The June 30 acreage report showed that for the 2023/24 growing season, 83.5 million acres of soybeans would be planted in the United States. Heading into the report, the average trade guess was 87.7 million acres – a whopping 4.2 million acres higher. That difference caused a bullish surprise for the soybean complex.

In response, November 2023 soybean futures finished the trading day 77-1/2 cents higher than the previous day’s close.

The lower acres number was a shock to the market, and traders quickly pointed out that with the reduction of acres, that weather had to be perfect going forward, or total supply of soybeans would be reduced, ultimately reducing ending stocks on an already tight U.S. supply situation.

USDA’s fine print

Tucked in that acreage report was a special note from the USDA that trade seemed to skim over initially. However, this special note is quite important.

Specifically, that note said, “Estimates of the portion of the United States corn and soybean planted acreage that was left to be planted when the survey was conducted are published on page 6. These estimates are based on data provided by respondents who were contacted between May 30 and June 15. Nationally, corn left to be planted was 2.49 million acres. Soybeans left to be planted for the United States was 8.22 million acres.”

Now, every year when this report rolls around, there are acres of soybeans (and corn) yet to be planted. Usually when this occurs it’s due to soggy springtime weather which can cause planting delays in the Northern Plains or other portions of the Midwest.

However, this year’s “left to be planted” number seems to be mostly due to wheat acres needing to be harvested, so soybean acres can be double cropped behind it.

In essence, those 8.2 million acres of the soybean estimate will not get planted until the U.S. wheat crop is harvested; there is still a slight risk the full 83.5 million acres may not be achieved!

Add to it, double-crop soybeans have a shorter growing season due to the delay in planting (until wheat is harvested), which oftentimes can result in lower yield.

More wheat in soybean country

High wheat prices in the fall of 2022 incentivized U.S. farmers to plant additional wheat, and especially motivated more farmers in the Midwest to consider planning soft red winter wheat in the fall and soybeans in the same field following wheat harvest in the summer 2023. The USDA reports confirms that notion.

The Acreage Report estimated the total U.S. wheat planted area at 49.6 million acres, up 9% from 2022.

The 2023/24 planted area still represents the largest planted area since 2016/17.

Little changed from the March estimates regarding the winter wheat area, projected at 37.0 million acres, up 11% from last year.

The most significant increase occurred in the soft red wheat area as it registered at 7.66 million acres nearly a 17% increase from the year prior.

Insurance twist

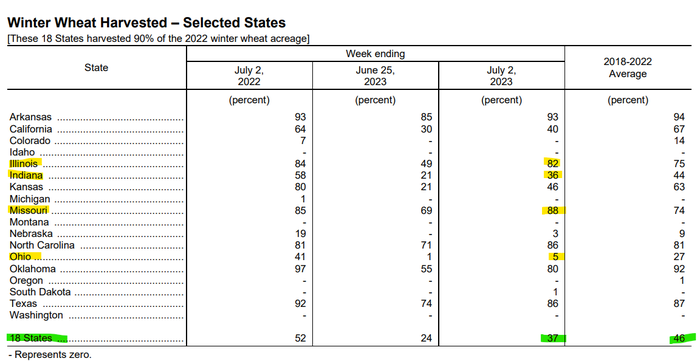

It is already a common practice to double crop soybeans in top soybean states like Illinois, Indiana, and Ohio, where soft red winter wheat is the dominant class. A move by the federal government earlier this year aimed at increasing the number of counties (in some of those states) eligible for double-cropping insurance. This was a highly intentional action with a goal of both increasing U.S. production of wheat and soybeans. It worked, as more farmers in Illinois, Indiana and Ohio planted additional wheat acres, with the likely intent of double cropping beans behind them.

Now where are we? Slow wheat harvest may impact those last 8 million acres of soybeans to be planted.

It is often said that a picture paints a thousand words. And so I leave you with this. The U.S. wheat harvest seems to be running slower than normal.

Depending on weather in the coming weeks, will producers have time, incentive, and desire to harvest the wheat and then get those soybeans planted as quickly as possible? The later they are planted, the more at risk those beans are to adverse weather, including August heat, potential drought, or even early frost in September.

Bottom line, we need those 8 million soybean acres to get planted in the ground yet in the coming weeks. There is plenty more to the soybean story, and quite frankly, the story could just be beginning.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like