Last week USDA released February’s WASDE report. As reflected by the sharp increase in volatility in soybean futures on Wednesday, the wide array of factors that simultaneously affect the markets makes predicting day-to-day price movement impossible.

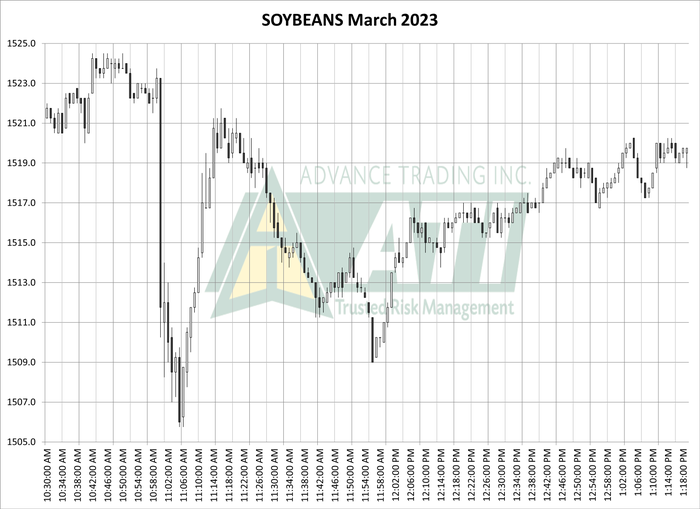

The much-anticipated USDA monthly supply and demand report was set for release at 11:00 a.m. CST. At 10:40 a.m. CST, March 2023 soybean futures were trading at $15.20 and nudged up to $15.23 just prior to the release of the report.

When USDA at 11:00 am pegged U.S. ending stocks of beans at 225 mbu—nearly 7% above the average trade guess of 211 mbu—March futures promptly plummeted nearly $0.15. By 11:05, the contract had fallen another nickel to $15.06.

Prices then whipsawed higher, rebounding to $15.20 within a few minutes. By the end of trading at 1:20 p.m., March futures closed at $15.19 ¾—essentially unchanged from where they were before the report.

What happened?

The short answer is it’s impossible to say. It’s worth noting there were some warning signs for weaker domestic U.S. soybean demand prior to the release of the report. For example, the pace of soybean crush has slowed recently and justified the USDA’s decision to reduce usage by 15 mbu.

A case could be made, then, that the immediate sell-off may have been linked to ideas of increasing stock levels of U.S. beans.

At the same time, the pre-report consensus was that the ongoing drought in Argentina would lead to a significant reduction in this month’s production estimate. The USDA concurred with that notion, lowering its production estimate 4.5 MMT compared to January to 41.0 MMT.

Many believe, however, that production could fall well short of the updated USDA forecast—perhaps below 35.0 MMT. Thus, the rebound may have been fueled by that thought. Or, perhaps, it was a combination of these factors (and others that are not yet apparent).

Argentina crop cut

Fast forward to Friday and Monday, and the market changed again. The Buenos Aires Grain Exchange cut the Argentina soybean crop by 3 mmt. Rain was expected in the region, but it wasn’t believed to be enough to make a difference on the already suffering crop. Additionally, soybean oil rallied alongside crude oil.

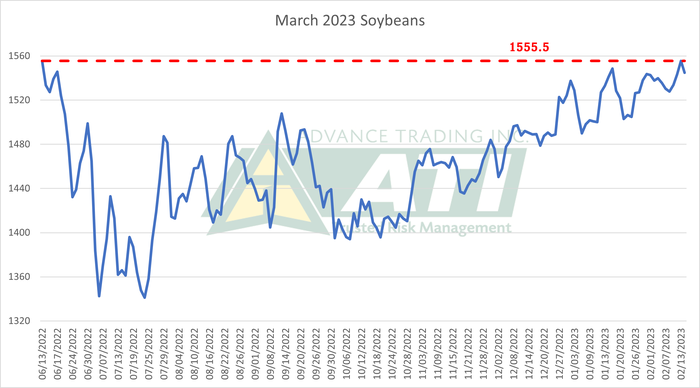

Seemingly between the weather market in Argentina and the escalated war in Ukraine, March soybean futures rallied to $15.55 ½. Today the market traded 20 cents lower than yesterday’s 8-month contract high.

Manage your risk

This serves as an important reminder of a key risk management principle: The wide array of factors that simultaneously affect the markets makes predicting day-to-day price movement impossible, much less projecting long-term trend.

Accepting and embracing this principle is a critical step in developing and implementing a risk management strategy that is designed to defend your balance sheet. A strategy that is built upon discipline in managing a position—as opposed to price prediction—can turn market uncertainty into opportunity.

Your Advance Trading advisor stands ready to assist in the execution of a customized marketing plan for your operation.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures: The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like