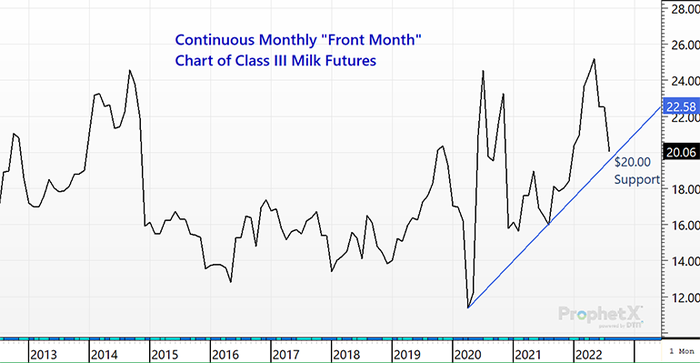

Milk futures have had an exciting start to the week with both trade and market news. While the overall front month Class III milk futures contracts continue to teeter-totter around the $20.00 price level, deferred contracts have been inching higher.

Two key reports released Monday

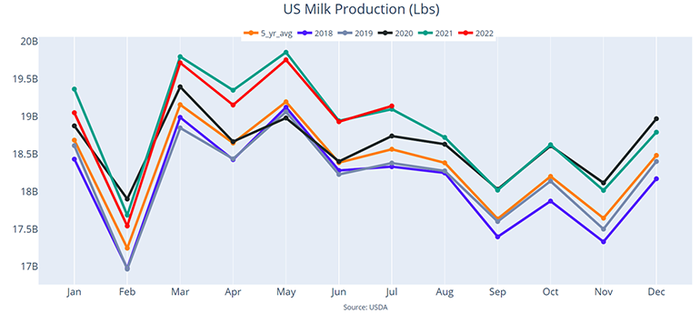

The first was the U.S. milk production report which showed that milk production in July totaled 18.3 billion pounds, up 0.3% from the same month last year. Now, 0.3% is not a large amount, yet this was the second month in a row for a report to show a growth in year-over-year production. The trend in milk production may be attempting to reverse, and grow, after starting the year with five reports showing lower production year-over-year.

Milk production per cow averaged 2,033 pounds, up 19 pounds from the same month last year. Total milk cows on farms in the U.S. came in at 9.42 million head which is 67,000 less than July of last year, but up 1,000 head from last month.

The other report released this week was the cold storage report. This report showed that monthly cheese in cold storage at the end of July 2022 totaled 1.522 billion pounds. This was up 5% from the same month last year and up 1% from June 2022 totals. By comparison, the amount of cheese in storage in July 2021 was 1.449 billion pounds.

Monthly butter in cold storage at the end of July 2022 totaled 314.36 million pounds. This is down 21% from the same month last year and down 5% from June. By comparison, the amount of butter in storage in July 2021 was 396.47 million pounds.

Demand remains robust

We know that milk production is starting to creep higher, but thankfully demand is increasing as well.

Domestic cheese demand has seen a small uptick, but it is export demand that continues to be a showstopper and helps to offset larger cheese supplies.

United States Dairy Exports in June totaled 255,688 metric tons. This is up 24,060 metric tons from June of 2021 but is down 7,033 metric tons from the previous month. Spot butter exports were up a remarkable 82% year over year and up 45% from May. This was at its highest monthly total since April 2014! Cheese exports were even more impressive by posting their best month ever at 43,907 metric tons!

Like most commodities, milk futures prices are also sitting on that two yearlong upward price trendline that has been in place since the initial aftermath of the 2020 Covid lockdowns. The balance of true supply and demand fundamentals versus potential negative economic news is keeping the milk market steady for now.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like