We have now executed on our last old crop soybean sale for 2020.

We began the marketing year by advising clients to store 100% of last season’s crop prior to harvest. We pulled the trigger on 1/18/21 on our first one-third of the soybean crop when May futures hit $13.76. We sold another one-third on 4/7/21 when July futures hit the $15.94 target. We made an additional incremental sale in the cash market when July hit $15.75 or better on 6/21/21 which brought us to 75% sold.

I would highlight that this sale was made after the correction which saw us wipe out over $2 in market value and many people declaring the bull run was over. We waited patiently for the market to come back almost a dollar, and it did.

Basis firepower

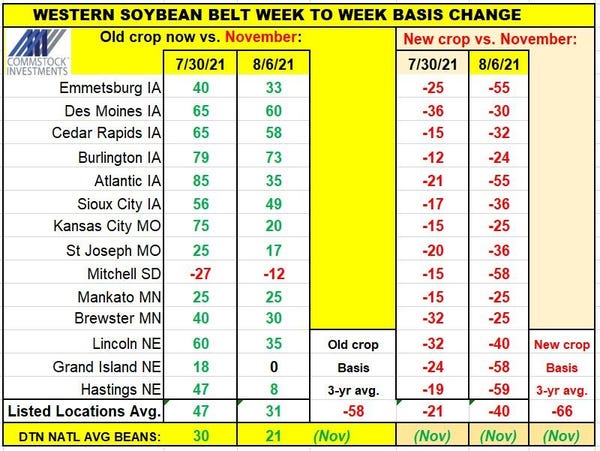

Depending upon location, you could add another 20 to 80 cents to these prices in positive basis. By tracking the basis, we know that the historical three-year average has been a negative 58 cents in the western soybean belt and a negative 22 cents in the Eastern soybean belt. Based off of the record basis alone it was worth storing soybeans in many areas to pick up the increase in basis. Where our farms are located, the difference between current and historical basis was as much as $1.00!

Unfortunately, we missed out on the basis improvement on our last sale. The soybean basis has begun to fall apart in August as crushers moved from trading the August contract which has expired, directly to the November contract, and completely ignoring the September contract. They would like us to think that they have an optimal supply to reach the new crop, which is unlikely to be the case.

Our goal was to hold some soybeans into summer, but we have been surprised by the ability of crushers to avoid a squeeze until next crop. Early planted soybeans combined with dry weather in some areas should push new crop earlier than normal.

We have targeted $14.00 in the September contract for our last sale. We overstayed the market on this sale, but it is still much better than having sold too early last year around this time.

Tight stocks remain

So far, not much is changing for next year as soybean ending stock continue to be tight. In the USDA WASDE report last week, it appears that the agency is attempting to artificially prop up soybean inventories. Last July saw ending stocks at 155 million bushels. The USDA made several changes including a reduction in yield which was “magically” offset by a reduction in exports and crushings, not to mention they found 25 million in beginning stocks (or an additional 18%) which suddenly appeared out of nowhere.

After all of these changes, ending stocks for August remained unchanged at exactly 155 million bushels. A little too perfect.

We will likely hold onto to the 2021 crop once again post-harvest as we see basis tightening up again similar to this season. Continuing to know and track our historical basis will help us monitor performance and set pricing targets.

Matthew Kruse is President of Commstock Investments. He can be reached at: [email protected]

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like