Brazil’s soybean planting progress is nearing completion but it still lags about 10% behind historical averages.

According to the Mato Grosso Institute of Agricultural Economics (IMEA) roughly 5% of the state’s soy acres, or 1.5 million, will need to be replanted. One private estimate believed this to be well understated, saying it would be “a minimum of 10% of the state, if not higher.” One example I can give that lends credence to this is one of the farms that I visited last January with our tour group. They will have to replant nearly half of their 6,400 acres. We would emphasize yet again, that just because the farmer chooses not to replant, doesn’t mean the field has full yield potential simply because the rain begins to trickle in.

We should get done with planting on our farm in Minas Gerais today, about a week behind schedule. We prefer to get done with planting in November.

It looks like we will avoid having to replant, but the same cannot be said elsewhere. I drove nearly three hours on Sunday and while some crops looked decent, it was clear that the planting window was delayed as I saw several recently planted fields when they should be further along at this point.

Damage denial?

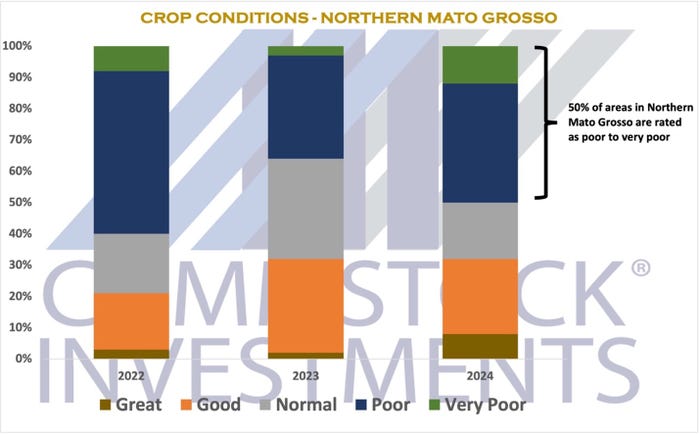

Crop ratings in the state are also suggesting the market does not fully comprehend the crop damage that has taken place. The President of a local county growers association in Central Mato Grosso that represents over 1 million acres described the situation as “critical.” Half of the crop in this Northern Mato Grosso county is rated bad or poor.

According to him, some areas are already being abandoned despite some scattered rainfall. He described a plot of 600 acres of soybeans on his own property that was already in the V4 stage that he will abandon. This means that they no longer expect to harvest this field, and therefore will no longer apply any further inputs through previously planned applications of insecticide, fungicide or fertilizers.

Regardless of how much rainfall there is, that particular field was beyond repair.

So while the market is focused on how much rainfall is in the forecast, it overlooks the fact that fields like this will yield zero no matter how much it rains. In this specific example, rather than replant to soybeans and give up on second crop corn, the farmer choose to give up on soybeans with the hope of getting a full second crop of corn. They will plant the second crop of corn in January, giving it plenty of time to perform.

Replant options

Others will still opt to replant beans. Those same producers that decide to replant soybeans, may look to plant a cover crop after harvest as they know there will not be enough time for a second crop of corn. This will better prepare the 24/25 soybean crop, planting into millet or Brachiaria as opposed to planting soybeans on soybeans next season.

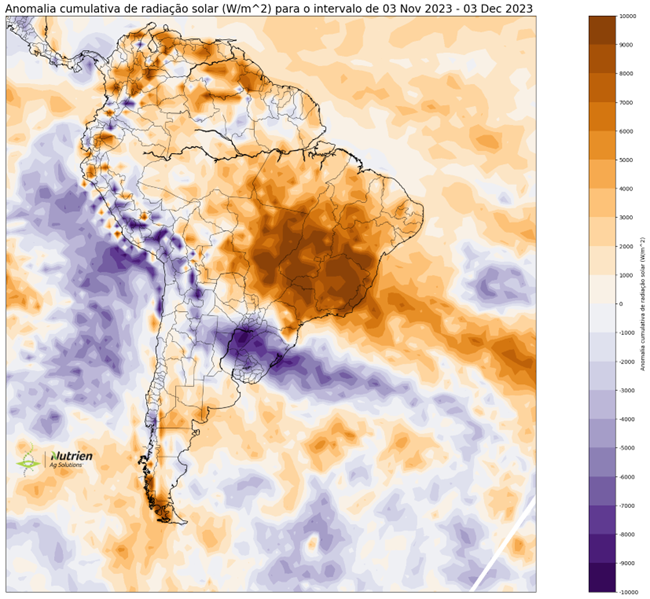

Figure 1: Purple shade highlights sunlight deficiency from excessive rain

Similar to last week, GFS models show much drier forecast for Northern Brazil compared to European models. They are consistent in keeping heavier rainfall volumes further out in the two-week forecast with lighter showers in the nearby. The next ten days should bring 1-3 inches in much of Brazil’s growing regions. Both models do agree on heavy rainfall in Southern Brazil. Heavier volumes of 4” or more center over Paraguay and spilling over into Western Mato Grosso and RGDS. NOAA models suggest El Niño will reach its peak in either late December or early January. This would suggest below average rainfall and above average temperatures may continue during the period when we typically see some of Brazil’s highest rainfall levels.

IMEA has already reduced Mato Grosso’s production by 1.6 MMT to 42.1 MMT. This compares to last season’s record of 45.3 MMT. The same county grower President surmised that Mato Grosso has already lost closer to 10 MMT of soybeans. This would put their state production closer to 34 MMT which would more closely reflect 2019 production levels despite increasing acres since then by 22%.

Using USDA’s projections of 163 MMT for Brazil as a whole would bring overall crop size down to 153 MMT, and below last season’s record production of 154.6 MMT. Other private estimates have come in even lower.

Friday’s USDA report may not give the production cut that is warranted, but there should be at least some notable cut to production to reflect reality.

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Read more about:

BrazilAbout the Author(s)

You May Also Like