sight, and along with it prospects for rallies during the growing season ahead. Despite the market’s current funk, history shows at least decent odds of hedging expected production for a profitable price.

Key pieces to the 2024 puzzle are starting to emerge, allowing my early guesses to become a little more educated. While these early forecasts are anything but bullish, markets don’t go down forever. As unlikely as it may seem now, better days may eventually emerge.

Markets often act crazy, but they aren’t irrational. Two factors tend to drive price moves. From March through May, expectations for supply and demand motivate buyers and sellers. Once crops are planted, rallies from summer through harvest rise and fall with yield conditions out in the field.

USDA triggered some of the first serious talk about 2024 at its annual Outlook Forum last week, releasing updated forecasts for acreage, production and prices. Like the agency’s first take last November, these tables are based on statistical projections. Harder data starts to emerge soon, beginning with Prospective Plantings at the end of March, before the agency’s first monthly forecasts begin in May.

Those May numbers have statistically significant correlations to rallies historically, and using the outlook report as a placeholder in the calculations is one method. I use gauge targets.

To be sure, the outlook was not bullish. USDA forecast corn acreage at 91 million, the same as November, with soybeans at 87.5 million, up 500,000 from November, enough to produce ample supplies with normal yields. Average cash price prospects for the marketing year declined, with corn down to $4.40 and soybeans at $11.20. Both crops pencil out in the red, based on the government’s last forecasts for production costs, with corn losing $73 and acre and soybeans $32 an acre in the hole. Like the ratio of new crop soybean to corn futures, which last week was around 2.5 to 1, the profit outlook favors farmers planting more soybeans and less corn than in 2023.

Econ 101 says prices follow supply and demand, which in the grain market is measured by the ratio of projected supplies left over at the end of the marketing year to total usage for the crop. The higher the ratio, the lower prices should be – at least in theory.

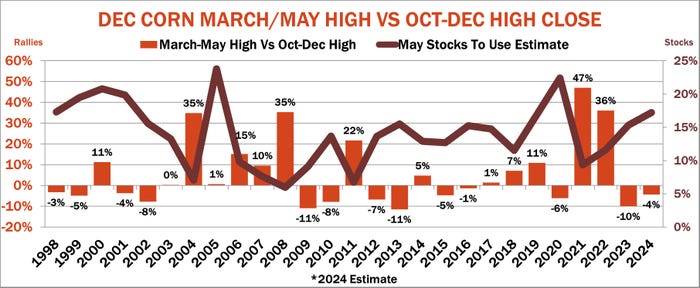

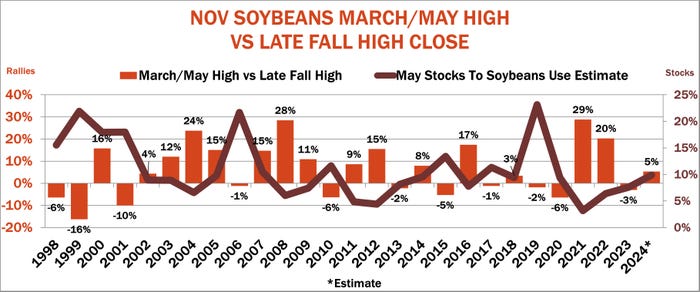

This idea can be seen in the charts below. These compare the May stocks to usage estimate with rallies, defined as differences between fall highs and those from the following March through May. In years when the market fears high stocks, rallies tend to be lower, or even negative – spring highs tumble below the fall highs.

Spring market hopes

USDA’s soybean outlook was not great, but not as bad as corn. Government economists said corn stocks at the end of the 2024 marketing year would swell to 2.521 billion bushels, with the stocks-to-use ratio increasing to 17.2%. Based on this, the top of a December futures spring rally could fall 4% to the top of last fall’s peak of $5.25, or just over $5 a bushel. But while down, that would be better than last week’s trade, which closed at $4.5875.

Soybeans look a little better. USDA said ending stocks would increase to 435 million bushels, with the stocks-to-use ratio at 9.9%. That wouldn’t be nearly as bad as at the end of the trade war with China in 2019 and could produce a spring rally high 5% above the late fall high of $13.14, or around $13.80. Again, that’s better than last week’s close before President’s Day, which came in at $11.485.

These forecasts are far from perfect, with plenty of room for statistical error – some $1.20 for corn and $1.40 for soybeans. So, spring rallies could be big, say, if planting problems develop – or small, if all goes well and demand stays tepid.

Weather rules

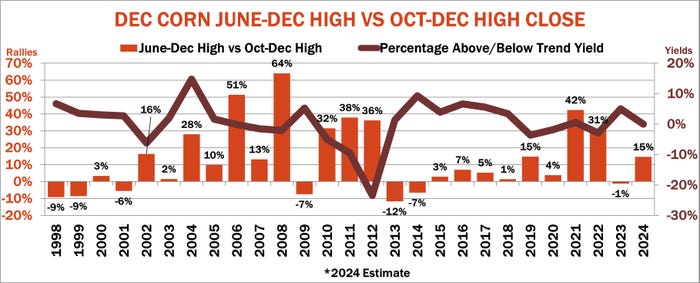

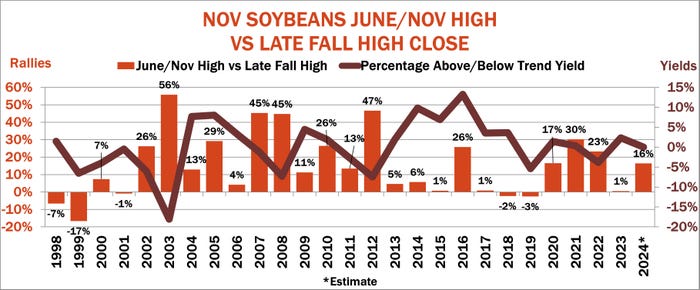

Barring a bombshell about demand, summer markets into the fall tend to be about weather and traders’ expectations for yields. So, this part of the analysis, shown in the charts below, compares summer/fall rallies to the amount yields differ from the statistical trend over the last 20 years.

Right now, long before the growing season, I assume yields will be the same as trend. And as last year demonstrated for corn, even average years can produce good selling rallies for pre-harvest hedges. So, for corn, this projects to a potential rally that’s 15% above the late fall corn high and 16% above the peak for soybeans. This translates into a corn high around $6.10, with soybeans all the way to $15.30.

Even after statistical error – around $1.15 a bushel for both crops – those targets would be an improvement. But are they at all reasonable?

The latest update on the El Nino-La Nina cycle says a qualified maybe. The La Nina cooling pattern in the equatorial Pacific expected to emerge for summer correlates with lower yields, though statistical confidence is fairly low. But rapid transitions in this pattern tend to produce volatile weather, which should at the least be in the back of traders’ minds.

These targets are anything but a sure bet, but they at least are better than the bearish Outlook Forum report last week from USDA. And this type of hope is a sure sign of spring, too.

About the Author(s)

You May Also Like