Grain marketing has many moving components that affect the price of corn, soybeans, and wheat. The largest components are supply and demand, both on a domestic and national level. However there are additional factors that come into play as well.

The agricultural marketing industry refers to these additional influences as “outside market factors.”

What’s happened

A few times a year I like to update farmers on the current and potential future outside market factors affecting U.S. grain prices. There are four factors to be highlighted in the current marketplace: global trade, wars, inflation, and the funds.

From a marketing perspective

You’ve experienced it, one day the grain markets are behaving and trading in a mostly expected fashion, and the next day, the markets have either rallied big or fallen apart on some unexpected piece of news.

Remember Covid? Grain futures prices initially tanked on fears of doomed demand. Remember when Russia invaded Ukraine? The grain markets rallied for days. It is important to be aware of outside market news, and how that could affect grain prices in terms of either a price rally or sell off.

Global trade

Geo-political drama and global trade initiatives can put bumps in the road for grain prices. Remember in late May of 2018 when President Trump proceeded with tariffs on China and the price of soybean futures dropped $2.00 in just four weeks?

Trade wars or positive trade deals can occur at any time. Power plays, contentious conversations between global leaders, and outcomes of global summits are eagerly watched by the world.

Currently the world leaders are walking a precarious path as global economic powerhouses still weigh the aftermath of the Covid pandemic, two global wars, and upcoming global elections in Argentina and in Taiwan in January.

Global wars

With two global wars waging, any heightened tensions in the Middle East or NATO nations near Ukraine need to be monitored closely.

Also, important to monitor is any potential conflict in the South China Seas, or temper tantrums from North Korea. Then there is the long-term question about who will govern the Palestinian region after Israel – Hamas war.

Any global war flare ups could have the ability to affect the prices of U.S. grain.

Inflation

Over the past year, stubbornly high inflation has caused the Fed to raise interest rates over the past year. This has made the U.S. dollar rally and weighed on some agricultural commodities as higher inflation causes the notion of less demand for products.

However, very recently, there are economic signs that inflation may finally be tamed here in the United Sates.

Recently, the Consumer Price Index (CPI = measure of inflation at the retail level) was reported to be 0% for October; the market was expecting an increase of 0.1%. This was welcome news, meaning that prices at the retail level had held steady and are not increasing for consumers.

Also welcomed news was the Producer Price Index (PPI = measures inflation before it hits consumers), actually dropped 0.5% in October from September, which was the biggest drop since April 2020. Trade was expecting a 0.1% increase.

Why should you care? It means the Fed action of increasing interest rates has worked. Demand for some goods has slowed enough to bring prices of various commodities or merchandise down.

The Fed will likely hold interest rates steady for a few more months to make sure inflation continues to fall. Once they see further evidence of slow or lower inflation, it may give them confidence to then lower interest rates. Lower interest rates and lower inflation rates also make for good fodder in an upcoming election year.

Funds

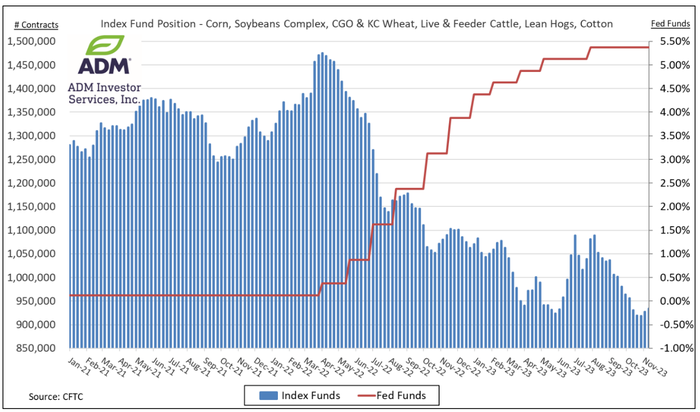

The funds. The large investment money that can take part in commodity trader as either buyers or sellers. Currently for corn and wheat futures, they are in “sell mode.”

The funds take their trading cues off of supply and demand fundamentals, seasonal trade aspects, technical trading, and computer algorithms.

One thing is clear, since the Feds have been raising interest rates, fund traders have either largely left commodities, or have been sellers of commodities on the notion that higher interest rates create less demand for commodities.

With higher interest rates, there are other opportunities to invest money in that have attractive rates of return, without the risk that commodity trading can bring.

It is important to be aware of the fund activity, because the amount of buying or selling they can do can push futures prices dramatically higher or lower than expected.

Prepare yourself

As we head into the end of 2023 and prepare for 2024, there will be plenty of moving parts that will affect the price of grain. Depending on the above factors, along with supply and demand, grain prices will have plenty of opportunities for potential dramatic price movement.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like