USDA’s 100th annual Agricultural Outlook Forum provided a closer look at USDA’s expectations of 2024 production prospects for U.S. farmers, and the results were eagerly digested by the market, which has been waiting for further fundamental information to dictate price direction at a time when commodity prices have been on the decline.

Translation: Jacquie is at ag analyst nerd prom this week and living her best life!

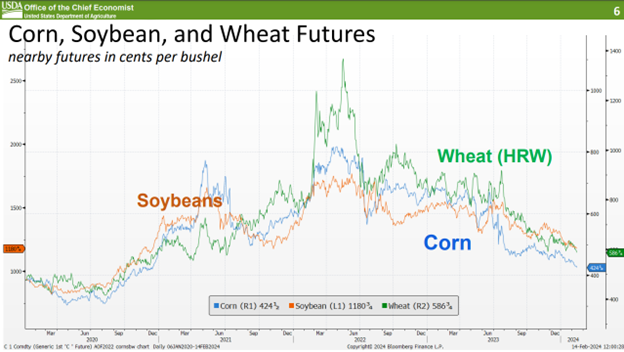

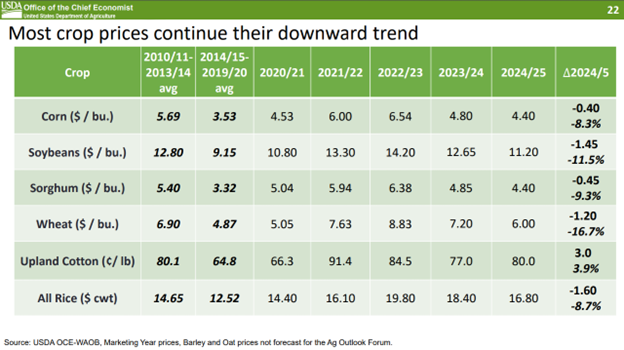

The highlight of Thursday morning’s sessions was the release of USDA’s 2024 grain and oilseeds outlook, which provided the most updated look at where USDA economists expect the 2024 growing season to play out. And unfortunately for farmers – who have endured a 38% drop in nearby corn futures prices ($2.56/bushel) and a 30% decline in nearby soybean futures contracts ($3.56/bushel) – profit margins are likely to stay tight throughout the upcoming crop year.

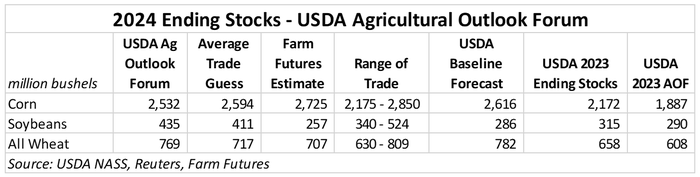

Corn and soybean prices edged slightly lower following USDA’s report release, which points to another year of big corn crops in 2024 as well as an uptick in soybean supplies. Wheat prices also struggled for upward price momentum as USDA expects wheat stocks to balloon to a four-year high as rains return to the Plains.

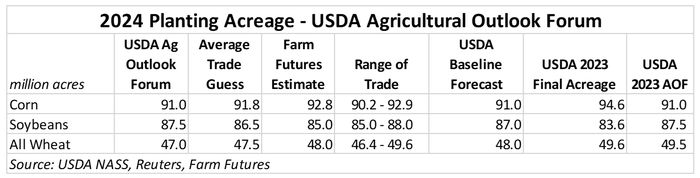

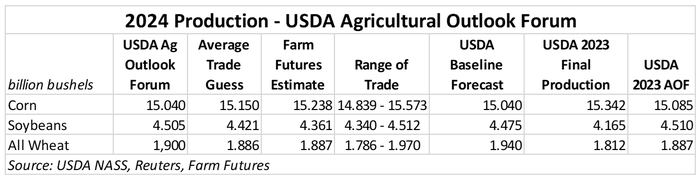

USDA kept its 2024 corn, soybean, and wheat forecasts largely consistent with its Baseline Projections published last fall. For the 2024 growing season, the economists expect that U.S. farmers will likely perform a 1:1 change in corn and soybean acres.

