Ink sometimes dries fast on USDA reports, even eagerly awaited ones like the plantings and stocks data that dropped March 31. Analysts who guessed wrong on the government numbers quickly dismissed the results. Even those of us who were closer to the mark know that the market often takes a “move on folks, nothing to see here” attitude, especially with erratic behavior on Wall Street exacerbated by domestic politics and international tensions.

Corn and soybean futures focused on the “hits and misses” between the USDA and analysts’ estimates, in part because fewer folks are out there crunching the numbers with much rigor. So, money follows the headlines, even though some of the trade forecasts on the stocks report showed a clear lack of knowledge about what the inventories represent and what their meaning, if any, is.

Nearby contracts rallied to double digit gains after USDA’s tally of March 1 supplies came in less than the average trade guesses for both commodities.

I was already on the low side of the trade estimates. USDA put corn inventories at 7.401 billion bushels, 9 million less than my guess, compared to the average from the trade, which was 79 million bushels higher at 7.480 billion. USDA’s soybean print of 1.685 billion was 19 million more than my number, and 68 million less than the average from the trade of 1.753 billion.

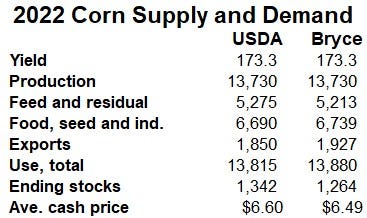

Some traders may argue the lower than expected stocks mean USDA overestimated the size of 2022 corn and soybean production. That may be the case when the government finalizes its crop estimates after the end of the marketing year. But according to my math any differences are inconsequential.

April fools?

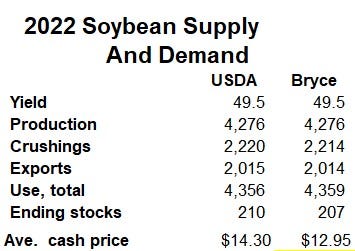

USDA will fold the stocks update into its next World Agricultural Supply And Demand Estimates, due out April 11. Based on what we know now, I don’t expect much in the way of changes to the government’s bottom line of soybean carryout at the end of the marketing year Aug. 31, 2023. It should stay close to the 210 million bushels put out in the March WASDE.

The April 11 corn ending stocks estimate from USDA is a bit trickier to guess because so much of corn demand is allocated to feed usage. While exports, seed, food and industrial demand is relatively easy to track, feed – and a small amount of “residual” usage – can only be inferred from demand that isn’t explained by the other categories.

My own model for forecasting feed demand suggests it could be a little stronger than USDA called for earlier this month. But based on the first half of the marketing year, significant rationing may be needed in the spring and summer just to meet that goal. And, with supplies of alternative feeds like wheat likely to be tighter due to drought on the Plains, old crop corn carryout could be even smaller eventually.

USDA isn’t likely to make any big adjustments yet for corn. But small increases in ethanol and feed demand could show up in the April 11 report, cutting 78 million bushels off old crop carryout.

Weather fears

One thing we do know about the April report: It won’t include any reference to 2023 production, supply and demand. Those numbers won’t get an makeover until May, when acreage, and perhaps weather conditions could play a role.

Still, new crop appeared very much on the mind of traders after Friday’s reports. Prospective Plantings of soybeans was put at 87.505 million acres, only 5,000 more than the agency’s prediction at its February outlook conference. The average trade guess came in at 88.235 million, and the lower USDA estimate helped boost November futures.

December corn, by contrast, settled a half-cent lower Friday. USDA’s survey said growers planned to boost corn ground to 91.996 million, compared to the 91 million seen in the February outlook. The average trade guess was 90.849 million, so the reaction by December futures was restrained, if not bearish.

The Prospective Plantings appear to indicate that growers were attracted to corn and not soybeans due to better corn profit prospects created by lower fertilizer costs and a move in the soybean to corn price ratio more in favor of the feed grain. That was the conclusion I wrote about recently.

