June 21, 2022

In the grain markets, the end of June supplies a tremendous amount of information that seems to set the tone going into harvest. The Mid-July timeframe has become routine for pollination across the majority of the corn belt. This year is shaping up to be the same.

It sure feels like this time of year brings the most amount of uncertainty in the corn market. Weather patterns can tee up the U.S. for a robust crop, or significantly hurt production as we wait for a break in the heat and hope for rain. Throw in the June stocks report along with the final planting report at the end of June, and it can be difficult to navigate all the variables.

The weather this year has been challenging with delayed plantings. Some areas are now experiencing extended dryness into June. Although a drier June can still yield tremendous crops, it makes beneficial weather in July more critical. The USDA weekly crop progress reports typically begin reporting US corn silking progress for the primary 18 production states around the end of June.

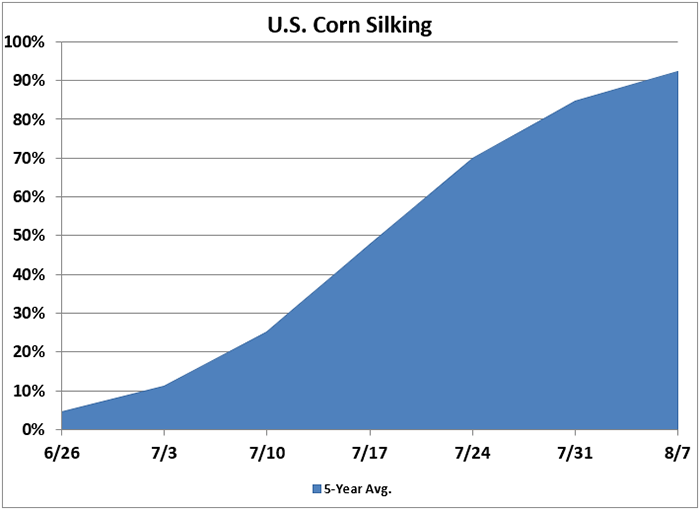

Each year is different but looking at a snapshot of the 5-year average, you can see pollination begins to ramp up around the 10th of July. By the 24th of July 70% of the corn crop is pollinating.

Pollination seems to be the last “extreme” variable prior to harvest. I typically consider the “extreme variables” to be Planting Prospective, planting conditions, and pollination. Once we get through pollination, grain fill can become a factor if the U.S. continues to stay hot and dry, but often doesn’t carry as much volatility as the other three.

Upcoming reports

June 30 will also be a critical time as we will get the much-anticipated final acreage report estimate for corn and soybeans. This will answer the dying questions:

Did the spring rally in corn switch acres away from beans?

Did North Dakota and Minnesota producers continue to plant corn into June?

The answer to these questions will certainly have an impact on an already tight carryout situation in both crops. If that wasn’t enough, on June 30, we will also get the quarterly stocks report, which from time to time has surprised the market with their feed demand estimates. Feed seems to be a difficult number to predict in the weekly reports and we have been known to see some wide discrepancies from traders’ expectations at the end of June.

With all of these unknowns swirling around looming over the weeks ahead, producers are asking, “What should I do?” Try not to get caught up in just one sale and look at your market plan for your total operation. If the current prices meet your profitability goals, be ready to protect these prices. This can be done by making sales on bushels you feel comfortable producing. Attach calls or buy puts to protect a floor as the crop continues to develop.

The next 30 days will provide “opportunities” for the market to rally with USDA reports and weather on everyone’s minds, but there is no guarantee the market will go in your favor. We know more about this crop than we did back on April 15. In the next 30 days we will take even further unknowns out of the market.

Take this time to review your market plan. Put yourself in a position you are comfortable with as we walk through these next 30 days.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc.

Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like