Corn acreage is forecast at 91.0 million acres, down 3.6 million acres (-4%) from year ago sowings. Soybean acres are projected at 87.5 million acres, up 3.9 million acres (+5%) from last year. Wheat acres are expected to see a 2.6-million-acre decline (-5%) to 47.0 million acres.

USDA also expects flat growth for sorghum and rice acres in 2024. Cotton acres could see a resurgence in the South this upcoming spring.

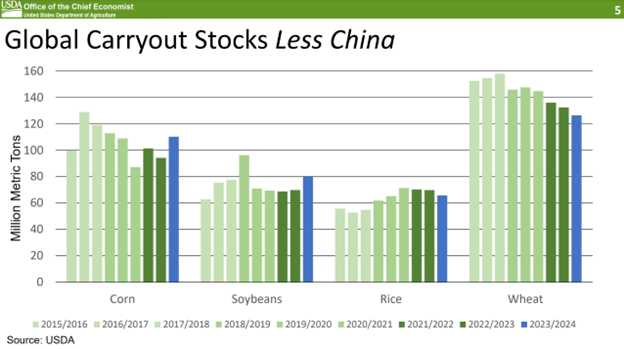

Market dynamics have been the key driver of these anticipated acreage shifts. USDA’s Chief Economist Seth Meyer cited an uptick in global corn and soybean carryout volumes (not including China’s stocks) as the force behind the corn-soybean acreage switch while tighter wheat and rice ending stocks will keep those acres somewhat competitive this spring.

The Farm Futures January 2024 grower survey results showed similar trends in corn and soybean acreage shifts, with higher corn acreage and lower soybeans relative to USDA’s estimates published this morning.

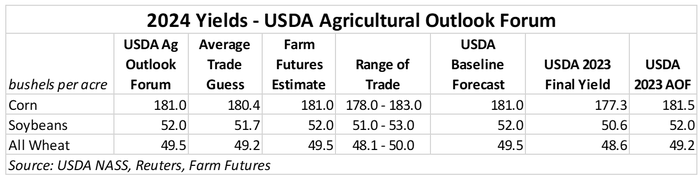

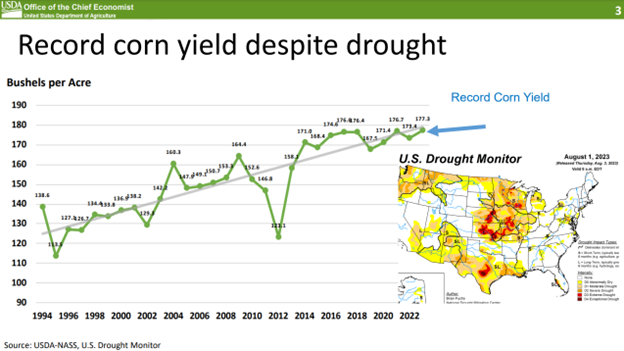

USDA also kept trendline yield forecasts aligned with its earlier projections, calling for record corn yields of 181.0 bushels per acre. Soybean yields are forecast to remain close to trendline as well. Improving soil moisture conditions across the U.S. Plains are also increasing the likelihood of a return to trendline wheat yields.

Meyer emphasized the resiliency of U.S. crop production when referencing yields, noting that despite less than ideal growing conditions in the Heartland last year, when an early season drought would’ve torched corn and soybean crops without timely rains at peak pollination and pod fill periods, U.S. crop yields are still reasonably within striking distance of trendline projections.

The resulting corn production estimates from the acreage and yield figures place 2024’s corn haul at 15.040 billion bushels. If realized, that would be the third largest crop on record, trailing 2023’s record and 2016’s second place crop.