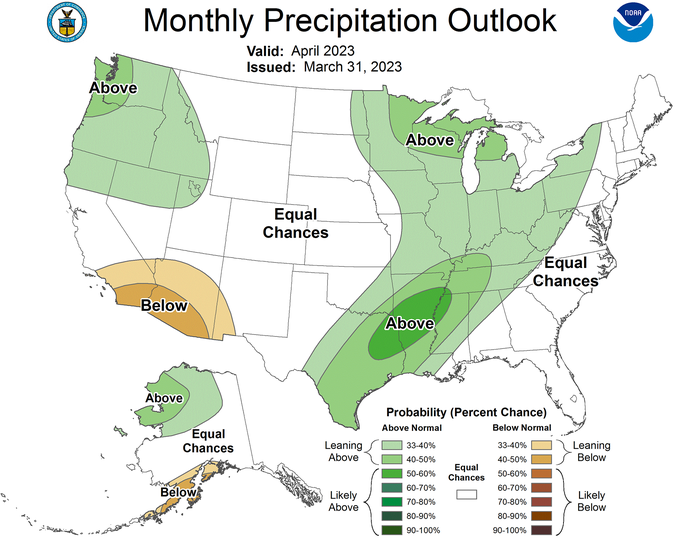

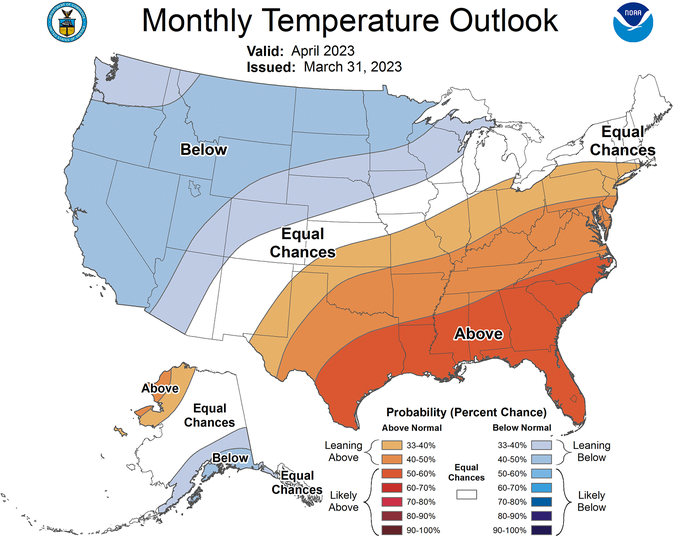

The reaction from December corn after the report Friday demonstrated how quickly the trade can move on. Even before the report many appeared ready to dismiss it due to concerns about delays due to slow early planting in the South and wet conditions in the North. Friday’s updated forecast for April weather appeared to confirm those fears.

Lower corn yields?

USDA won’t update its acreage estimates until the July WASDE. Planting delays don’t happen often, but they can force USDA to downgrade its forecast for yields sooner. That’s what happened last year, when the agency knocked 4 bushels per acre off its earlier yield prediction, which assumed normal planting progress and June/July weather.

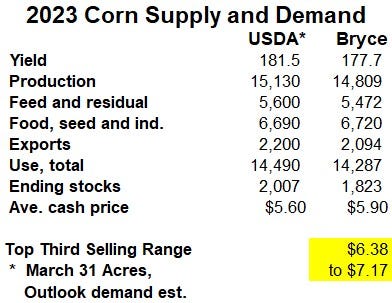

My own forecast for yields doesn’t make this weather adjustment, and is nearly 4 bpa lower for corn already. Even with more acres, this lower yield could knock around 320 million bushels off USDA’s forecast. That might be enough keep projected 2023 crop ending crops to around 1.823 billion bushels ��– a lot, but not completely burdensome, especially if farmers are unable to plant some of their intended acres or demand improves.

Under this scenario, the top third of my projected 2023 crop selling range is $6.38 to $7.17. December is well below that target now, though it did trade into it on last year’s spring rally.

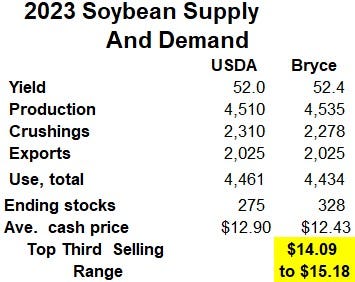

Planting delays are not a significant factor in soybean yields, so USDA isn’t likely to make any adjustments in its May supply forecast. USDA puts the “normal” yield at 52 bushels per acre. I use a yield based on the statistical trend over the past 20 years, which is a little higher at 52.4 bpa. That, plus still-uncertain biodiesel demand could take carryout a little higher than USDA forecast in its February outlook. Still the forecast top-third of my trading range is $14.09 to $15.18, a level last reached at the end of 2022.

So, there’s hope for rallies this spring, but they may be a fickle as the weather – or your favorite baseball team’s dreams of a pennant.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like