With the holidays long past and tax season in full swing, many farmers may be watching a falling market wondering what to do with remaining 2023 crops.

If you are still holding bushels – either on deferred pricing, basis contract, or un-contracted in your bin – and you are wondering just what to do, know that you have more control than you might think. It has been over 3 years since we saw corn prices with a $3 in front of them.

Price or prolong?

Is now the right time to price remaining crops?

Current prices are NOT attractive. But you still must manage those remaining bushels at some point. Your next crop is coming fast, and cashflow will be required to pay bills and secure inputs.

If the last four months have taught us anything, it's that the market is not always going to give you the price that works for you and your operation.

With March first notice this week, you may be forced to decide if you will price or roll basis contracts. Are there more bushels that could pressure futures in the short term? Could we rally right after you price your grain?

Best of both worlds

If you are concerned about whether to act today or simply kick the can down the road in hopes of a nice recovery that may or may not come, you may be able to accomplish both.

Pull the trigger. Price those bushels now and spend 12-15 cents on a call option for corn.

For soybeans, 20-30 cents will get you out into the summer with upside. That may stop storage costs, but what it also does is helps you regain control of those bushels and maintain control out into the summer. Plus, it helps you manage the upcoming crop that you are about to plant.

Your basis is strong, and the implied volatility in the options is the cheapest it has been in almost four years. That means that calls are affordable, even if you are buying more time. They can give you that opportunity to participate on any subsequent rally and eliminate your seller's remorse.

Market outlook

Prices will eventually go higher. But the "when" or from what level is always the hard part.

South American soybean harvest is in full swing, and the safrinha (second crop) corn is getting planting. We are about one month away from the Prospective Planting Intentions and Grain Stocks report at the end of March. Could the pressure on prices hold a surprise on intend acres? That’s anyone’s guess at this point.

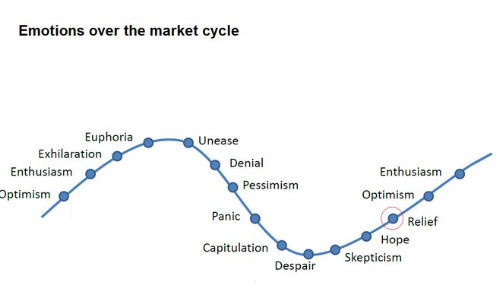

Don’t let your emotions take over and dictate what you think/hope happens. It’s great to have hope and optimism as you plant a seed in the ground this spring, but getting a floor and maintaining some “skin in the game” on those old crop bushels helps take the emotion out of it. It allows you to turn focus to 2024 expected production and get a plan in place there as well.

You don’t want lower prices to hurt your balance sheet for both 2023 and 2024.

If you would like to discuss this more, please call. Gain control and go into the tractor this spring feeling assured you have a plan moving forward.

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like