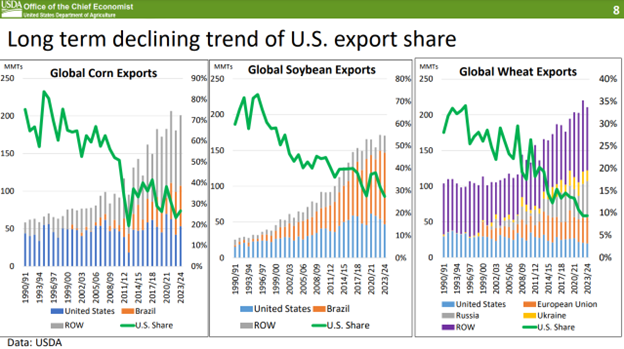

Meyer also attributed the shrink in corn acres to growing competition from South America, specifically Brazil. A long-term decline in U.S. corn exports (as well as soybeans and wheat) are limiting global consumption of U.S. corn and driving U.S. farmers to be more reliant on domestic end users for price opportunities.

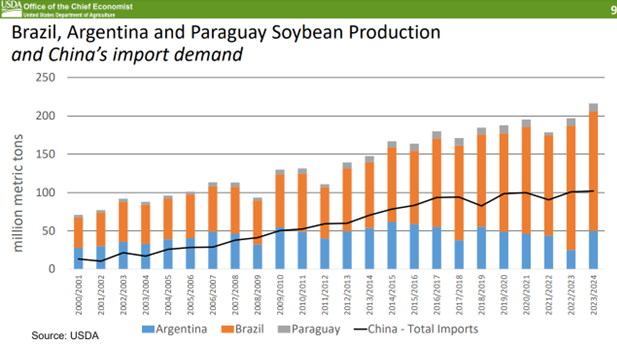

Soybean production is forecast at a new record high of 4.505 billion bushels, which if realized would surpass the current high of 4.464 billion bushels set in 2021. Markets responded particularly bearish to the soybean figure, as it would provide the first significant increase to domestic soybean supplies the soy industry has experienced since the peak of the Trade War in 2018.

With China slowing down its import paces from the U.S. in favor of cheaper Brazilian supplies, U.S. soybean producers are going to find themselves more reliant on domestic consumption, similar to their corn counterparts.

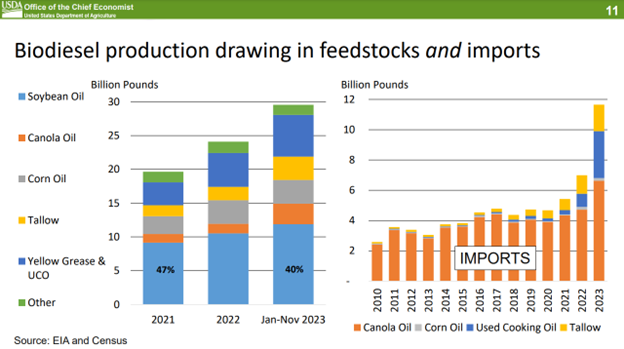

But there is a lot of optimism here. Growth in the bio-based diesel sector will help to offset slowing export volumes, so farmers will still see profit opportunities for the extra soybeans they are planning to plant this spring and those dollars will create more value in local economies than if they had been exported. Plus, it will help to reduce imported feedstock volumes into the U.S. and keep more dollars churning through rural communities.

The 2024 wheat crop is projected at 1.9 billion bushels even, the largest wheat crop grown in the U.S. since 2019. A return to more favorable growing conditions in the Plains after three consecutive drought events will be the primary driver of the 2024 wheat crop size.

