So many marketing frustrations could be solved if we could just rewind the clock, go back in time, and make different decisions. Unfortunately, we can’t, but each day is an opportunity to learn and improve the approach we take to managing price risk going forward.

Many customers took positions in recent months to get control and defend their bottom line using Livestock Risk Protection (LRP) or a futures/options strategy. After reading my last article, I hope many readers did the same.

Price drops are all too familiar

As the market sells off, it feels a bit like Groundhog Day.

April Live Cattle climbed nearly $25 per cwt above their December low but have given $10 of that back over the past two weeks.

A $25 per cwt move in April fats since December equates to a $350 per head range in value on a finished 1,400-pound steer.

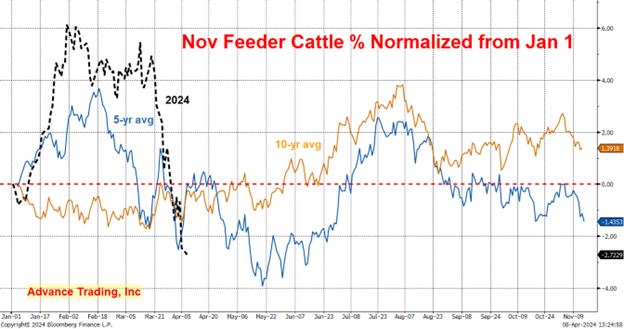

Feeders have seen similar gut-wrenching price action over the past six months.

November Feeders have dropped $25 per cwt off their February high, another significant move. Break it down to a per-head basis and an 800-pound steer lost $200 per head on that $25 per cwt move.

Headline risk

Why? We talk a lot about the ‘unknowns’ ahead of us in marketing, and how impossible it is to predict the future.

The latest Highly Pathogenic Avian Influenza (HPAI) headlines seem to be the primary culprit for funds turning to the exits and liquidating their long positions. I can’t say that I blame them. It’s all about managing risk and there is much uncertainty about how this will impact the industry.

But I don’t believe bird flu is the sole reason the cattle market has softened, it’s simply a reason to exit.

Looking at the bigger picture, the choice beef cutout has rolled over, weekly kills have been running light, and the available supply of market-ready cattle is 5-6% above year-ago levels. The cattle market has a very front-loaded inventory. The funds had built up a sizeable long position and chose to manage their risk. Funds exit their long positions to manage their risk.

Ranchers have a physical long position. Your long position is your physical animal. To exit that long position you have to sell, hedge, or establish some type of price floor. You must enter a position to do this.

Looking for something to blame

A familiar theme resurfaces whenever we have a market move lower: “Blame the funds. Blame the LRP. Grab your tin-foil hat. The proverbial ‘they’ are all out to get you.”

It seems to me that many of these claims are simply convenient excuses to defend a person’s lack of risk management. Often those who spread these messages are catering to an audience they know wants to hear this message, and only this message. It’s a disservice and provides nothing but false comfort.

Find the voice you need to hear

Telling someone what they want to hear is tempting in this clickbait society. We all need avoid getting stuck in an echo chamber. We need to search for voices that will instead tell us what we need to know, however painful that message might be. Delivering this message doesn’t get likes, clicks or follows, make you friends, or go viral. It’s not popular, but it might just make a difference to your bottom line.

Going forward, break the habit

If these market moves are frustrating you, it’s time to rethink the tools you are using and your overall approach to managing price risk (how, when and why you use the tools).

If you get a position in place and manage that position as the market moves, I firmly believe this will serve you much better. Get the control you need, the opportunity you want, and the flexibility you didn’t know you could have. It will allow you to truly embrace this type of volatility.

Take your risk management strategy to the next level with futures, options and Livestock Risk Protection.

Contact Advance Trading at (800) 747-9021 or go to https://www.advance-trading.com/.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

Risk ManagementAbout the Author(s)

You May Also Like