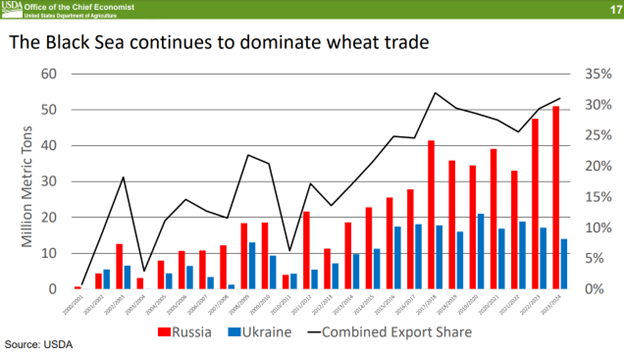

Winter wheat prices in Chicago are currently trading at a three-month low. Kansas City futures have dropped to a 2.5-year low. Minneapolis spring wheat futures are trading substantially higher than its winter wheat counterparts, but nearby futures are still hovering near a 2.75 low after all three contracts recorded highs in the aftermath of Russia’s invasion of Ukraine in 2022.

And therein lies the barrier for U.S. wheat producers. Despite the past two years of geopolitical turmoil in the Black Sea, wheat shipments out of Ukraine and Russia continue to dominate the global market and have limited growth for wheat prices around the world. Both countries command 31% of global exportable wheat supplies. The U.S.’s share has dropped to 9%, making it only the world’s fourth-largest wheat exporter.

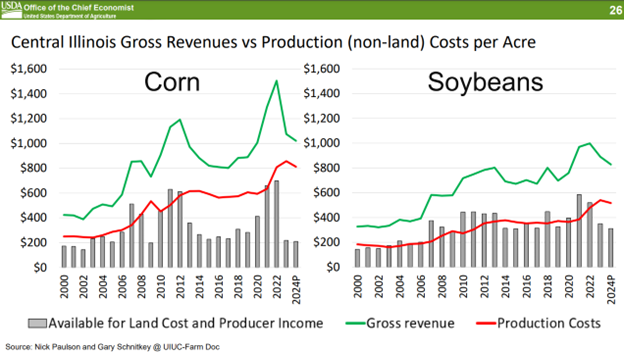

The resulting pricing implications are significant for farmers, especially at a time when input pressure continues to weigh heavily on the pocketbook.

Ending stock volumes for corn came in slightly lower than pre-report analyst expectations, but with 2024/25 stocks-to-use ratios increasing by over 2% from the current marketing year, it should come as no surprise that USDA expects that the average market price for this upcoming corn crop will drop $0.40/bushel from current estimates to $4.40/bushel.

That’s the lowest average marketing year price for corn since prices dropped to $3.56/bushel during the 2019/20 marketing campaign.

Soybean and wheat ending stock volumes saw bigger-than-expected additions to 2024/25 ending supplies in USDA’s projections, resulting in even bigger price losses relative to corn. The larger stocks will sink both prices received by farmers to four-year lows.

And as commodity prices sink, farmers’ margins will continue to tighten. Fertilizer prices have come down from their peaks following the Russian invasion of Ukraine, but Dr. Meyer reminded the audience that input costs tend to be “sticky” and stay high even as commodity revenues fall.

Plus, recent inflation readings suggest that higher prices for consumers are stubbornly sticking around as well, meaning that the Federal Reserve is less likely to cut interest rates. This means that farming operations dependent upon operating capital (which is all farms, but especially livestock producers who face significant biological lags in production and earnings), will continue to stomach higher interest expenses in addition to high feed and input costs.

Farmers will need to increasingly rely on record-setting profits earned over the past few years to combat tighter belts expected in 2024. After several consecutive years of tight supplies, we have finally been able to restock global demand pipelines for grain and oilseeds. But that will require a new level of discipline in marketing and management as this new – and less profitable – environment settles over the industry.

For more information on USDA’s commodity outlooks, please visit the following link for the agency’s information on grain and oilseeds, livestock and poultry, cotton, sugar, and dairy market insights.

Dr. Seth Meyer’s presentation slides can be found here.

If you are at the AOF here in Crystal City, Virginia, flag me down and say, “hi!”

About the Author(s)

You May Also Like